Research

February 05, 2026

Restaurant Job Openings

Restaurant and lodging job openings held steady from 2024 to 2025 despite large monthly swings

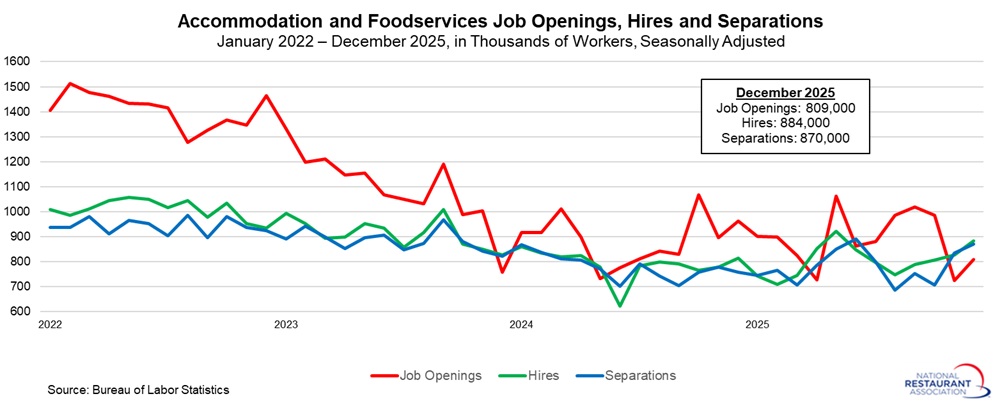

Job openings in the restaurant and lodging sector rose from a revised 724,000 in November to 809,000 in December, continuing a pattern of sign month-to-month volatility. In 2025, monthly openings averaged 890,000, essentially unchanged from the average of 889,000 seen in 2024. Despite the wide swings in the monthly data, there has been a surprising degree of resilience in labor demand for restaurants and lodging despite broader economic uncertainties and signs of a softening labor market overall. Indeed, foodservices and accommodations job openings averaged 835,000 per month in the 2017 to 2019 time period, putting the current level not far from pre-pandemic levels.

Net hiring rebounded somewhat in December. Hiring rose from 827,000 to 884,000, a 7-month high, but separations also increased, up from 835,000 to 870,000, the highest since June. As such, net hiring—or hires minus separations—was 14,000 in December, up from -8,000 in December.

The hiring level averaged 895,000 per month between 2017 and 2019, with separations averaging 875,000 in those pre-pandemic years. In 2025, the monthly average was 806,000 for hires and 783,000 for separations, both notably below pre-pandemic levels. These data are consistent with the cooling labor market seen in other indicators.

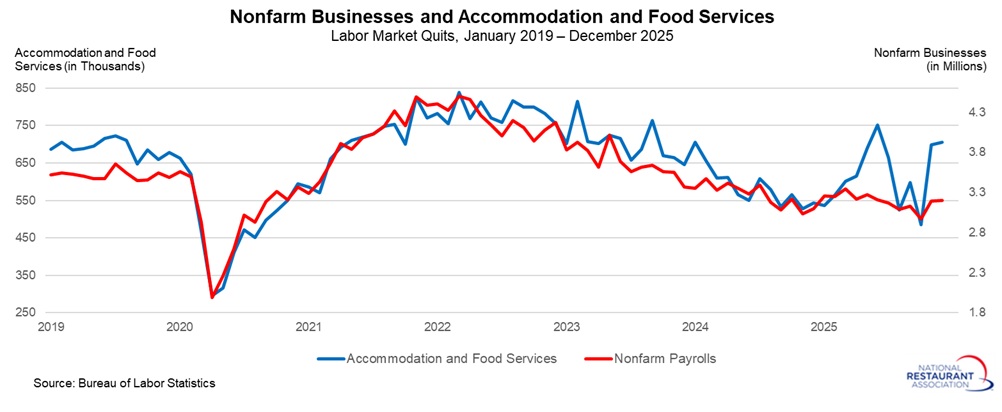

The recent surge in quits in November and December are curious, and we will see if future data return to the normalization seen over the summer. Recent data have been consistent with the transition from the “Great Resignation” prevalent a few years ago to the current “Great Stay” period, which has been closer to pre-pandemic trends. For comparison, quits averaged 4.22 million for nonfarm payrolls and 787,000 for restaurants and lodging in 2022, when the labor market was historically tight and businesses struggled to find sufficient workers. In 2025, quits averaged 3.19 million and 620,000, respectively.

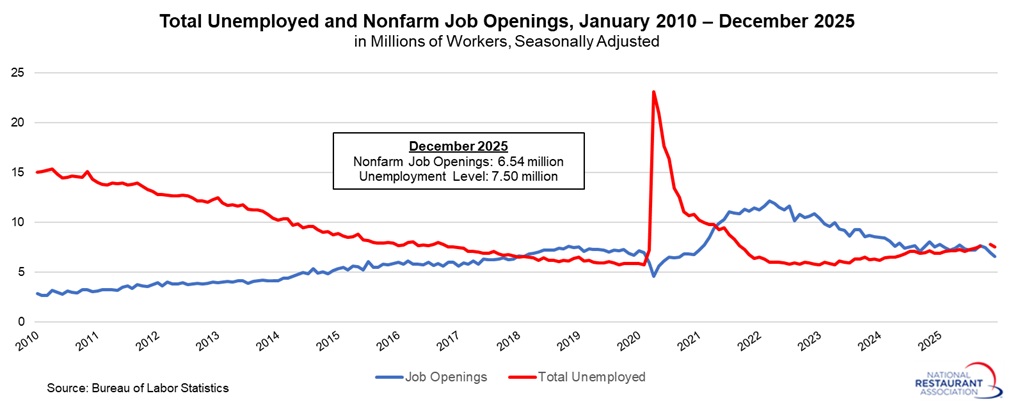

For perspective, the labor market was considerably tighter in July 2022, when job openings outnumbered unemployed individuals by 2-to-1. At that time, there were just 49.7 unemployed workers for every 100 job openings, with a surplus of more than 5.84 million job postings relative to job seekers.

Net hiring rebounded somewhat in December. Hiring rose from 827,000 to 884,000, a 7-month high, but separations also increased, up from 835,000 to 870,000, the highest since June. As such, net hiring—or hires minus separations—was 14,000 in December, up from -8,000 in December.

The hiring level averaged 895,000 per month between 2017 and 2019, with separations averaging 875,000 in those pre-pandemic years. In 2025, the monthly average was 806,000 for hires and 783,000 for separations, both notably below pre-pandemic levels. These data are consistent with the cooling labor market seen in other indicators.

The recent surge in quits in November and December are curious, and we will see if future data return to the normalization seen over the summer. Recent data have been consistent with the transition from the “Great Resignation” prevalent a few years ago to the current “Great Stay” period, which has been closer to pre-pandemic trends. For comparison, quits averaged 4.22 million for nonfarm payrolls and 787,000 for restaurants and lodging in 2022, when the labor market was historically tight and businesses struggled to find sufficient workers. In 2025, quits averaged 3.19 million and 620,000, respectively.

For perspective, the labor market was considerably tighter in July 2022, when job openings outnumbered unemployed individuals by 2-to-1. At that time, there were just 49.7 unemployed workers for every 100 job openings, with a surplus of more than 5.84 million job postings relative to job seekers.