Menu prices

Menu price growth picked up slightly in June despite overall progress on U.S. inflation

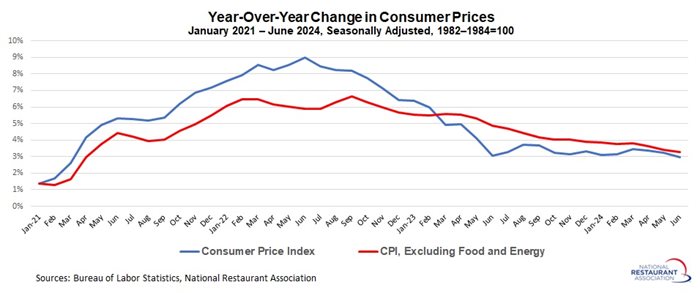

The Consumer Prices Index edged down 0.1% in June, the first monthly decline since May 2020 after being flat in the prior release. Over the past 12 months, consumer prices have risen 3.0%, down from 3.3% in May and the slowest year-over-year pace since March 2021.

At the same time, core consumer prices (which exclude food and energy) inched up 0.1% in June, down from 0.2% growth in May and the weakest monthly increase since August 2021. Core inflation rose 3.3% year-over-year in June, down from 3.4% in May and the slowest pace since April 2021.

Overall, these data show a U.S. economy that is making progress on consumer inflation, with continued moderation, albeit perhaps not as fast as desired. For its part, the Federal Open Market Committee is expected to keep interest rates unchanged at its upcoming July 30–31 meeting. With core inflation that continues to remain above its target (2% over the long-term), the Federal Reserve is likely to wait until there are clearer signs of pricing progress before it starts the process of normalizing rates.

The FOMC is likely to start cutting interest rates later this year. While there will be a chorus of analysts suggesting that there has been sufficient progress to warrant a decrease in the federal funds rate at the September 17–18 FOMC meeting, the Federal Reserve might opt to wait until after the election, making a move at the December 17–18 meeting. (There is also a meeting on November 6–7, which takes place the same week as the U.S. election.) Indeed, policymakers continue to make it clear that rates will stay “higher for longer” until more progress is made.

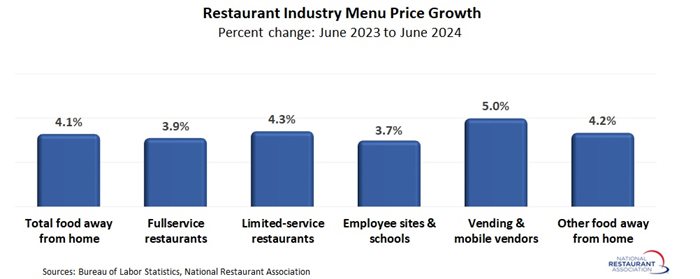

Menu prices rose 4.1% over the last 12 months

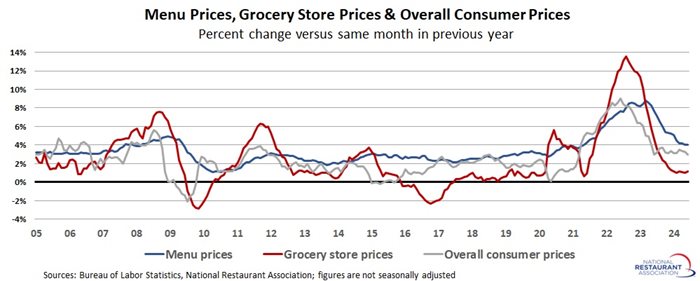

Menu prices grew 0.4% in June for the second straight month. The Consumer Price Index for Food Away from Home increased 4.1% between June 2023 and June 2024, up from 4.0% in May. Despite the uptick in the latest data, menu inflation has trended lower year to date, down from 5.3% year-over-year in December (and peaking at 8.8% in March 2023).

Meanwhile, grocery prices increased 0.1% in June after being flat in May. The Consumer Price Index for Food at Home rose 1.1% between June 2023 and June 2024, up from 1.0% in May. Overall, grocery price growth has decelerated sharply since topping out at 13.5% year-over-year growth in August 2022.

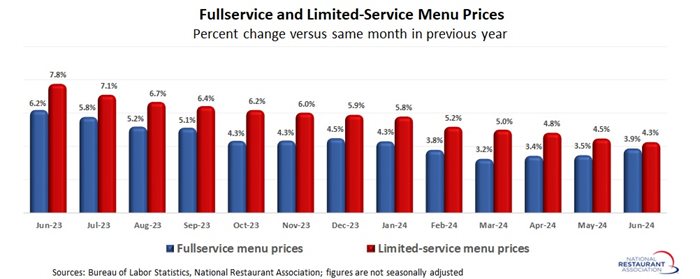

Within the food-away-from-home sector, fullservice menu prices outpaced the limited-service segment in June, up 0.6% and 0.2%, respectively. Fullservice menu prices rose at their fastest pace since March 2023. Overall, fullservice menu prices rose 3.9% between June 2023 and June 2024, up from 3.5% year-over-year in May and the fastest pace since January. Despite the rise year to date, growth in fullservice menu prices have trended lower since peaking at 9.0% year-over-year for several months in 2022. At the same time, limited-service menu prices have increased 4.3% over the past 12 months, down from 4.5% year-over-year in May and the slowest pace since June 2020.

Elsewhere in the food-away-from-home sector, the price index for food from vending machines and mobile vendors increased 5.0% between June 2023 and June 2022, the slowest since December 2021.

The price index for food at employee sites and schools increased 3.7% between June 2023 and June 2024, edging down from 3.8% year-over-year in May. This component had been significantly dampened for much of 2021 and 2022, which BLS attributed to widespread free school lunch programs. As these programs expired, many students went from paying nothing to paying regular prices for school lunches. That resulted in sharp year-over-year increases in this price index from mid-2022 to mid-2023. These base effects are now running their course, which will result in a normalization of this price index as well as its outsized impact on the overall Consumer Price Index for Food Away from Home.

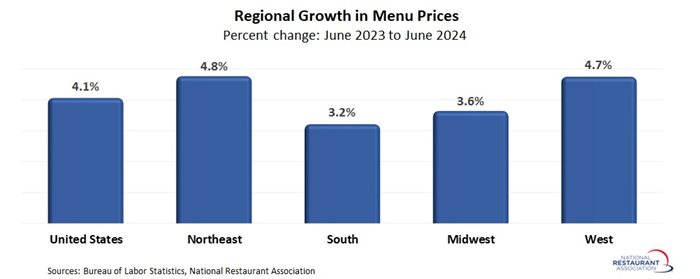

On a regional level, the Northeast (4.8%) and West (4.7%) regions saw the strongest menu price growth between June 2023 and June 2024, stronger the national rate. Average menu prices in the South (3.2%) and Midwest (3.6%) regions increased more modestly during the last 12 months.

Track more economic indicators and read more analysis and commentary from the Association's economists.