Menu Prices

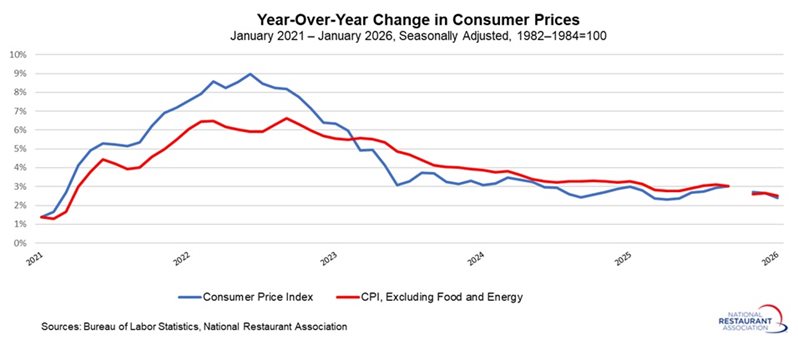

Core CPI—which excludes food and energy—increased 0.3% in January, with 2.5% growth seen over the past 12 months, the slowest pace since March 2021.

Price trends across core categories were mostly higher in January. Notable increases included transportation services (+1.4%), apparel (+0.3%), household furnishings and supplies (+0.3%), medical care services (+0.3%), and shelter (+0.2%). At the same time, prices were lower for used cars and trucks (-1.8%) and medical care commodities (-0.1%).

While core inflation continues to run slightly above the Federal Reserve’s stated 2% long-run objective, there has been tremendous progress over the past couple of years to decelerate consumer prices from the highly accelerated paces seen in 2022. For now, the Federal Reserve remains more concerned about a cooling labor market than inflation pressures, and this report will reinforce that view.

Looking ahead, the Fed is expected to maintain its data‑dependent stance in shaping monetary policy. The Federal Open Market Committee is poised to cut the federal funds rate again in 2026, but it seems unlikely to make until later this year. Incoming data will help to frame the timing of any possible cut.

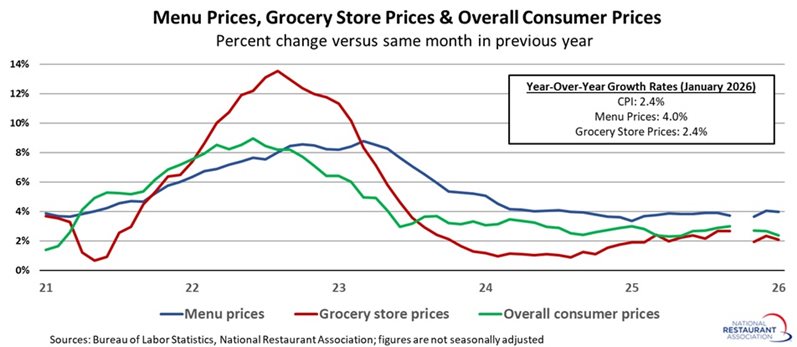

Grocery price growth outstripped menu prices in January

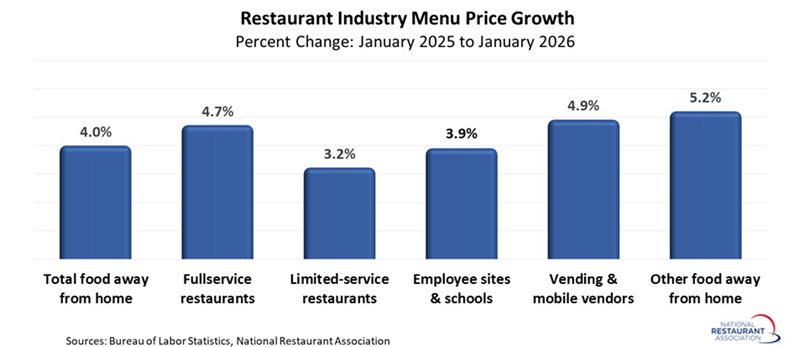

Menu prices increased by 0.2% in January, moderating after jumping by 0.7% in December, which was the fastest monthly growth since October 2022. In 2025, prices for food away from home averaged monthly growth of 0.4%. On a year-over-year basis, menu prices have risen 4.0% since January 2025, easing from 4.1% year-over-year in December. Overall, menu inflation remains firm, though well below the 8.8% peak seen in March 2023, the fastest rate in over two decades.

