Total U.S. jobs

National economy added 206,000 jobs in June, as the unemployment rate rose to 4.1%

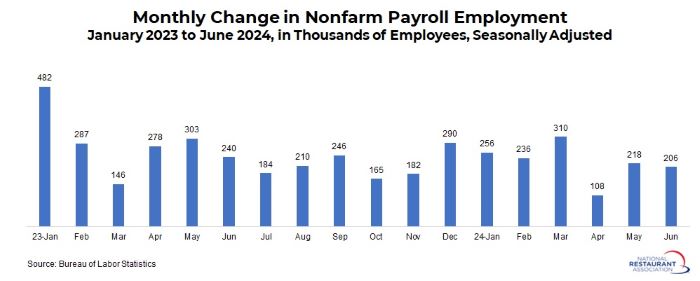

Nonfarm payroll job growth rose by 206,000 workers in June on a seasonally adjusted basis, easing somewhat from a gain of 218,000 seen in May. The May figure was revised lower, with the original estimate being 272,000. Overall, U.S. job growth remains solid, with 1,334,000 net new workers added year to date, averaging more than 222,000 per month.

These data show that the labor market remains a bright spot, helping to provide resilience to economic growth and for increased spending. Nonfarm payroll employment has risen for 42 consecutive months, adding more than 16.1 million jobs in that period. As a result of the steady gains, total U.S. nonfarm payroll employment stood more than 6.3 million (or 4.2%) above the February 2020 pre-pandemic peak, rising to a new record level: 158.6 million.

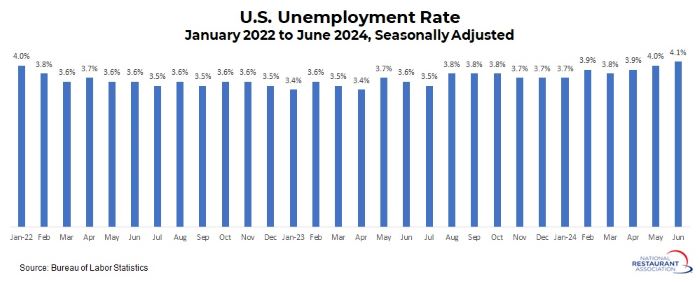

The unemployment rate ticked up from 4.0% in May to 4.1% in June, remaining a strong figure despite rising to the highest rate since November 2021. The number of unemployed Americans rose from 6,649,000 to 6,811,000, a 32-month high. At the same time, the labor force participation rate inched up from 62.5% to 62.6%.

Average hourly earnings for production and nonsupervisory workers among private sector workers rose 4.0% over the past 12 months, matching the year-over-year rate seen in both April and May. The labor market remains tight but has seen some cooling over the past couple of years. For reference, year-over-year earnings growth peaked at 7.0% in March 2022.

Job growth in June was led by strong gains for private education and health services, state and local government and construction, but there were notable declines in manufacturing, professional and business services, retail trade and eating and drinking places, the latter of which fell by 3,100. Overall, the private sector added a net 136,000 jobs in June, while government employment increased by 70,000. Here is a breakdown of the employment growth in June by sector (ranked from highest to least):

• Private education and health services (up 82,000)

• Local government (up 39,000)

• Construction (up 27,000)

• State government (up 26,000)

• Other services (up 16,000)

• Trade, transportation and utilities (up 14,000, but with retail sales down 8,500)

• Financial activities (up 9,000)

• Leisure and hospitality (up 7,000, but with eating and drinking places down 3,100)

• Information (up 6,000)

• Federal government (up 5,000)

• Mining and logging (unchanged)

• Manufacturing (down 8,000)

• Professional and business services (down 17,000)

Track more economic indicators and read more analysis and commentary from the Association's economists.