Research

February 12, 2026

Consumer outlook

Consumer resilience is being tested by a slowing labor market

The resilient U.S. labor market, which has fueled much of the current consumer-driven economic expansion, showed signs of weakness in recent months. The private sector added just 367,000 net new jobs during 2025. That was down from a gain of 1 million jobs in 2024 and represented the weakest calendar-year job growth since 2009 (excluding the 2020 pandemic period).

At the same time, the national unemployment rate remains low by historical standards – just 4.3% in January 2026 – and there hasn’t been a significant uptick in layoffs. Still, the recent slowdown in job growth is a potential sign that a key catalyst of consumer activity may be losing momentum.

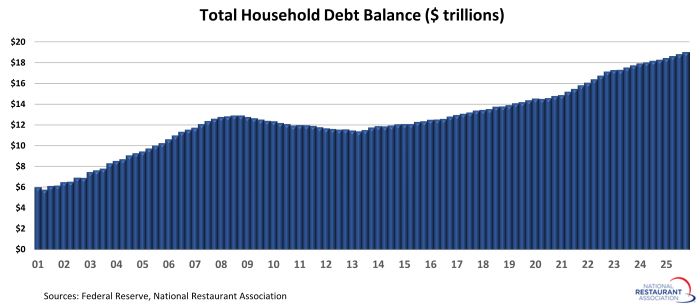

It’s not just a softer labor market that can impact consumers’ capacity to spend. Rising debt levels – along with an uptick in delinquency rates – will limit the ability of some households to keep spending. However, the debt-to-income ratio remains reasonably manageable in historical terms, which reduces the worry somewhat.

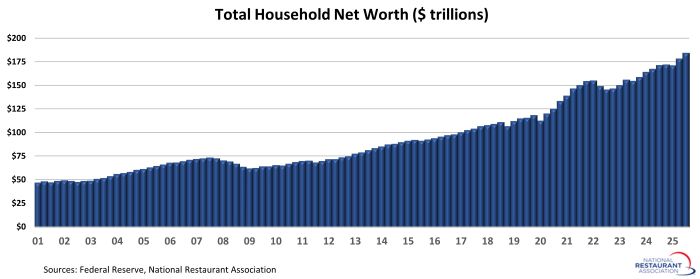

In addition, household wealth keeps reaching new record levels, which will continue to boost the confidence of consumers with homes and investments.

Despite the mixed signals, the underlying fundamentals remain generally positive, which points toward continued economic growth in 2026. Factor in the impact that changes to federal income tax laws will have on households – including both larger tax refunds and lower tax withholdings – and it’s likely that consumers on the aggregate will retain the financial wherewithal to continue spending in 2026.

This article presents the latest trends in key indicators that impact consumers’ ability and willingness to spend. Visit this page throughout the year for ongoing analysis of the state of the American consumer.

