Menu prices

Menu-price growth remains moderate while overall inflation continues to fall

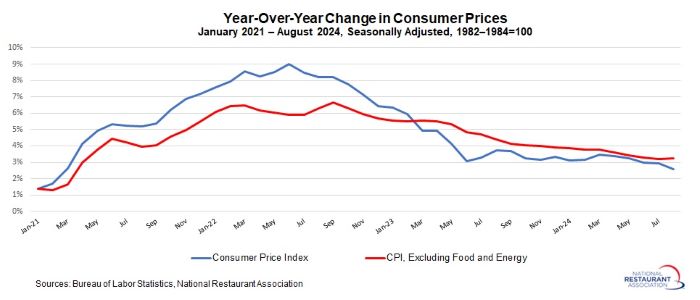

The overall inflation rate continued to trend lower in August, clearing the way for the Federal Open Market Committee (FOMC) to begin cutting short-term interest rates at their meeting next week.

The Consumer Price Index rose 0.2% in August, matching the gain posted in July. On a 12-month basis, consumer prices were up just 2.5%. That was down from a 2.9% increase last month and represented the lowest 12-month inflation rate since February 2021 (1.7%).

The core CPI – which excludes food and energy prices – remained somewhat firmer in August. Core consumer prices were up 0.3% in August and 3.2% on a year-over-year basis. The 3.2% increase in the core CPI matched the July reading as the lowest 12-month gain since April 2021.

The continued deceleration of consumer prices, as well as the recent cooling of the labor market, offered additional data points that inflationary pressures have largely subsided. While the start of an easing cycle this month is a near certainty, the question of whether it begins with a 25- or 50-basis-point cut remains unanswered, though the odds are tilted toward the smaller of the two.

Menu prices rose 4.0% during the last 12 months

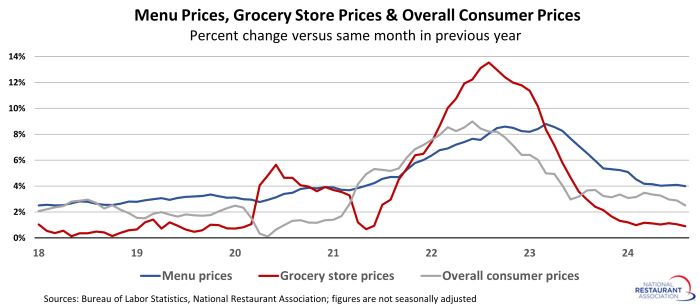

Menu-price growth slowed in recent months, but remained above gains in both grocery store prices and the overall CPI. The Consumer Price Index for Food Away from Home increased 4.0% between August 2023 and August 2024. That represented the 5th consecutive month with 12-month gains in the 4.0% - 4.1% range, after trending sharply lower from the recent peak increase of 8.8% in the 12 months ending March 2023.

Growth in grocery store prices also leveled off in recent months, albeit at a much lower level. The Consumer Price Index for Food at Home rose 0.9% between August 2023 and August 2024, which marked the 9th consecutive month with 12-month gains below 1.5%. The recent moderation was a significant departure from the decades-high grocery price inflation of more than 13% during 2022.

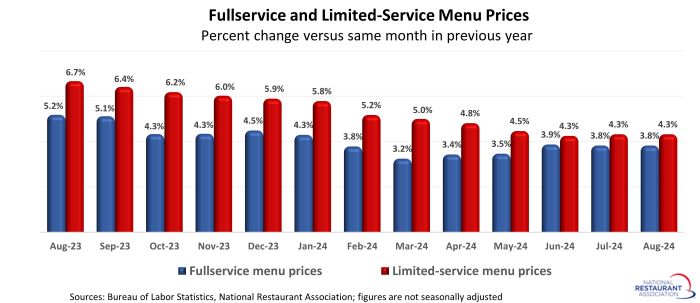

Within the food-away-from-home sector, growth in limited-service menu prices continues to outpace the fullservice segment, but the gap narrowed in recent months.

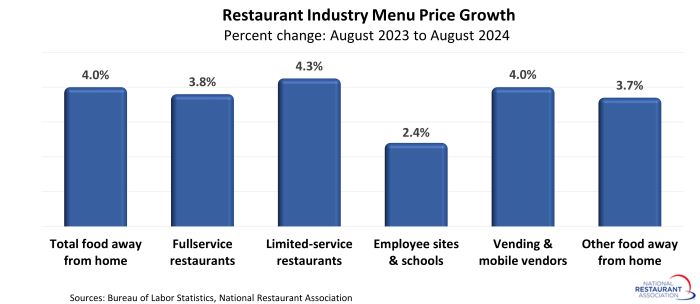

Limited-service menu prices increased 4.3% between August 2023 and August 2024, which matched the June and July readings as the smallest 12-month gain in more than 4 years. Fullservice menu prices stood 3.8% above year-ago levels, which represented the 7th consecutive month with 12-month gains below 4%.

Elsewhere in the food-away-from-home sector, the price index for food from vending machines and mobile vendors increased 4.0% during the last 12 months. The price index for food at employee sites and schools rose 2.4% between August 2023 and August 2024. Both readings were significantly down from the double-digit gains posted in 2022 and 2023.

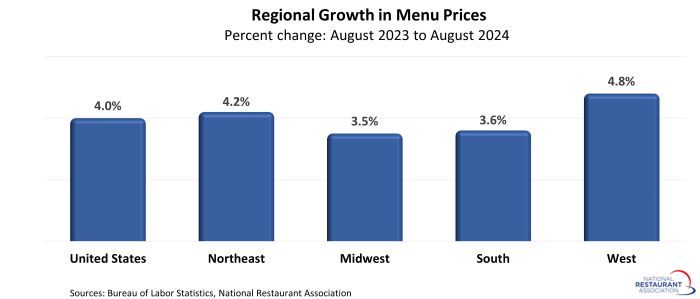

On a regional level, the West (4.8%) and Northeast (4.2%) regions registered the strongest menu price growth between August 2023 and August 2024. Menu-price growth in the South (3.6%) and Midwest (3.5%) regions remained below the national average in recent months.

Track more economic indicators and read more analysis and commentary from the Association's economists.