Restaurants projected to add 200k jobs in 2024

More than three years after the onset of the COVID-19 pandemic in the U.S. that resulted in millions of restaurant employees being laid off or furloughed, the size of the industry’s workforce finally returned to pre-pandemic levels.

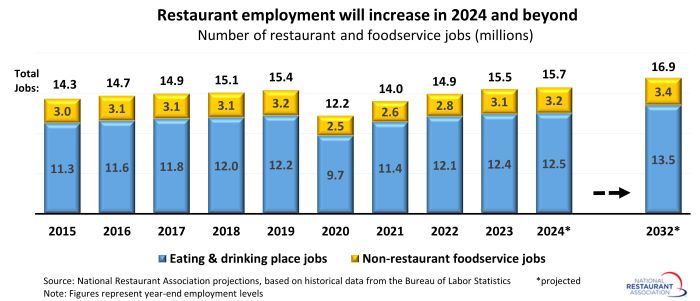

By the end of 2023, the restaurant and foodservice industry was once again the nation’s second largest private sector employer, providing 15.5 million jobs – or 10% of the total U.S. workforce. This included 12.4 million jobs at eating and drinking places, plus an estimated 3.1 million foodservice jobs in other sectors such as healthcare, accommodations, education, food-and-beverage stores, and arts, entertainment and recreation.

The restaurant and foodservice workforce will continue to grow in 2024, albeit at a much slower pace than recent years when the industry was recovering from pandemic losses. A projected increase of 200,000 jobs will bring total industry employment to 15.7 million by the end of 2024.

During the next several years, restaurant and foodservice employment will continue to rise at a moderate rate. Between 2024 and 2032, the industry is projected to add 150,000 jobs a year on average, with total staffing levels reaching 16.9 million by 2032.

The path toward a deeper labor pool

To achieve these long-term staffing needs, the U.S. labor force will need to expand at a rate above expectations – particularly in the cohorts that are important to restaurants.

Early in the pandemic, a sharp decline in the labor force contributed to record-high job openings across the economy. More than 8 million people dropped out of the labor force between February 2020 and April 2020, and the overall labor force didn’t return to pre-pandemic levels until August 2022.

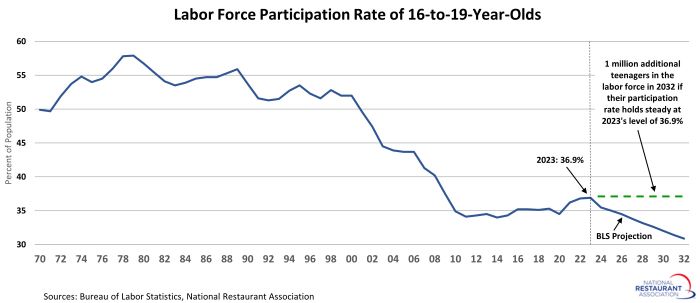

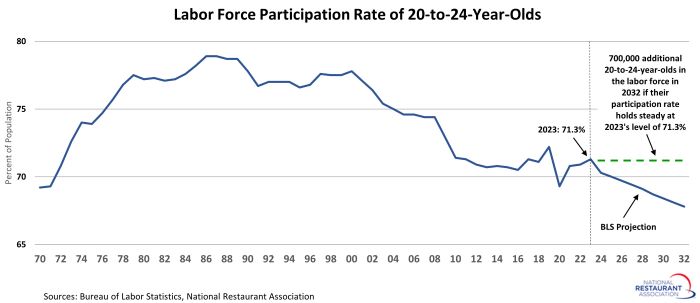

Importantly for restaurants, labor force growth was also seen across among teenagers and young adults – cohorts that together make up 40% of the industry workforce. Due largely to higher wages offered by employers as a result of the tight labor market, young workers were increasingly likely to enter the labor force in recent years.

In 2023, 36.9% of 16-to-19-year-olds were in the labor force. This represented the highest level since 2009 (37.5%), though it remained well below 1979’s record high of 57.9%. The 20-to-24-year-old participation rate stood at 71.3% in 2023, which was up significantly from the pandemic lows.

Looking ahead, the population of the 16-to-24 age cohort is projected to remain relatively steady during the next decade. However, the Bureau of Labor Statistics (BLS) expects their labor force participation to decline steadily. This would result in a sharp reduction in the number of teenagers and young adults in the labor force.

Fortunately, the last few years offered a clear indication that the teenage and young adult workforce should not be written off, and they will come off the sidelines under the right circumstances.

Rather than declining as projected by BLS, a more optimistic scenario could see the labor force participation rates of 16-to-24-year-olds remaining flat during the next decade.

If the labor force participation rate of 16-to-19 year olds holds steady at the 2023 level of 36.9%, it would translate to an additional 1 million teens in the labor force by 2032, as compared to the current BLS projections.

In the 20-to-24-year-old age cohort, a stable participation rate would result in an additional 700,000 people in the labor force.

If the current participation rate of younger workers can be maintained in the years ahead, it would go a long way to alleviating some of the industry’s staffing challenges.

Read more analysis and commentary from the Association's chief economist Bruce Grindy, including the latest outlook for consumers and the economy.