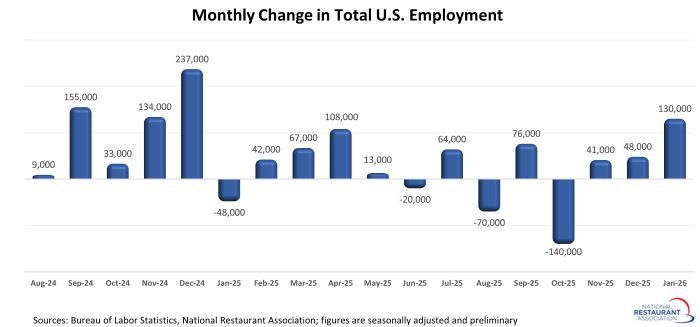

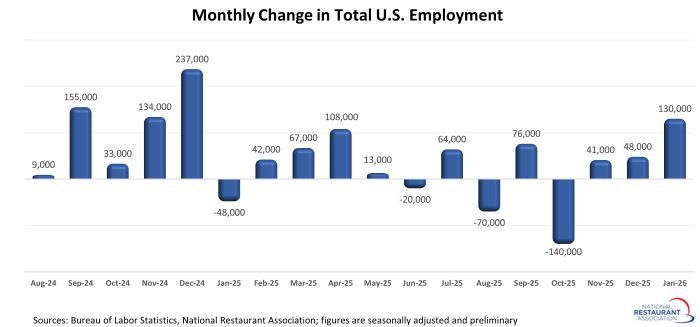

Job growth slowed in recent months

Employment growth in the national economy slowed dramatically in recent months, with employers adding just 181,000 net new jobs during 2025. That was down sharply from an increase of nearly 1.5 million jobs in 2024. While a sharp reduction in the size of the federal government workforce drove much of the slowdown, private sector hiring also downshifted in 2025. Private employers added 367,000 jobs during 2025, down from 1 million in 2024. The economy rebounded with a gain of 130,000 jobs in January, the strongest increase since December 2024.

Consumer confidence remains dampened

Coinciding with the slowdown in the labor market, The Conference Board’s Consumer Confidence Index showed signs of rising economic uncertainty among households. This measure of consumer sentiment trended steadily lower during 2025, before settling in January 2026 at its lowest level in more than a decade. That was largely due to declines in the expectations component of the index, which measures consumers’ short-term outlook for income, business, and labor market conditions. Not surprisingly, consumers on the lower end of the income scale are much less confident in the direction of the economy.

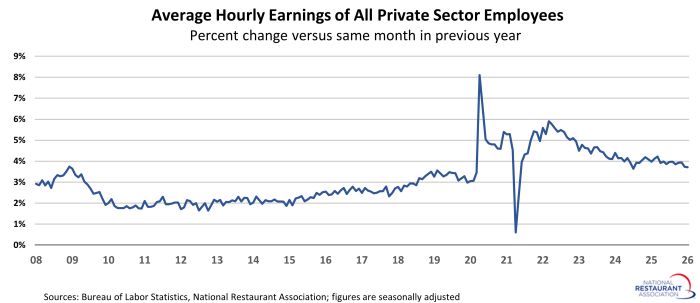

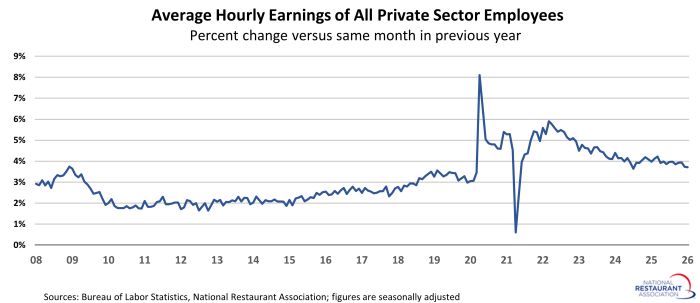

Wage gains remain positive despite slowing job growth

Although job growth slowed in recent months, wage growth held up relatively well. Average hourly earnings of private sector employees increased 3.7% between January 2025 and January 2026. That was 2 percentage points below the strong gains posted during 2022, but still remained above the 3.3% average increase during 2019.

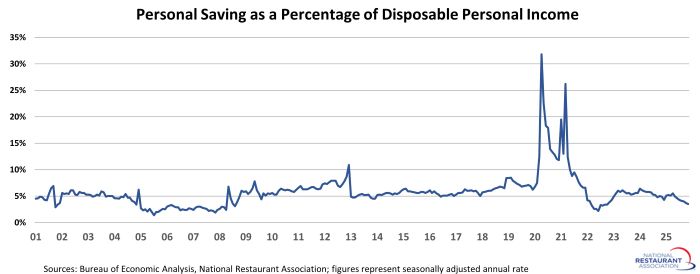

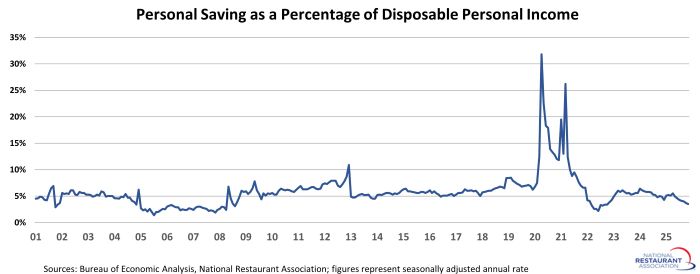

Savings rate declined in recent months

Although nominal personal income continues to rise at a moderate pace, persistent inflation means growth is somewhat muted in inflation-adjusted terms. At the same time, consumer spending has been outpacing income growth, which means many households are tapping into their savings to support these expenditures. This led to the personal savings rate falling to 3.5% in November, its lowest level since October 2022. It was also well below the pre-pandemic savings rate, which averaged 6.5% between 2017 and 2019.

