Food Costs

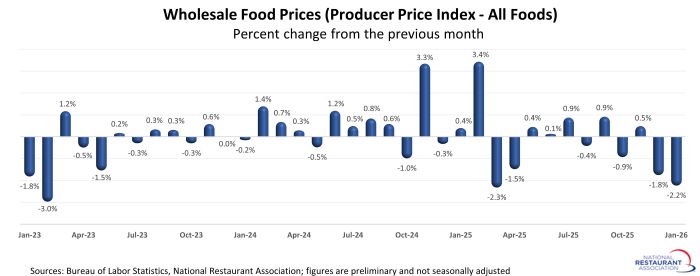

Average wholesale food prices fell sharply for the second consecutive month in January, according to preliminary data from the Bureau of Labor Statistics.

The Producer Price Index for All Foods – which represents the change in average prices paid to domestic producers for their output – declined 2.2% between December and January. That followed a 1.8% drop in December and represented the third sharp decline in the last four months.

The recent drop in the food price index was largely the result of declines in prices for fruit and vegetables, eggs and dairy products.

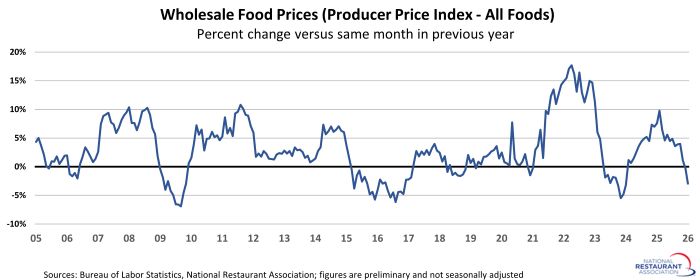

The last few months provided a degree of relief for restaurant operators, as the food price index began 2025 with a nearly 10% increase on a 12-month basis. Average wholesale food prices stood 3% below their year-ago level in January, the largest 12-month decline in two years.

Even with the recent declines, wholesale food prices remain well above their pre-pandemic levels. As of January 2026, the Producer Price Index for All Foods stood 31% above its February 2020 reading.

The overall food price index declined in recent months, but trends were mixed on the individual commodity level.

The price indices for eggs (-89.9%), butter (-46.7%), confectionary materials (-16.4%), fresh fruit (-11.9%), refined sugar (-9.0%), cheese (-8.8%), milled rice (-6.8%), milk (-6.6%) and wheat flour (-4.1%) fell sharply from their year-ago levels.

At the same time, prices for several commodities continued to rise, particularly proteins and beverages. Producer prices for coffee (24.7%), beef and veal (10.4%), pork (7.6%), soft drinks (5.3%), unprocessed finfish (5.1%), fats and oils (4.2%), unprocessed shellfish (3.4%), tea (2.9%) and processed poultry (2.3%) stood above their January 2025 levels.

While average food costs trended lower in recent months, the degree to which restaurants are experiencing pricing relief depends on the menu mix of each individual operation.