Menu prices

Consumer prices were stronger than anticipated in September, with menu costs up 0.3%

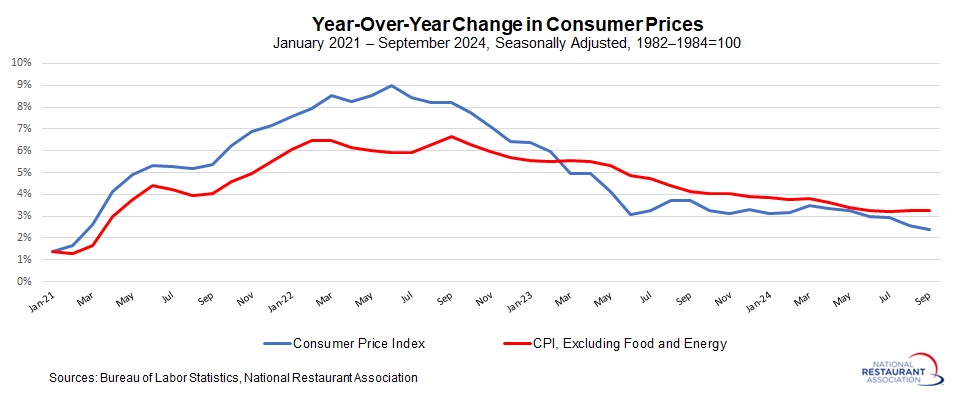

The Consumer Price Index (CPI) increased by 0.2% in September, marking the third consecutive month of gains and surpassing the consensus forecast of 0.1%. Over the past 12 months, consumer prices have risen 2.4%, down from 2.6% in August, representing the slowest year-over-year pace since February 2021.

In September, food prices climbed 0.4%, while energy costs dropped 1.9%. Excluding these volatile components, core consumer prices—which exclude food and energy—rose 0.3% for the second month in a row, exceeding expectations of a 0.2% increase. Notable gains were seen in transportation services (+1.4%), apparel (+1.1%) and medical care services (+0.7%). Year-over-year, core inflation held steady at 3.3% in September, unchanged from August but only slightly higher than July’s 3.2%, which was the lowest rate since April 2021.

Overall, the data present a mixed picture of inflation. While headline inflation has decelerated significantly over the past two years, core inflation remains stubbornly high, with little movement over the last four months.

Looking ahead, the Federal Open Market Committee (FOMC) is anticipated to lower the federal funds rate by 25 basis points at each of its next two meetings, scheduled for November 6–7 and December 17–18. This follows a 50-basis point cut at its September meeting, the first reduction since the start of the pandemic. The Fed aims to continue its rate-cutting cycle gradually as it works towards achieving a “soft landing” for the economy. However, given the persistence of core inflation, which remains above the Fed’s target, the path to rate normalization is expected to be slow and measured.

Menu prices rose 3.9% during the last 12 months

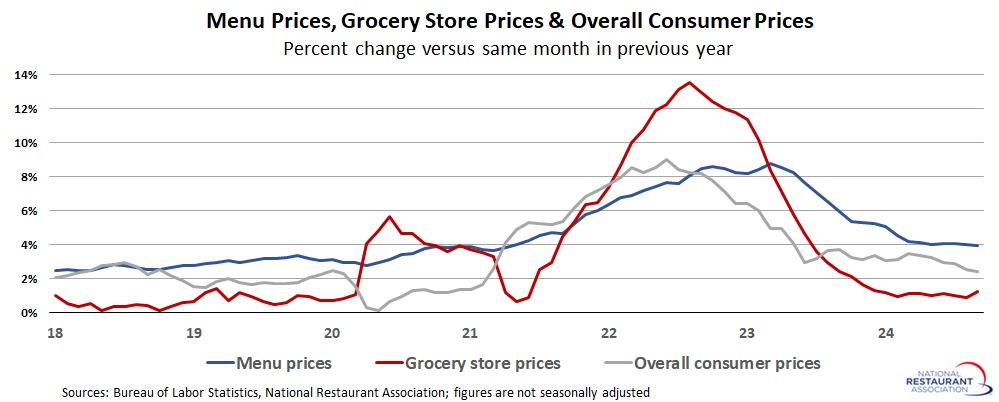

Menu prices rose 0.3% in September for the second straight month. The Consumer Price Index for Food Away from Home increased 3.9% since September 2023, down from 4.0% year-over-year in August and the weakest rate since April 2021. Overall, menu inflation has trended lower year to date, down from 5.3% year-over-year in December (and after peaking at 8.8% in March 2023).

Meanwhile, grocery prices increased 0.4% in September after edging down 0.1% in August. The Consumer Price Index for Food at Home has risen 1.3% since September 2023, up from 0.9% year-over-year in August, which had been the lowest since June 2021. Grocery price growth has decelerated sharply since topping out at 13.5% year-over-year growth in August 2022.