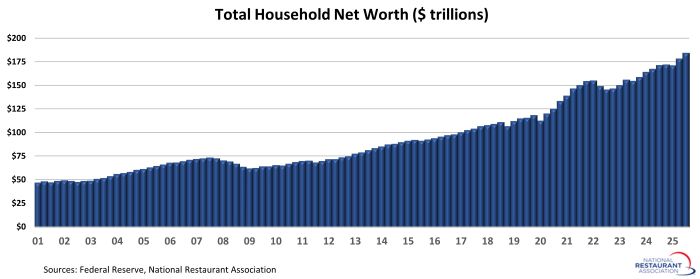

Household wealth surged in recent quarters

Household wealth continues to trend sharply higher, rising by more than $6 trillion in the third quarter of 2025. That followed an increase of more than $7 trillion in the second quarter, and represented seventh increase in the last eight quarters. The only interruption of the positive trendline was a modest dip in the first quarter of 2025, which was due largely to a decline in the stock market. In total during the last eight quarters, total household net worth jumped by nearly $30 trillion. That positively impacts consumers’ willingness to spend on discretionary items, including restaurants.

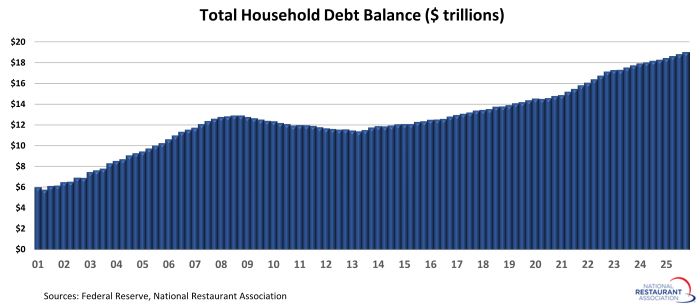

Household debt continues to rise

Household debt trended steadily higher in recent years, with aggregate balances reaching $18.8 trillion by 2025:Q4. Mortgages represent the bulk of household debt at 70%, followed by auto loans (9%), student loans (9%) and credit cards (7%).

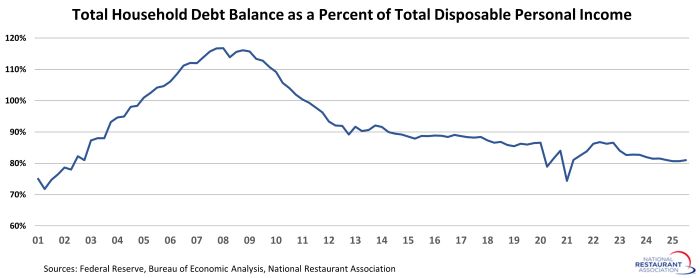

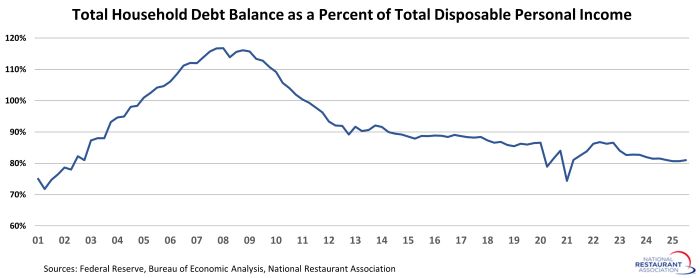

Debt to income ratio remains manageable

Even though debt levels are rising, it remains manageable in relation to income. On average during the first three quarters of 2025, the total household debt balance was about 81% of total disposable personal income. Aside from two quarters during the pandemic, that’s the lowest debt-to-income ratio in more than two decades. It’s also well below the record highs of more than 116% registered during the Great Recession in 2007 and 2008.

