Research

February 11, 2026

Total restaurant industry jobs

Restaurants added nearly 28k jobs in January

Restaurants continued to expand payrolls at a healthy pace in January, building on the momentum established during the back half of last year.

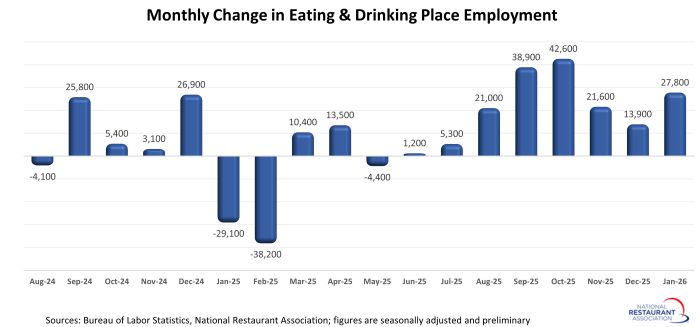

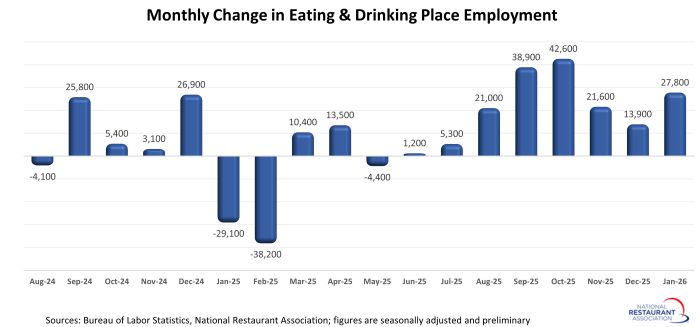

Eating and drinking places added a net 27,800 jobs in January on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS).

That was up from a gain of 13,900 jobs in December and represented the 8th consecutive monthly increase in restaurant employment. In total during the last eight months, eating and drinking places added a net 172,000 jobs.

As a comparison, the overall economy added just 129,000 jobs during the last eight months, though included in that number was a loss of more than a quarter-million federal government jobs. Private sector employers added a net 389,000 jobs during the last eight months, with healthcare and restaurants standing out as the top job-creating sectors in the economy.

The recent employment trends suggest that many operators continue to prioritize boosting staffing levels, even in the midst of a challenging business environment.

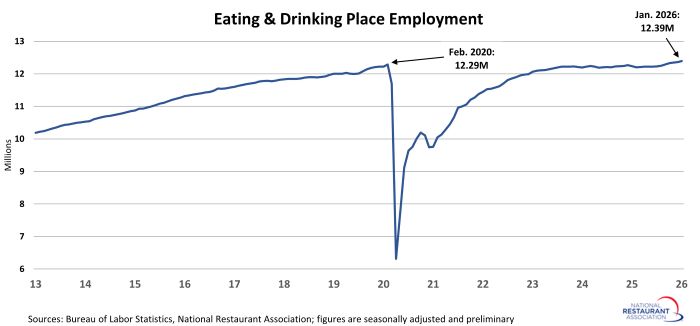

With the release of the January employment data, BLS incorporated their annual benchmark revisions. This process benchmarks the monthly establishment survey data to the Quarterly Census of Employment and Wages (QCEW), which counts jobs covered by the Unemployment Insurance (UI) tax system.

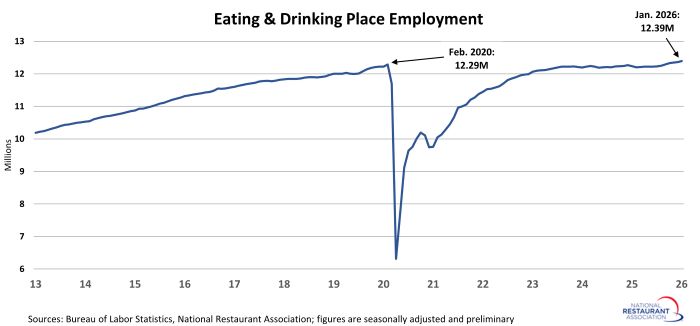

In addition to revising the month-to-month changes, this resulted in a downward shift in overall eating and drinking place employment levels for both 2024 and 2025. The net result is that the January 2026 employment reading at eating and drinking places was somewhat closer to the February 2020 pre-pandemic level.