In contrast, grocery prices grew 0.6% in January, building on the 0.5% gain seen in December. Grocery prices averaged 0.3% growth per month in 2025. The CPI for food at home rose 2.4% year-over-year in January.

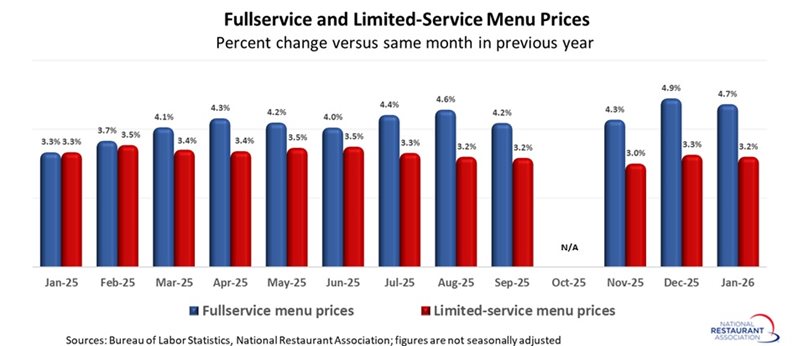

In the food away from home category, menu prices at limited-service restaurants rose 0.3% in January, slowing from 0.6% growth in December. Meanwhile, fullservice menu prices were unchanged in January after jumping by 0.8% in December.

On a year-over-year basis, full-service menu prices increased 4.7% in January, while limited-service prices rose 3.2% year-over-year. Despite sizable growth in 2025, inflation in both segments has moderated significantly from earlier peaks: full-service restaurant prices surged as high as 9.0% year-over-year in 2022, while limited-service prices peaked at 8.2% in April 2023.

Within the broader food-away-from-home category, prices for food from vending machines and at employee sites and schools both edged up 0.1% in January. Each slowed from stronger growth in December: vending machines (+0.5%) and employee sites and schools (+0.3%).

Year-over-year, prices at vending and mobile vendors rose 4.9% since January, with prices for food at employee sites and schools increasing by 3.9%. The broader “other food away from home” category posted a 5.2% annual increase in prices in January year-over-year.

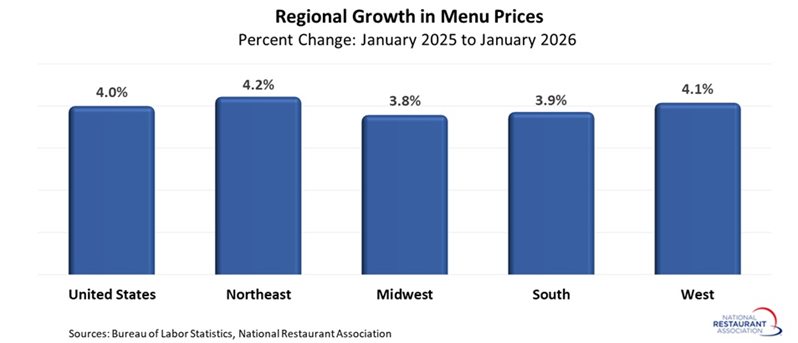

Regionally, menu prices grew 0.3% in the Northeast and 0.2% in the Midwest. At the same time, menu prices in the South and West both edged up by 0.1%. Over the past 12 months, the Northeast (+4.2%) and West (4.1%) experienced the fastest menu price growth, with the South (+3.9%) and Midwest (+3.8%) not far behind.