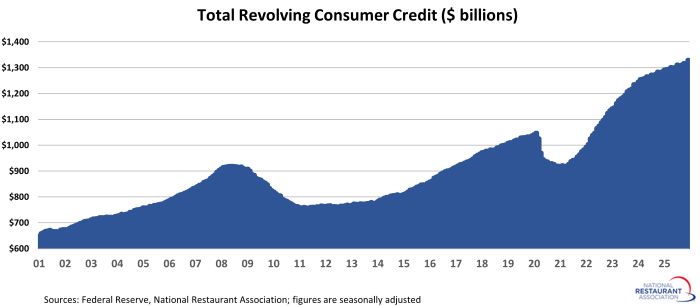

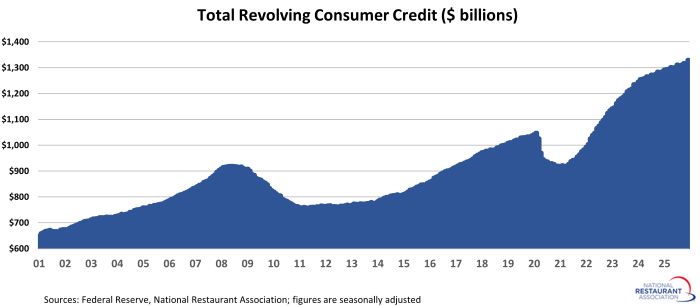

Revolving credit balances continue to rise

Revolving consumer credit rose sharply during the last 5 years, following an early-pandemic period during which balances dropped by more than 12%. By December 2025, total revolving credit balances topped $1.3 trillion, which was $282 billion (or 27%) above their pre-pandemic peak. While balances continue to rise, the rate of growth slowed somewhat in recent months. Total revolving credit balances increased 3.4% during 2025. That was down from stronger gains in 2023 (8.9%) and 2024 (4.1%), and represented the slowest non-pandemic calendar-year growth since 2013 (1.7%).

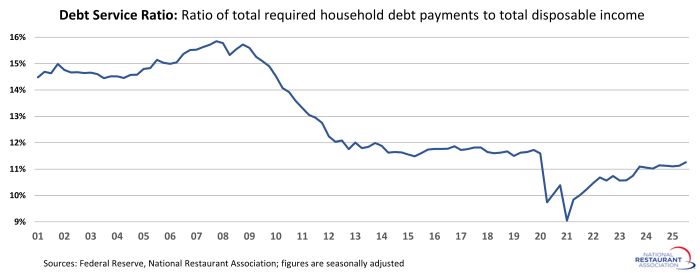

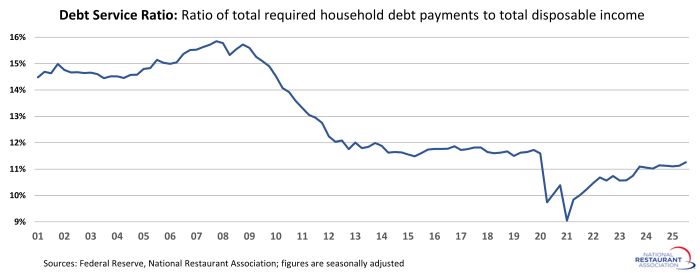

Debt service remains in check

Despite the elevated debt levels, debt service remains manageable for households on the aggregate. The Federal Reserve’s Debt Service Ratio, which is the ratio of total required household debt payments to total disposable income, was just over 11% in 2025:Q3. While that was higher than the lows posted during the first half of 2021, it remained slightly below pre-pandemic readings.

