Research

June 26, 2025

Economic outlook

Resilient Yet Cautious: The Economic Landscape and Outlook for Mid-2025

Consumers and businesses faced significant disruption in the first half of 2025, contending with heightened uncertainty and a marked decline in sentiment. Concerns over tariffs and their potential ripple effects eroded confidence and slowed economic momentum. At the same time, downside risks remain elevated due to geopolitical tensions and a range of policy shifts—both proposed and enacted—at the federal, state, and local levels.

Amid the noise, however, the U.S. economy continues to show signs of resilience, supported by steady—if cautious—spending. Real GDP declined 0.5% at an annual rate in the first quarter, largely reflecting a front-loading of imports ahead of potential tariffs, much of which ended up in inventory. A sharp rebound is likely in the second quarter as imports normalize from record highs earlier in the year. Notably, consumer spending and fixed investment rose at a 1.9% annualized pace in Q1, underscoring surprising underlying strength.

Employment and wages have continued to expand at a modest pace, even as broader labor market conditions have cooled over the past two years. This sustained income growth has given consumers the financial capacity to keep spending, providing a stabilizing force and helping to stave off a recession. Still, caution persists—particularly within the restaurant sector—where traffic, sales, and hiring trends have been mixed so far this year.

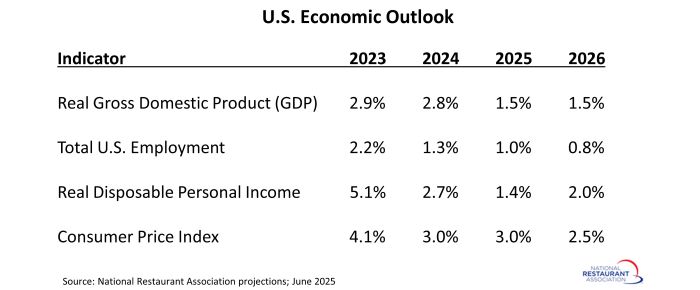

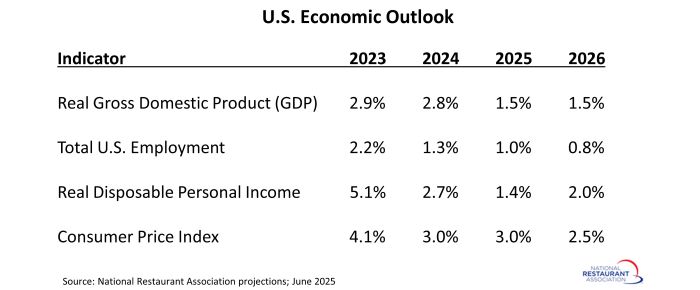

Looking ahead, the National Restaurant Association projects slower growth in both GDP and employment, with the economy expected to expand by 1.5% in 2025 and 2026. Inflation is likely to accelerate in the second half of this year following a period of post-pandemic moderation. While a modest expansion remains the base case, elevated downside risks continue to cloud the outlook. These dynamics are expected to keep the Federal Reserve in a wait-and-see mode, likely delaying any interest rate cuts until at least September.

This article presents the latest trends in key economic indicators as well as an outlook for the year ahead. Visit this page throughout the year for the Association’s latest projections for the U.S. economy.

