Research

June 27, 2025

PCE Deflator

Core Inflation Ticks Up Slightly as Personal Income and Spending Decline in May

The Personal Consumption Expenditures (PCE) deflator—the Federal Reserve’s preferred inflation gauge—edged up 0.1% for the second straight month. Food prices rose 0.2% in May, bouncing back somewhat after falling by 0.3% in April. At the same time, energy costs decreased 1.0%, falling for the second time in the past three months. Excluding the more volatile food and energy components, core PCE increased 0.2% in May following 0.1% in each of the prior two months.

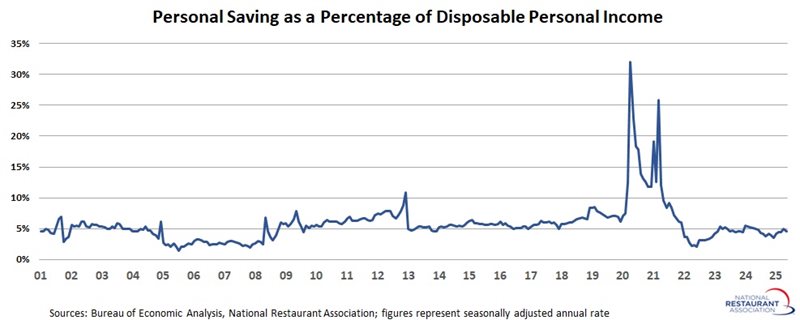

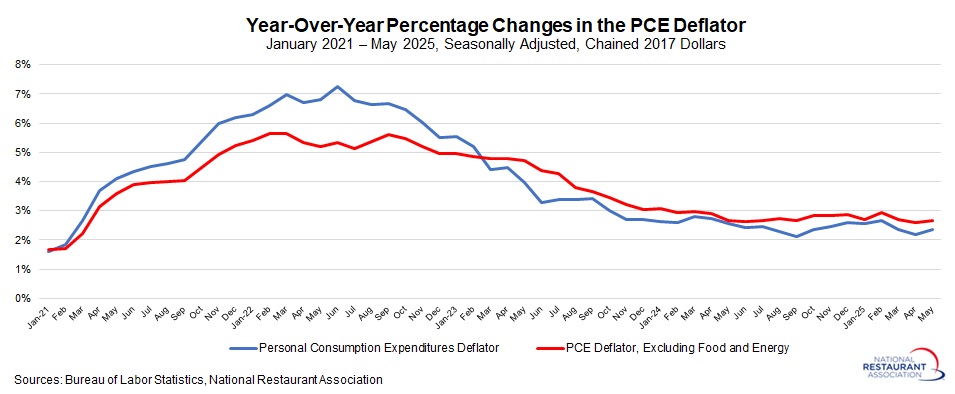

On a year-over-year basis, the PCE deflator increased 2.3% in May, up from 2.2% in April, which was the slowest pace since September. Core inflation grew 2.7% over the past 12 months, up from 2.6% in the previous release. The average core inflation reading over the past 13 months—since May 2024—was 2.7%, illustrating how much the moderation in pricing pressures has stalled over the past year. With that said, both headline and core inflation have cooled significantly from pandemic-era peaks—7.1% for headline PCE in June 2022 and 5.5% for core PCE in September 2022—bringing them closer to the Fed’s 2% target.

Looking ahead, prices could rise in the coming months due to higher tariffs, and this prospect is likely to keep the Federal Open Market Committee in a wait-and-see posture until its September 17–18 meeting. As noted at its previous meeting, the expectation is for two rate cuts later this year, but incoming data will continue to influence the timeline for changes in monetary policy from the Federal Reserve.

.jpg?lang=en-US)

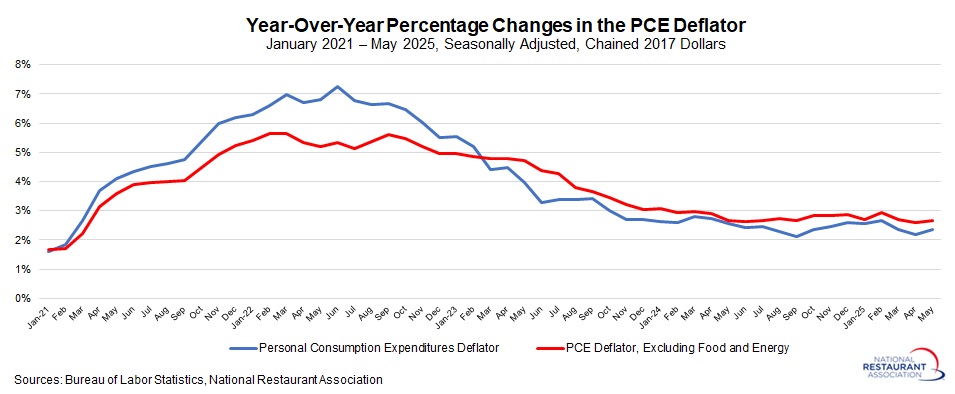

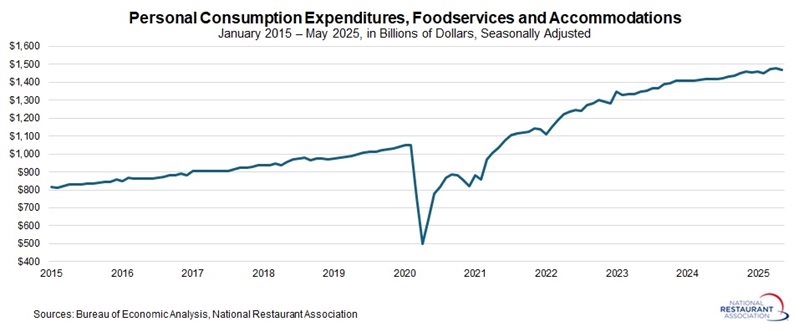

Beyond prices, the report also noted declines in both personal income and spending in May. Personal consumption expenditures inched down 0.1% in May, the first decline since January. Notably, spending on foodservices and accommodations fell 0.7%, off for the third time in the past six months and ending the solid rebounds seen in March and April. On a year-over-year basis, total personal spending increased has increased 4.5% over the past 12 months, which is a solid rate despite being the slowest pace since January 2024. Spending on foodservices and accommodations have risen by a modest 3.6% since May 2024.