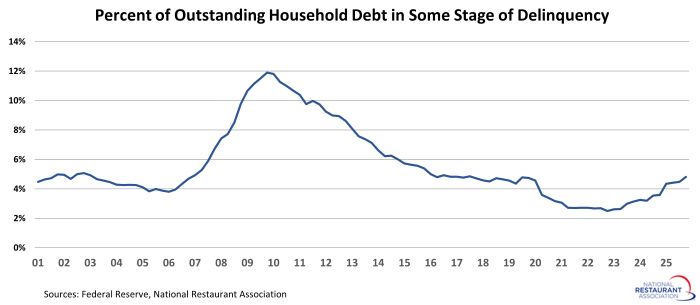

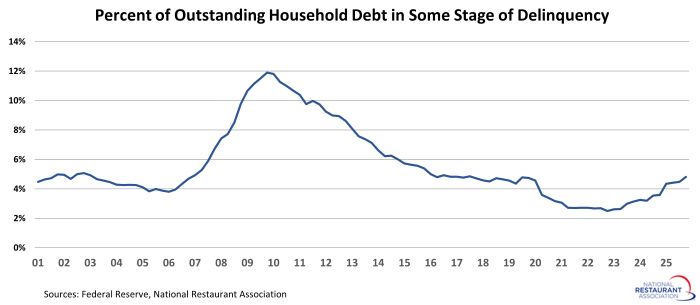

Overall delinquency rates are trending higher

While debt service levels remained manageable in historical terms, overall delinquency rates trended higher in recent quarters. As of 2025:Q4, 4.8% of outstanding household debt was in some stage of delinquency. That was up more than 2 full percentage points from the recent low of 2.5% in 2022:Q4, and represented the highest level since 2017:Q3 (4.9%).

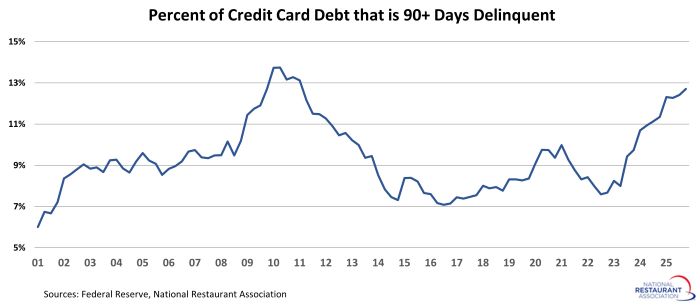

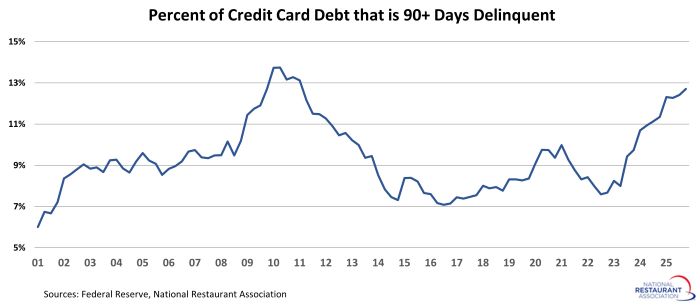

Credit card delinquencies are up sharply

Along with an uptick in overall delinquency rates, the percentage of credit cards that were severely delinquent rose dramatically in recent quarters. As of 2025:Q4, 12.7% of credit card debt was at least 90 days delinquent. That was up from a recent low of 7.6% in 2022:Q3 and represented the highest level in nearly 15 years.

At the same time, the national unemployment rate remains low by historical standards – just 4.3% in January 2026 – and there hasn’t been a significant uptick in layoffs. Still, the recent slowdown in job growth is a potential sign that a key catalyst of consumer activity may be losing momentum.

It’s not just a softer labor market that can impact consumers’ capacity to spend. Rising debt levels – along with an uptick in delinquency rates – will limit the ability of some households to keep spending. However, the debt-to-income ratio remains reasonably manageable in historical terms, which reduces the worry somewhat.

In addition, household wealth keeps reaching new record levels, which will continue to boost the confidence of consumers with homes and investments.

Despite the mixed signals, the underlying fundamentals remain generally positive, which points toward continued economic growth in 2026. Factor in the impact that changes to federal income tax laws will have on households – including both larger tax refunds and lower tax withholdings – and it’s likely that consumers on the aggregate will retain the financial wherewithal to continue spending in 2026.

This article presents the latest trends in key indicators that impact consumers’ ability and willingness to spend. Visit this page throughout the year for ongoing analysis of the state of the American consumer.