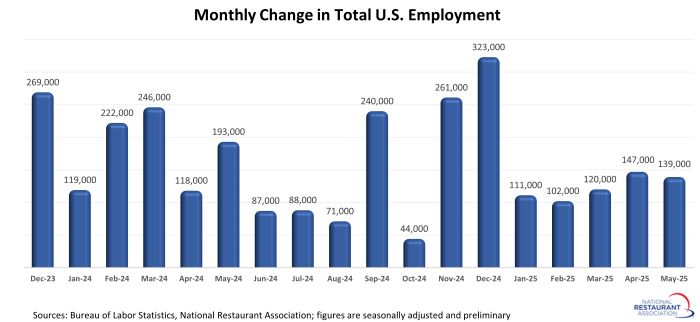

Labor market expansion remains intact

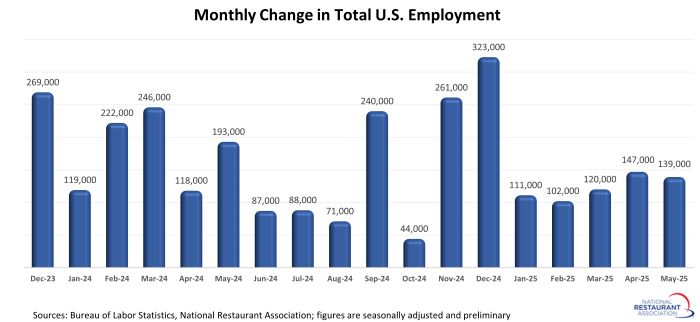

Although job growth slowed in recent months, the labor market expansion showed little signs of stalling. Employers added an average of 143,000 jobs during April and May, which was above the average monthly gain of 111,000 jobs during the first 3 months of 2025.

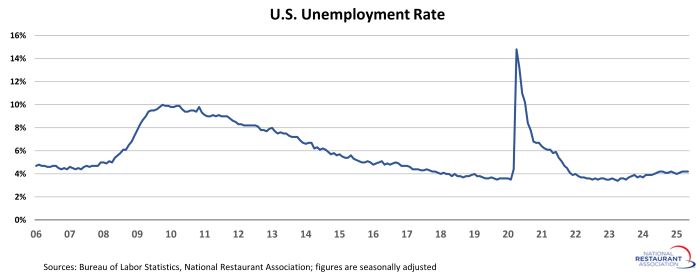

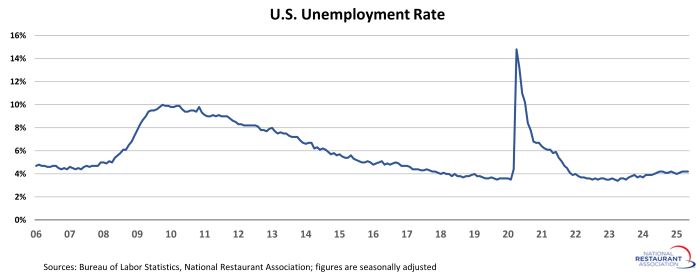

Unemployment rate remains historically low

The jobless rate ticked higher from the sub-4% lows of 2022 and 2023, but continues to suggest that the economy is at or near full employment. The national unemployment rate stood at 4.2% in May, which represented the 43rd consecutive month at a level of 4.2% or lower.

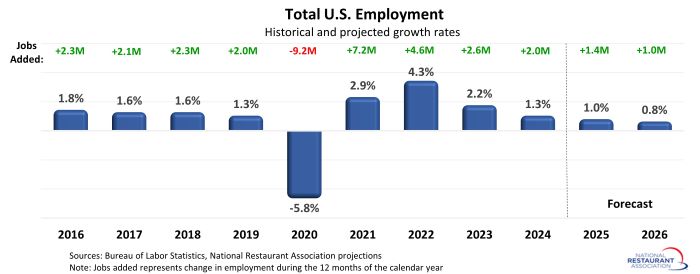

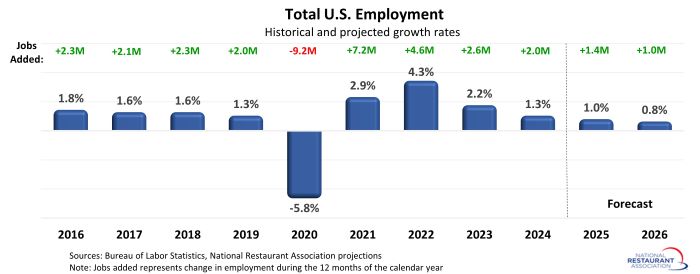

Economy projected to add 1.4 million jobs in 2025

Job growth slowed in recent months, but the labor market expansion is expected to continue throughout 2025 – albeit at a more modest pace. The national economy is projected to add a net 1.4 million jobs during 2025, which would be down from the 2 million jobs added during 2024. Despite the slowdown, 2025 is expected to represent the 5th consecutive year of job growth, with total gains in excess of 17.5 million jobss.

