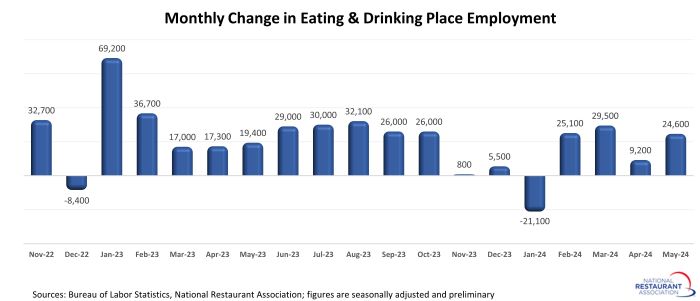

Restaurants added more than 24k jobs in May

After a soft patch to begin the year, restaurant job growth started to regain some footing in recent months.

Eating and drinking places* added a net 24,600 jobs in May on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS). That represented the third time in the last four months that the industry added at least 24,000 jobs, which is roughly on par with the average monthly job growth during 2023.

On a non-seasonally-adjusted basis, eating and drinking places added more than 380,000 jobs in April and May. That puts restaurants on track to add more than 500,000 seasonal jobs this summer, according to National Restaurant Association projections.

Restaurant job growth was choppy in recent months, but overall employment levels continue to climb above pre-pandemic levels. As of May 2024, eating and drinking places were nearly 69,000 jobs (or 0.6%) above their February 2020 employment peak.

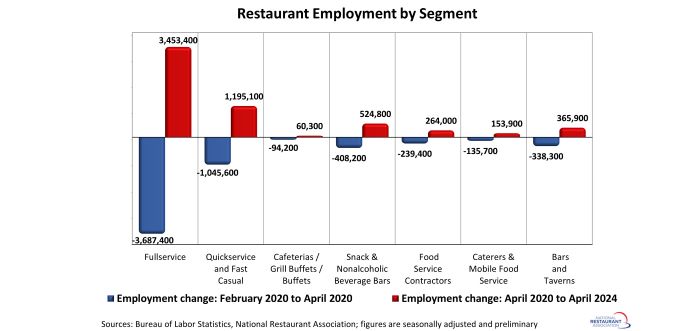

Fullservice segment still down 234k jobs

The fullservice segment experienced the most job losses during the initial months of the pandemic – and it still has the longest path to recovery. As of April 2024, fullservice restaurant employment levels were 234,000 jobs (or 4%) below pre-pandemic readings in February 2020.

Employment counts in the cafeterias/grill buffets/buffets segment (-31%) also remained below their February 2020 levels.

Job losses in the limited-service segments were somewhat less severe during the initial months of the pandemic, as these operations were more likely to retain staff to support their existing off-premises business. As of April 2024, employment at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – was nearly 117,000 jobs (or 15%) above February 2020 readings.

Staffing levels in the quickservice and fast casual segments were nearly 150,000 jobs (or 3%) above pre-pandemic levels. Headcounts at bars and taverns were 28,000 jobs (or 6%) above the pre-pandemic peak.

[Note that the segment-level employment figures are lagged by one month, so April is the most current data available.]

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, providing jobs for roughly 80% of the total restaurant and foodservice workforce of 15.5 million.

Read more analysis and commentary from the Association's economists, including the Restaurant Economic Insights blog.