Restaurant Performance Index fell 0.8% in December

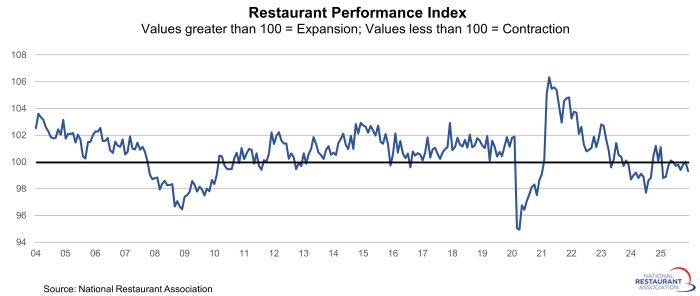

The National Restaurant Association’s Restaurant Performance Index (RPI) registered a moderate decline in December, due in large part to softer sales and traffic levels. The RPI – a monthly composite index that tracks the health of the U.S. restaurant industry – stood at 99.3 in December, down 0.8% from November and the lowest reading since March.

The RPI’s decline was the result of downturns in both the current situation and expectations components, with the same-store sales and customer traffic indicators registering the sharpest drops. Restaurant operators are also somewhat less optimistic about sales growth in the months ahead, while their outlook for the economy remains uncertain.

The Current Situation Index, which measures current trends in four industry indicators, stood at 98.3 in December – down 1.0% from a level of 99.2 in November. December was the lowest reading since February, and represented the sixth consecutive month in which the current situation component was below 100 in contraction territory.

The Expectations Index, which measures restaurant operators’ six-month outlook for four industry indicators, stood at 100.2, down 0.6% from the previous month. While the expectations component remained above 100 in expansion territory, restaurant operators have a mixed outlook for business conditions.

RPI Methodology

The National Restaurant Association's Restaurant Performance Index (RPI) is a monthly composite index that tracks the health of the U.S. restaurant industry. Launched in 2002, the RPI is released on the last business day of each month.

The RPI is measured in relation to a neutral level of 100. Index values above 100 indicate that key industry indicators are in a period of expansion, while index values below 100 represent a period of contraction for key industry indicators. The Index consists of two components — the Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), and the Expectations Index, which measures restaurant operators’ six-month outlook for four industry indicators (same-store sales, employees, capital expenditures and business conditions).

The RPI is based on the responses to the National Restaurant Association’s Restaurant Industry Tracking Survey, which is fielded monthly among restaurant operators nationwide on a variety of indicators including sales, traffic, labor and capital expenditures. Restaurant operators interested in participating in the tracking survey: contact Bruce Grindy.

Updated 1/30/2026