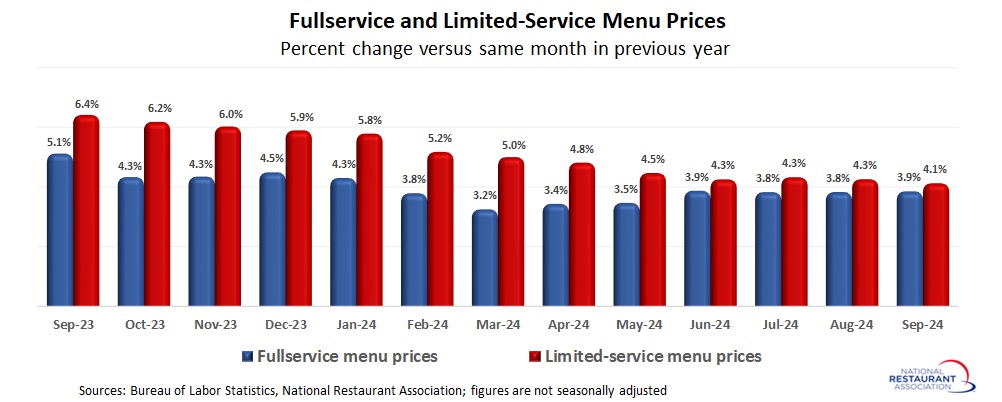

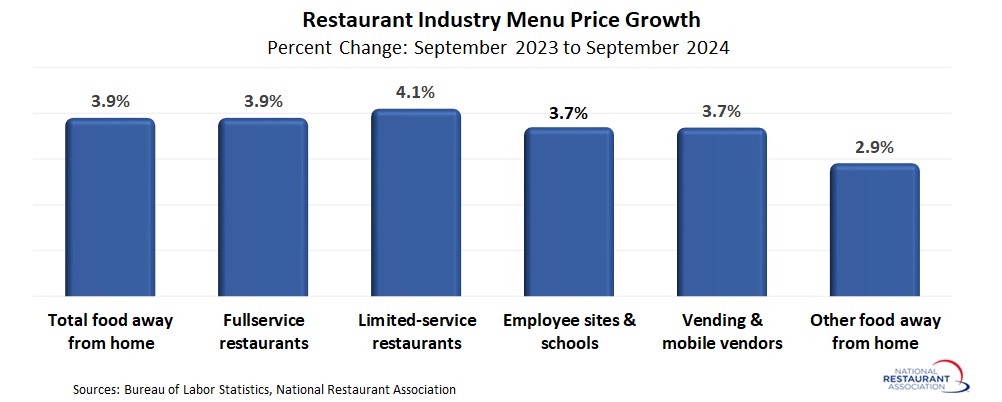

In the food-away-from-home sector, fullservice menu prices increased by 0.4% in September, outpacing the 0.2% rise in limited-service menu prices. This marks the fastest monthly gain for fullservice menus since May. On a year-over-year basis, fullservice menu prices rose 3.9%, while limited-service prices grew 4.1%, the latter reflecting its slowest annual increase since June 2020.

Year-over-year growth in full-service menu prices has remained within a narrow range over the past four months, edging higher since the spring. Both segments have shown significant progress over the past couple of years. Fullservice menu prices peaked at 9.0% year-over-year several times in 2022, while limited-service prices reached a high of 8.2% in April 2023.

In other areas of the food-away-from-home sector, employee sites and schools saw a robust 1.7% increase in prices in September. Prices for food from vending machines and mobile vendors edged up 0.2% during the month, while costs for other food purchased away from home rose 0.5%. On a year-over-year basis, prices at employee sites & schools and vending & mobile vendors each increased by 3.7% compared to September 2024, while other food-away-from-home costs rose 2.7%.

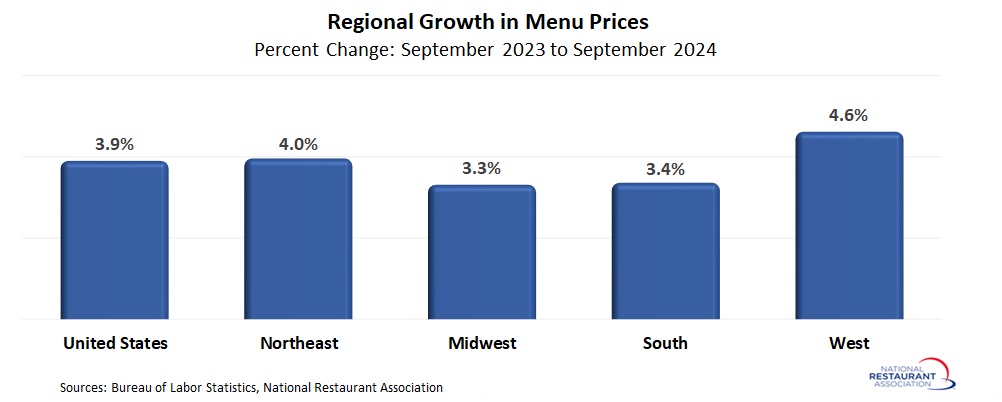

Regionally, the West experienced the highest menu price growth, with a 4.6% increase year-over-year. Meanwhile, menu prices in the Northeast rose 4.0% over the same period, followed by the South at 3.4% and the Midwest at 3.3% since September 2023.

Track more economic indicators and read more analysis and commentary from the Association's economists.