Research

February 20, 2026

PCE Deflator

Consumer inflation accelerated in December, with core prices up 3% year-over-year

The Personal Consumption Expenditures (PCE) deflator—the Federal Reserve’s preferred inflation gauge—rose 0.4% in December, up from 0.2% in November and marking its strongest monthly gain since February. Food prices similarly increased 0.4% after being unchanged for two consecutive months, while energy costs edged up 0.2%, easing sharply from November’s 1.7% jump. Core PCE, which excludes food and energy, also advanced 0.4%, breaking a five‑month run of 0.2% gains and likewise posting its largest increase since February.

Year-over-year, the headline PCE deflator accelerated to 2.9% in December from 2.8% in November. Core PCE inflation rose 3.0% over the past 12 months, up from 2.8% in both October and November and the highest reading since February.

These data highlight two dynamics. First, as noted above, consumer inflation has edged higher in recent months, rising to the highest rates since February. Yet the longer-term trend continues to reflect moderation from post‑pandemic highs. Over the past 20 months—since May 2024—core inflation has averaged 2.8%. Both headline and core inflation remain well below their peaks of 7.1% (June 2022) and 5.5% (September 2022), even as progress toward the Federal Reserve’s 2% target remains incomplete.

For now, employment concerns are overshadowing inflation risks, although the Federal Reserve is closely monitoring both. The December pickup in prices complicates the case for near-term rate cuts, and the Federal Open Market Committee is likely to keep policy steady at its March 17–18 meeting while it waits for additional data. Further rate reductions are still expected in 2026, but are unlikely before mid‑year at the earliest.

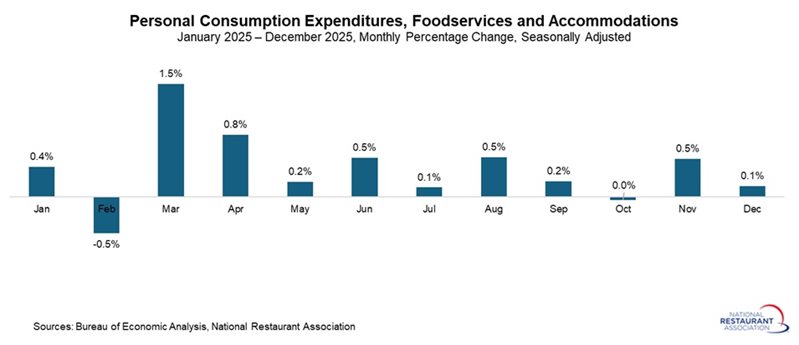

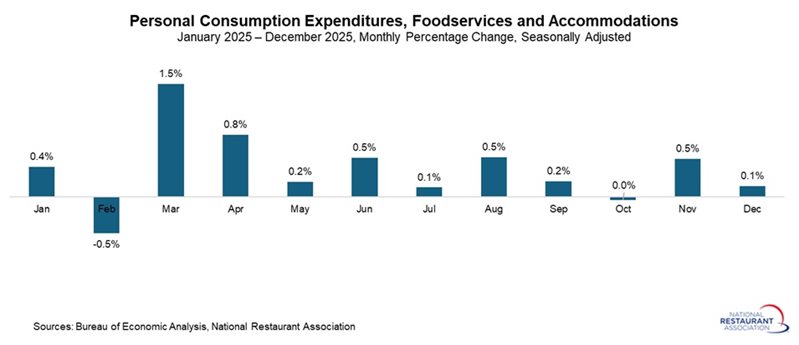

Beyond prices, personal consumption expenditures rose 0.4% in December for the second straight month. Spending on foodservices and accommodations edged up 0.1% in December after jumping by 0.5% in November. Over the past year, total personal spending has grown a healthy 4.7%, with expenditures on foodservices and accommodations up 4.6% since December 2024, signaling surprising resilience in consumer demand despite persistent headwinds and a softer-than-desired reading for December.

Part of this growth reflects higher prices, even as real spending continues to advance at a more modest pace. Inflation-adjusted personal consumption inched up 0.1% in December, with 1.7% growth year-over-year. Real spending on foodservices and accommodations rose 1.2% over the past year. Even after accounting for inflation, consumers are allocating more toward dining and travel, a positive sign for those sectors, albeit at a softer pace than many would prefer.

Personal income rose 0.3% in December, increasing for the seventh straight month but slower than the 0.4% pace seen in November. Personal income grew 4.3% over the past 12 months. Wages, which have been a large contributor to the economy’s resilience, increased 0.2% in December, with 3.7% growth year-over-year.

