New Census Outlook Survey Shows Challenging Conditions for Restaurant Operators

The U.S. Census Bureau has introduced an experimental data set, the Business Trends and Outlook Survey (BTOS). This relatively new series “consists of approximately 1.2 million businesses split into six panels (approximately 200,000 cases per panel). Businesses in each panel will be asked to report once every 12 weeks for a year.” New data are released every other week, starting late last year through the present. This large sample of respondents includes restaurants, providing another data point to assess the health of the sector.

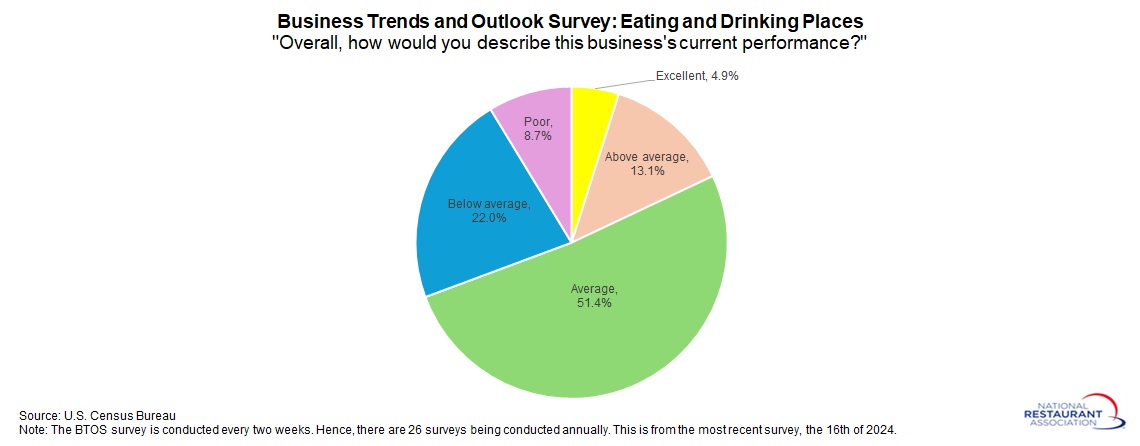

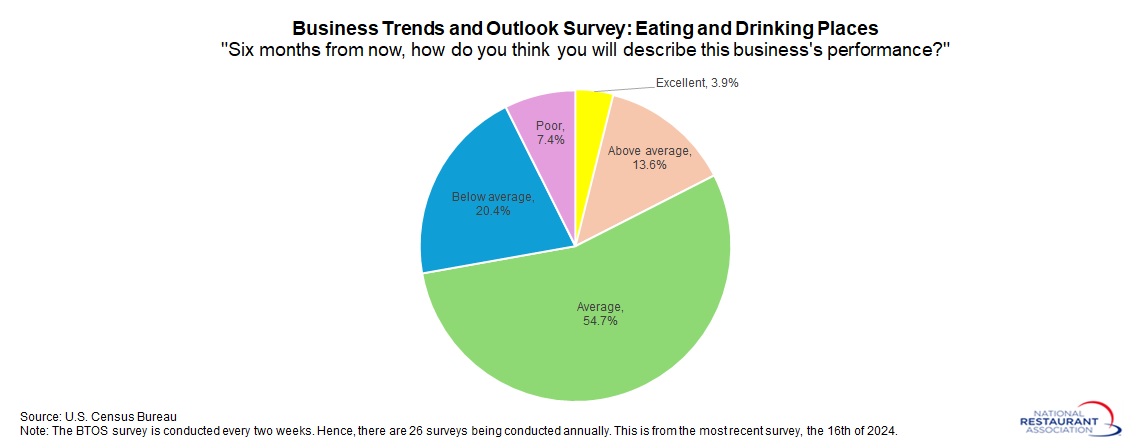

Similar to recent trends in the Restaurant Performance Index, the BTOS shows that conditions are challenging for eating and drinking places. While 51.4% of restaurants operators suggest that their business’s current performance is average in the latest survey (the 16th biweekly period in 2024), 30.7% suggest that conditions are either below average or poor while 18.0% feel that they are either above average or excellent. Moreover, those who were above average or excellent has slipped from 24.2% saying the same thing at the end of 2023, with 27.3% citing below average or poor conditions in the final survey of last years.