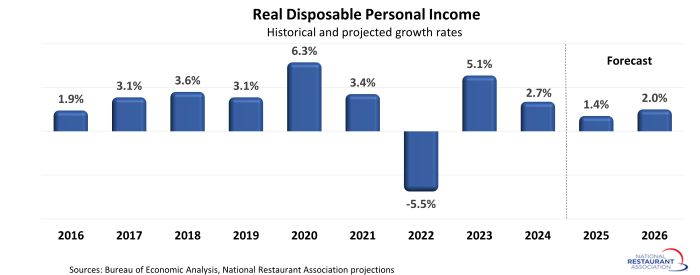

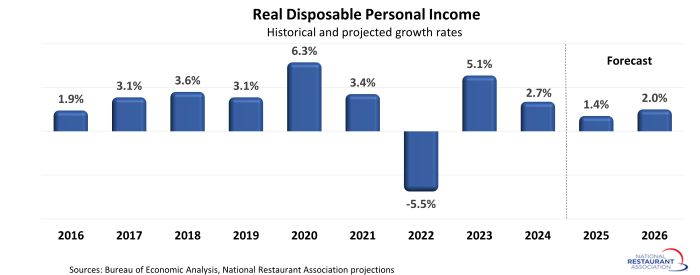

Personal income growth expected to slow in 2025

Wage growth is expected to continue in 2025, but decelerating employment gains will likely dampen the increase in aggregate income. Disposable personal income – a key driver of restaurant sales – is projected to increase at an inflation-adjusted rate of 1.4% in 2025. While still positive, that would be down from a stronger 2.7% gain in 2024.

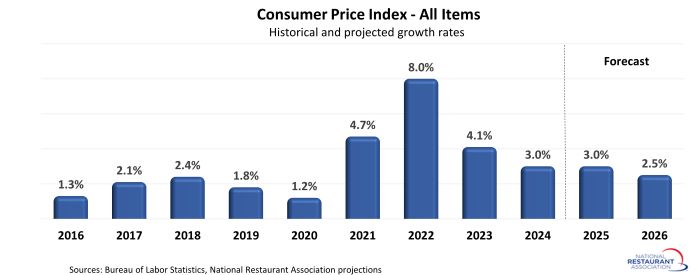

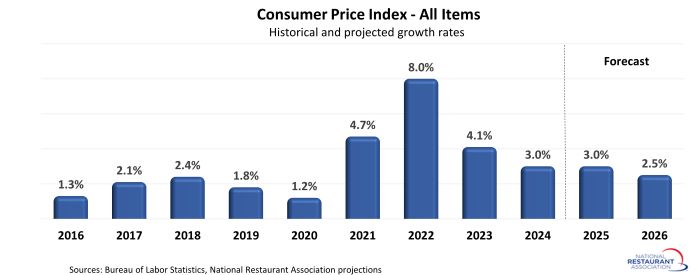

Inflation remains sticky

After hitting a peak of 9.1% in mid-2022 – the strongest 12-month increase in 4 decades – growth in consumer prices moderated in the months that followed. Although progress has been made toward reaching the Federal Reserve’s 2% target level, prices remain sticky in many areas. Adding to the uncertainty is the potential impact that tariffs will have on consumer prices during the second half of 2025. As a result, the National Restaurant Association expects the CPI to increase 3.0% in 2025 on an average annual basis, which would match the 3.0% gain registered in 2024.