As of January 2026, eating and drinking places were 105,000 jobs (or 0.9%) above their February 2020 employment peak.

Fullservice segment posted the strongest job growth in 2025

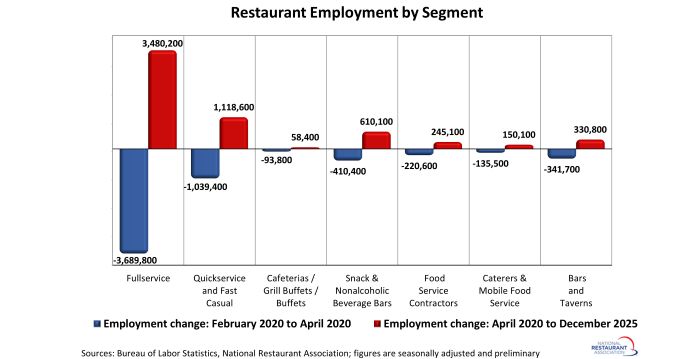

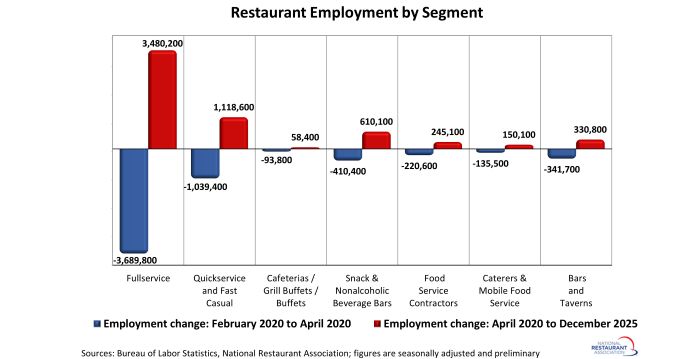

The fullservice segment lost nearly 3.7 million jobs during the first two months of the pandemic, and it has yet to fully recover. As of December 2025, fullservice restaurant employment remained 210,000 jobs (or 3.7%) below pre-pandemic readings.

However, fullservice restaurants registered the strongest job growth among the industry segments in recent months. The fullservice segment added a net 55,000 jobs during 2025, while second-ranked snack and nonalcoholic beverage bars added 35,000 jobs.

Despite the slower growth, employment in the limited-service segments continued to rise above pre-pandemic readings in 2025. As of December 2025, employment at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – was 200,000 jobs (or 25%) above February 2020 readings.

Employee counts at quickservice and fast casual restaurants were 79,000 jobs (or 2%) above pre-pandemic levels.

[Note that the segment-level employment figures are lagged by one month, so December 2025 is the most current data available.]

Restaurant job growth uneven across states

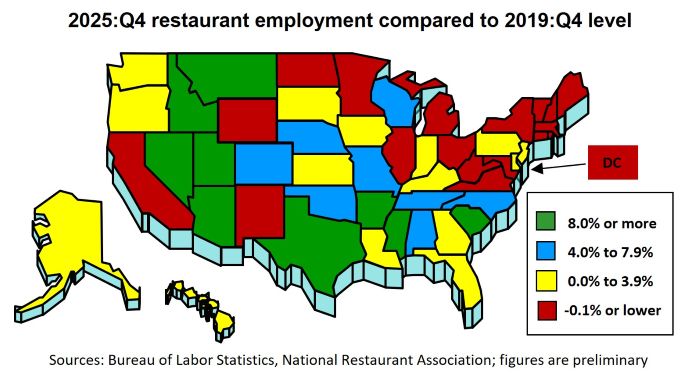

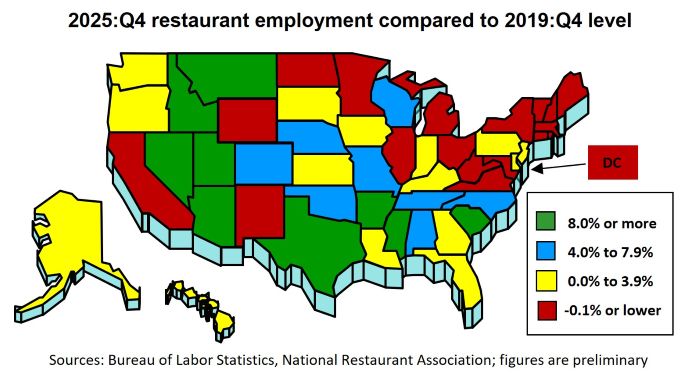

More than 5 years after the onset of the pandemic in the U.S., restaurant staffing levels remain below pre-pandemic readings in 18 states and the District of Columbia.

