Restaurants expanded payrolls in February

Restaurant employment resumed its upward trend in February, according to preliminary data from the Bureau of Labor Statistics (BLS).

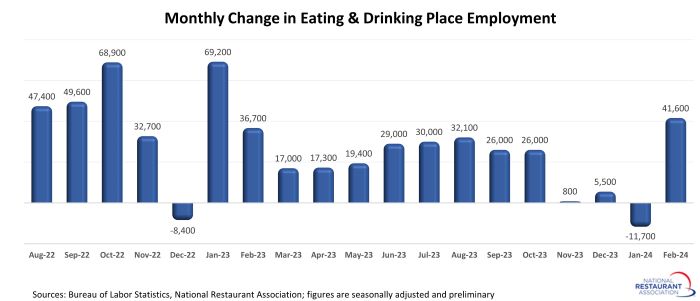

Eating and drinking places* added a net 41,600 jobs in February on a seasonally-adjusted basis. That was a solid improvement from a decline of 11,700 jobs in January and represented the strongest monthly increase since January 2023.

On average during the last 4 months, eating and drinking places added 9,000 jobs. That was well below the average monthly increase of 30,000 jobs during the first 10 months of 2023.

Job growth was choppy in recent months, but industry employment remained above pre-pandemic levels. As of February 2024, eating and drinking places were 31,000 jobs above their February 2020 employment peak.

Despite the recent slowdown, the industry’s workforce expansion likely has more room to run. In total during 2024, the Association expects the overall restaurant and foodservice industry to add an additional 200,000 jobs.

Labor market may be normalizing

Along with the slower job growth in recent months, data from the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) program suggest that the dynamics of the hospitality sector’s labor market may be shifting.

On the last business day of January, there were 941,000 job openings in the combined restaurants and accommodations sector, according to BLS. That represented the 4th consecutive month with fewer than 1 million job openings, after spending a record 30 months above that level.

This suggests a cooling in the demand for employees, though postings still remained above the 2019 average of 875,000 job openings each month.

One reason that job openings are trending lower is because restaurant operators are having more success keeping the employees that they have.

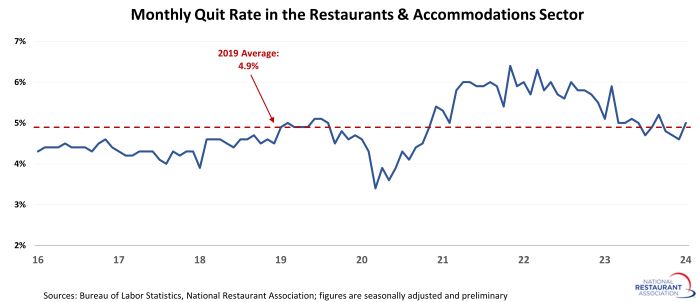

During the last 4 months, an average of 4.8% of employees in the combined restaurants and accommodations sector quit their jobs, according to BLS. That was a full percentage point below the average monthly quit rate of 5.8% during 2021 and 2022.

It was also generally on par with 2019’s average monthly quit rate of 4.9%, which is another indication that the industry’s labor market may be normalizing.

[It’s important to note that the figures above are on the national level, and the same trends will not apply evenly by region. All labor markets are local, and significant differences will always exist in communities across the country.]

Note: The job openings and quits data presented above are for the broadly-defined Accommodations and Food Services sector (NAICS 72), because the Bureau of Labor Statistics does not report data for restaurants alone. Eating and drinking places account for nearly 90% of jobs in the combined sector.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, providing jobs for roughly 80% of the total restaurant and foodservice workforce of 15.5 million.

Read more analysis and commentary from the Association's economists, including the latest outlook for consumers and the economy.