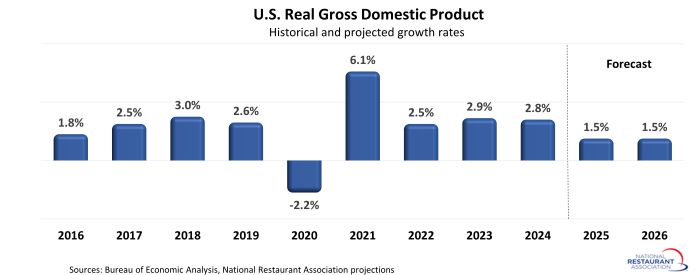

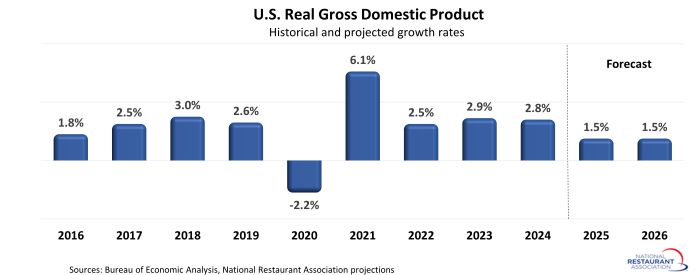

Economic growth expected to remain modest

Overall, the expectation is that the U.S. economy will slow significantly in 2025, with continued modest gains projected for 2026. Real Gross Domestic Product (GDP) – the value of goods and services produced in the United States – is projected to increase at a 1.5% rate in 2025. That would be down from the gains of nearly 3% in both 2023 and 2024, and would represent the weakest annual gain since 2020.

Amid the noise, however, the U.S. economy continues to show signs of resilience, supported by steady—if cautious—spending. Real GDP declined 0.5% at an annual rate in the first quarter, largely reflecting a front-loading of imports ahead of potential tariffs, much of which ended up in inventory. A sharp rebound is likely in the second quarter as imports normalize from record highs earlier in the year. Notably, consumer spending and fixed investment rose at a 1.9% annualized pace in Q1, underscoring surprising underlying strength.

Employment and wages have continued to expand at a modest pace, even as broader labor market conditions have cooled over the past two years. This sustained income growth has given consumers the financial capacity to keep spending, providing a stabilizing force and helping to stave off a recession. Still, caution persists—particularly within the restaurant sector—where traffic, sales, and hiring trends have been mixed so far this year.

Looking ahead, the National Restaurant Association projects slower growth in both GDP and employment, with the economy expected to expand by 1.5% in 2025 and 2026. Inflation is likely to accelerate in the second half of this year following a period of post-pandemic moderation. While a modest expansion remains the base case, elevated downside risks continue to cloud the outlook. These dynamics are expected to keep the Federal Reserve in a wait-and-see mode, likely delaying any interest rate cuts until at least September.

This article presents the latest trends in key economic indicators as well as an outlook for the year ahead. Visit this page throughout the year for the Association’s latest projections for the U.S. economy.

Labor market expansion remains intact

Although job growth slowed in recent months, the labor market expansion showed little signs of stalling. Employers added an average of 143,000 jobs during April and May, which was above the average monthly gain of 111,000 jobs during the first 3 months of 2025.

Unemployment rate remains historically low

The jobless rate ticked higher from the sub-4% lows of 2022 and 2023, but continues to suggest that the economy is at or near full employment. The national unemployment rate stood at 4.2% in May, which represented the 43rd consecutive month at a level of 4.2% or lower.

Economy projected to add 1.4 million jobs in 2025

Job growth slowed in recent months, but the labor market expansion is expected to continue throughout 2025 – albeit at a more modest pace. The national economy is projected to add a net 1.4 million jobs during 2025, which would be down from the 2 million jobs added during 2024. Despite the slowdown, 2025 is expected to represent the 5th consecutive year of job growth, with total gains in excess of 17.5 million jobss.

Personal income growth expected to slow in 2025

Wage growth is expected to continue in 2025, but decelerating employment gains will likely dampen the increase in aggregate income. Disposable personal income – a key driver of restaurant sales – is projected to increase at an inflation-adjusted rate of 1.4% in 2025. While still positive, that would be down from a stronger 2.7% gain in 2024.

Inflation remains sticky

After hitting a peak of 9.1% in mid-2022 – the strongest 12-month increase in 4 decades – growth in consumer prices moderated in the months that followed. Although progress has been made toward reaching the Federal Reserve’s 2% target level, prices remain sticky in many areas. Adding to the uncertainty is the potential impact that tariffs will have on consumer prices during the second half of 2025. As a result, the National Restaurant Association expects the CPI to increase 3.0% in 2025 on an average annual basis, which would match the 3.0% gain registered in 2024.

Economic growth expected to remain modest

Overall, the expectation is that the U.S. economy will slow significantly in 2025, with continued modest gains projected for 2026. Real Gross Domestic Product (GDP) – the value of goods and services produced in the United States – is projected to increase at a 1.5% rate in 2025. That would be down from the gains of nearly 3% in both 2023 and 2024, and would represent the weakest annual gain since 2020.