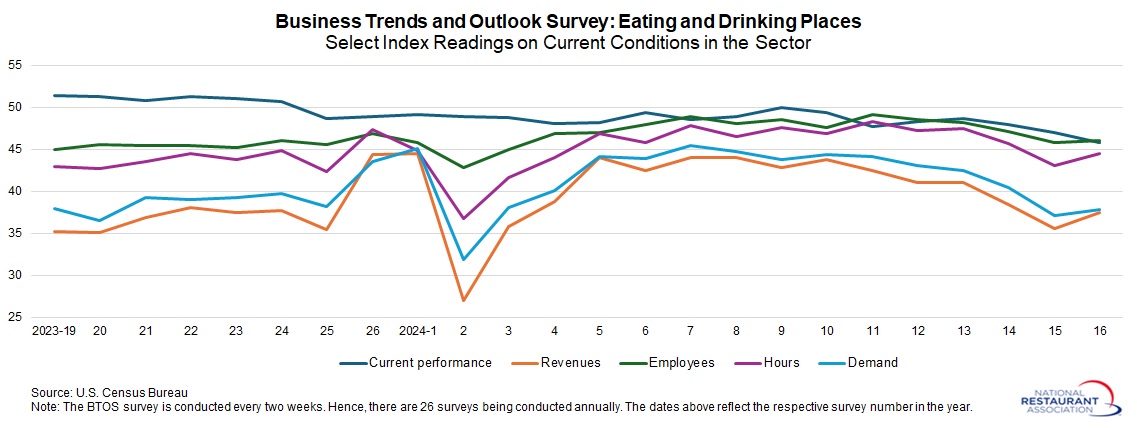

The result is that many of the key indices for the eating and drinking places sector have remained consistently below the key threshold of 50, reflecting more negative than positive sentiment. It is notable that restaurant operators began 2024 on a solidly negative note—including for revenues, employment, hours and demand—but conditions have stabilized somewhat since then, albeit still weaker than desired. In addition, the rate of decline lessened somewhat between the 15th and 16th biweekly survey for 2024.

While this might be disconcerting, one could also frame this more positively. In the latest survey, those restaurants feeling that their current performance was average, above average, or excellent totaled 69.4%. This perhaps suggests more resilience than not, even if conditions are weaker than ideal.

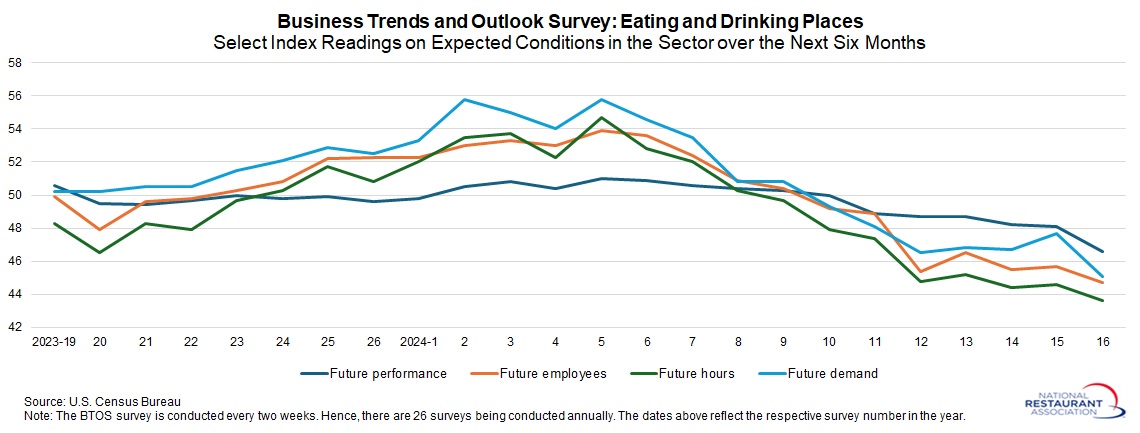

The future-oriented indices highlight the challenging expectations of respondents in the eating and drinking places sector for the next six months, with each of the key measures trending lower year to date.

The National Restaurant Association will continue to monitor this new experimental data set, providing insights on upcoming trends in the restaurant sector in this exciting survey development.

Track more economic indicators and read more analysis and commentary from the Association's economists.

More from Association's economists:

More from the Association's economists:

-

Research

Consumer outlook

March 05, 2026Consumer resilience is being tested by a slowing labor market -

Guides

Employer DHS/ICE Raid Preparedness Action Plan Checklist

March 02, 2026A checklist for restaurant operators developed by the National Restaurant Association, the Restaurant Law Center, and the Fisher Phillips law firm. -

Research

Food Costs

February 27, 2026Wholesale food prices trended lower in recent months -

Research

Same-store sales and customer traffic

February 27, 2026Restaurant operators reported mixed sales and traffic results in January -

Articles

Ring for restaurants: Security solutions that drive success

February 26, 2026Using Ring devices can help stop incidents before they escalate. -

Articles

Operator success: Meet customers where they are

February 24, 2026Chief Economist Chad Moutray says focus on value, staying nimble and innovative, are key to profitability. -

Research

Economic outlook

February 20, 2026Resilient growth and mixed signals amid labor market headwinds -

Research

PCE Deflator

February 20, 2026Consumer inflation accelerated in December, with core prices up 3% year-over-year -

Research

GDP

February 20, 2026U.S. economy grew slower than expected in Q4, pulled lower by government shutdown -

Articles

Key regulatory food safety trends in 2026

February 20, 2026ServSafe Allergens training integrates guidance to help operators stay ahead of compliance and serve guests confidently.

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.