This group was led by West Virginia, which had nearly 6% fewer eating and drinking place jobs in the fourth quarter of 2025 than it did in the fourth quarter of 2019. Maine (-5%), New Mexico (-5%), Massachusetts (-4%) and Illinois (-4%) were also well below their pre-pandemic restaurant employment levels.

In contrast, restaurant employment in several of the mountain states has climbed well beyond pre-pandemic levels. This group is led by Idaho (+20%), Utah (+14%) and Nevada (+13%).

[Note that the state-level analysis uses 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available for every state.]

View the latest employment data for every state.

Note: Eating and drinking places are the primary component of the total restaurant and foodservice industry, providing jobs for roughly 80% of the total restaurant and foodservice workforce of more than 15.7 million.

Track more economic indicators and read more analysis and commentary from the Association's economists.

Eating and drinking places added a net 27,800 jobs in January on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS).

That was up from a gain of 13,900 jobs in December and represented the 8th consecutive monthly increase in restaurant employment. In total during the last eight months, eating and drinking places added a net 172,000 jobs.

As a comparison, the overall economy added just 129,000 jobs during the last eight months, though included in that number was a loss of more than a quarter-million federal government jobs. Private sector employers added a net 389,000 jobs during the last eight months, with healthcare and restaurants standing out as the top job-creating sectors in the economy.

The recent employment trends suggest that many operators continue to prioritize boosting staffing levels, even in the midst of a challenging business environment.

With the release of the January employment data, BLS incorporated their annual benchmark revisions. This process benchmarks the monthly establishment survey data to the Quarterly Census of Employment and Wages (QCEW), which counts jobs covered by the Unemployment Insurance (UI) tax system.

In addition to revising the month-to-month changes, this resulted in a downward shift in overall eating and drinking place employment levels for both 2024 and 2025. The net result is that the January 2026 employment reading at eating and drinking places was somewhat closer to the February 2020 pre-pandemic level.

As of January 2026, eating and drinking places were 105,000 jobs (or 0.9%) above their February 2020 employment peak.

Fullservice segment posted the strongest job growth in 2025

The fullservice segment lost nearly 3.7 million jobs during the first two months of the pandemic, and it has yet to fully recover. As of December 2025, fullservice restaurant employment remained 210,000 jobs (or 3.7%) below pre-pandemic readings.

However, fullservice restaurants registered the strongest job growth among the industry segments in recent months. The fullservice segment added a net 55,000 jobs during 2025, while second-ranked snack and nonalcoholic beverage bars added 35,000 jobs.

Despite the slower growth, employment in the limited-service segments continued to rise above pre-pandemic readings in 2025. As of December 2025, employment at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – was 200,000 jobs (or 25%) above February 2020 readings.

Employee counts at quickservice and fast casual restaurants were 79,000 jobs (or 2%) above pre-pandemic levels.

[Note that the segment-level employment figures are lagged by one month, so December 2025 is the most current data available.]

Restaurant job growth uneven across states

More than 5 years after the onset of the pandemic in the U.S., restaurant staffing levels remain below pre-pandemic readings in 18 states and the District of Columbia.

This group was led by West Virginia, which had nearly 6% fewer eating and drinking place jobs in the fourth quarter of 2025 than it did in the fourth quarter of 2019. Maine (-5%), New Mexico (-5%), Massachusetts (-4%) and Illinois (-4%) were also well below their pre-pandemic restaurant employment levels.

In contrast, restaurant employment in several of the mountain states has climbed well beyond pre-pandemic levels. This group is led by Idaho (+20%), Utah (+14%) and Nevada (+13%).

[Note that the state-level analysis uses 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available for every state.]

View the latest employment data for every state.

Note: Eating and drinking places are the primary component of the total restaurant and foodservice industry, providing jobs for roughly 80% of the total restaurant and foodservice workforce of more than 15.7 million.

Track more economic indicators and read more analysis and commentary from the Association's economists.