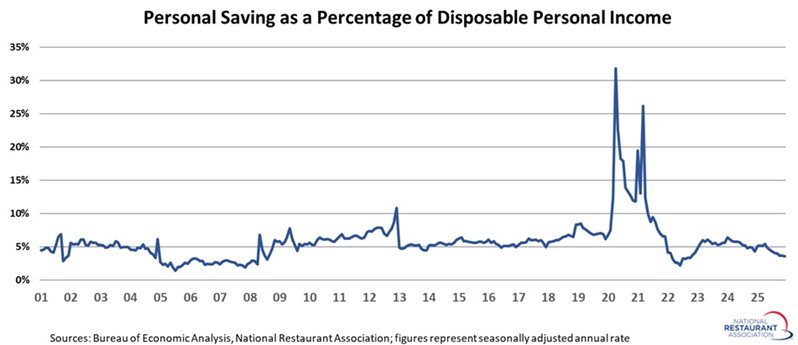

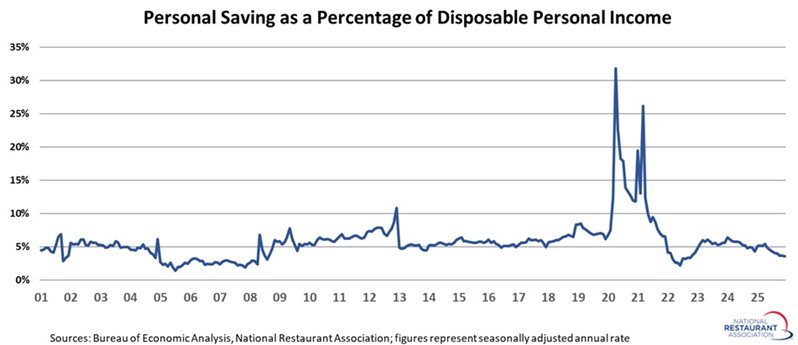

With spending growth slightly outpacing income gains, the personal savings rate fell to 3.6% in December, its lowest level since October 2022. Notably, savings rates in the post‑pandemic period remain well below historical norms. Prior to the pandemic, the savings rate averaged 6.5% from 2017 to 2019, compared with an average of just 5.0% since the start of 2023. Moreover, savings over the past eight months have consistently run below that already‑reduced pace.

Year-over-year, the headline PCE deflator accelerated to 2.9% in December from 2.8% in November. Core PCE inflation rose 3.0% over the past 12 months, up from 2.8% in both October and November and the highest reading since February.

These data highlight two dynamics. First, as noted above, consumer inflation has edged higher in recent months, rising to the highest rates since February. Yet the longer-term trend continues to reflect moderation from post‑pandemic highs. Over the past 20 months—since May 2024—core inflation has averaged 2.8%. Both headline and core inflation remain well below their peaks of 7.1% (June 2022) and 5.5% (September 2022), even as progress toward the Federal Reserve’s 2% target remains incomplete.

For now, employment concerns are overshadowing inflation risks, although the Federal Reserve is closely monitoring both. The December pickup in prices complicates the case for near-term rate cuts, and the Federal Open Market Committee is likely to keep policy steady at its March 17–18 meeting while it waits for additional data. Further rate reductions are still expected in 2026, but are unlikely before mid‑year at the earliest.

Beyond prices, personal consumption expenditures rose 0.4% in December for the second straight month. Spending on foodservices and accommodations edged up 0.1% in December after jumping by 0.5% in November. Over the past year, total personal spending has grown a healthy 4.7%, with expenditures on foodservices and accommodations up 4.6% since December 2024, signaling surprising resilience in consumer demand despite persistent headwinds and a softer-than-desired reading for December.

Part of this growth reflects higher prices, even as real spending continues to advance at a more modest pace. Inflation-adjusted personal consumption inched up 0.1% in December, with 1.7% growth year-over-year. Real spending on foodservices and accommodations rose 1.2% over the past year. Even after accounting for inflation, consumers are allocating more toward dining and travel, a positive sign for those sectors, albeit at a softer pace than many would prefer.

With spending growth slightly outpacing income gains, the personal savings rate fell to 3.6% in December, its lowest level since October 2022. Notably, savings rates in the post‑pandemic period remain well below historical norms. Prior to the pandemic, the savings rate averaged 6.5% from 2017 to 2019, compared with an average of just 5.0% since the start of 2023. Moreover, savings over the past eight months have consistently run below that already‑reduced pace.