However, part of this growth reflects higher prices. Inflation-adjusted personal consumption rose 2.2% year-over-year, while real spending on foodservices and accommodations increased just 0.5%. Even when accounting for inflation, consumers are spending more on dining and travel—a positive sign for these sectors, albeit at a softer rate than we might prefer.

Personal income fell 0.4% in May, largely on reduced transfer payments for the month, particularly for Social Security payments. In contrast, wages and salaries rose 0.4% in May, with 4.5% growth over the past 12 months. Healthy wage growth has been a large contributor to the economy’s resilience. At the same time, real personal disposable income dropped 0.7% in May, the sharpest decline since January 2022, perhaps explaining some of the weakness in spending described above.

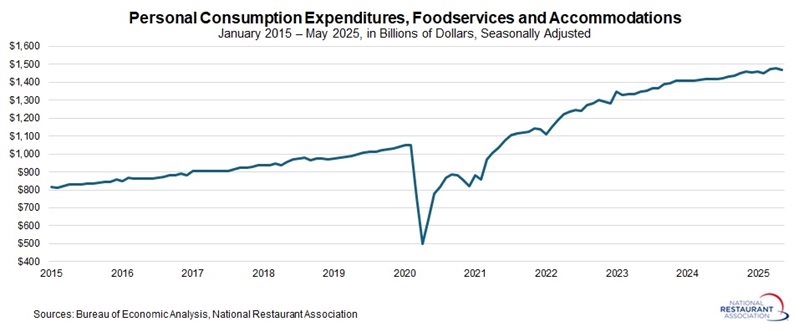

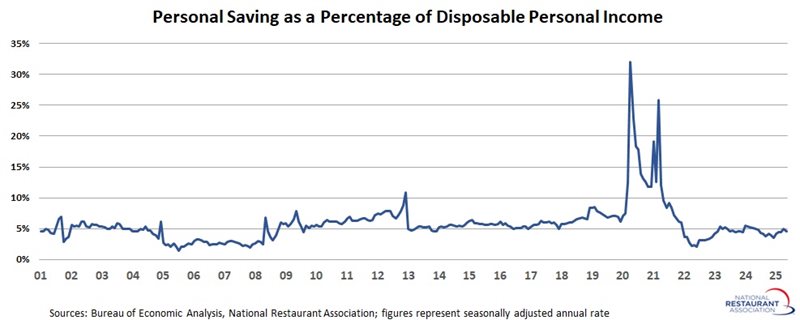

Amid these trends, the personal savings rate fell from 4.9% in April to 4.5% in May, as consumers continued to dip into their savings. While the rate has risen from a cycle-low of 3.5% in December, it remains below historical norms. From 2017 to 2019, the pre-pandemic average was 6.5%. Since the start of 2023, the rate has averaged just 4.6%—suggesting that, despite monthly fluctuations, the overall trend has held steady in recent years at a level well below pre-pandemic norms.

On a year-over-year basis, the PCE deflator increased 2.3% in May, up from 2.2% in April, which was the slowest pace since September. Core inflation grew 2.7% over the past 12 months, up from 2.6% in the previous release. The average core inflation reading over the past 13 months—since May 2024—was 2.7%, illustrating how much the moderation in pricing pressures has stalled over the past year. With that said, both headline and core inflation have cooled significantly from pandemic-era peaks—7.1% for headline PCE in June 2022 and 5.5% for core PCE in September 2022—bringing them closer to the Fed’s 2% target.

Looking ahead, prices could rise in the coming months due to higher tariffs, and this prospect is likely to keep the Federal Open Market Committee in a wait-and-see posture until its September 17–18 meeting. As noted at its previous meeting, the expectation is for two rate cuts later this year, but incoming data will continue to influence the timeline for changes in monetary policy from the Federal Reserve.

.jpg?lang=en-US)

Beyond prices, the report also noted declines in both personal income and spending in May. Personal consumption expenditures inched down 0.1% in May, the first decline since January. Notably, spending on foodservices and accommodations fell 0.7%, off for the third time in the past six months and ending the solid rebounds seen in March and April. On a year-over-year basis, total personal spending increased has increased 4.5% over the past 12 months, which is a solid rate despite being the slowest pace since January 2024. Spending on foodservices and accommodations have risen by a modest 3.6% since May 2024.

However, part of this growth reflects higher prices. Inflation-adjusted personal consumption rose 2.2% year-over-year, while real spending on foodservices and accommodations increased just 0.5%. Even when accounting for inflation, consumers are spending more on dining and travel—a positive sign for these sectors, albeit at a softer rate than we might prefer.

Amid these trends, the personal savings rate fell from 4.9% in April to 4.5% in May, as consumers continued to dip into their savings. While the rate has risen from a cycle-low of 3.5% in December, it remains below historical norms. From 2017 to 2019, the pre-pandemic average was 6.5%. Since the start of 2023, the rate has averaged just 4.6%—suggesting that, despite monthly fluctuations, the overall trend has held steady in recent years at a level well below pre-pandemic norms.