Job growth slowed in recent months

Employment growth in the national economy slowed dramatically in recent months, with employers adding just 181,000 net new jobs during 2025. That was down sharply from an increase of nearly 1.5 million jobs in 2024. While a sharp reduction in the size of the federal government workforce drove much of the slowdown, private sector hiring also downshifted in 2025. Private employers added 367,000 jobs during 2025, down from 1 million in 2024. The economy rebounded with a gain of 130,000 jobs in January, the strongest increase since December 2024.

Consumer confidence remains dampened

Coinciding with the slowdown in the labor market, The Conference Board’s Consumer Confidence Index showed signs of rising economic uncertainty among households. This measure of consumer sentiment trended steadily lower during 2025, before settling in January 2026 at its lowest level in more than a decade. That was largely due to declines in the expectations component of the index, which measures consumers’ short-term outlook for income, business, and labor market conditions. Not surprisingly, consumers on the lower end of the income scale are much less confident in the direction of the economy.

Wage gains remain positive despite slowing job growth

Although job growth slowed in recent months, wage growth held up relatively well. Average hourly earnings of private sector employees increased 3.7% between January 2025 and January 2026. That was 2 percentage points below the strong gains posted during 2022, but still remained above the 3.3% average increase during 2019.

Savings rate declined in recent months

Although nominal personal income continues to rise at a moderate pace, persistent inflation means growth is somewhat muted in inflation-adjusted terms. At the same time, consumer spending has been outpacing income growth, which means many households are tapping into their savings to support these expenditures. This led to the personal savings rate falling to 3.5% in November, its lowest level since October 2022. It was also well below the pre-pandemic savings rate, which averaged 6.5% between 2017 and 2019.

Household wealth surged in recent quarters

Household wealth continues to trend sharply higher, rising by more than $6 trillion in the third quarter of 2025. That followed an increase of more than $7 trillion in the second quarter, and represented seventh increase in the last eight quarters. The only interruption of the positive trendline was a modest dip in the first quarter of 2025, which was due largely to a decline in the stock market. In total during the last eight quarters, total household net worth jumped by nearly $30 trillion. That positively impacts consumers’ willingness to spend on discretionary items, including restaurants.

Household debt continues to rise

Household debt trended steadily higher in recent years, with aggregate balances reaching $18.8 trillion by 2025:Q4. Mortgages represent the bulk of household debt at 70%, followed by auto loans (9%), student loans (9%) and credit cards (7%).

Debt to income ratio remains manageable

Even though debt levels are rising, it remains manageable in relation to income. On average during the first three quarters of 2025, the total household debt balance was about 81% of total disposable personal income. Aside from two quarters during the pandemic, that’s the lowest debt-to-income ratio in more than two decades. It’s also well below the record highs of more than 116% registered during the Great Recession in 2007 and 2008.

Revolving credit balances continue to rise

Revolving consumer credit rose sharply during the last 5 years, following an early-pandemic period during which balances dropped by more than 12%. By December 2025, total revolving credit balances topped $1.3 trillion, which was $282 billion (or 27%) above their pre-pandemic peak. While balances continue to rise, the rate of growth slowed somewhat in recent months. Total revolving credit balances increased 3.4% during 2025. That was down from stronger gains in 2023 (8.9%) and 2024 (4.1%), and represented the slowest non-pandemic calendar-year growth since 2013 (1.7%).

Debt service remains in check

Despite the elevated debt levels, debt service remains manageable for households on the aggregate. The Federal Reserve’s Debt Service Ratio, which is the ratio of total required household debt payments to total disposable income, was just over 11% in 2025:Q3. While that was higher than the lows posted during the first half of 2021, it remained slightly below pre-pandemic readings.

Overall delinquency rates are trending higher

While debt service levels remained manageable in historical terms, overall delinquency rates trended higher in recent quarters. As of 2025:Q4, 4.8% of outstanding household debt was in some stage of delinquency. That was up more than 2 full percentage points from the recent low of 2.5% in 2022:Q4, and represented the highest level since 2017:Q3 (4.9%).

Credit card delinquencies are up sharply

Along with an uptick in overall delinquency rates, the percentage of credit cards that were severely delinquent rose dramatically in recent quarters. As of 2025:Q4, 12.7% of credit card debt was at least 90 days delinquent. That was up from a recent low of 7.6% in 2022:Q3 and represented the highest level in nearly 15 years.