Restaurant operators are more pessimistic about the economy

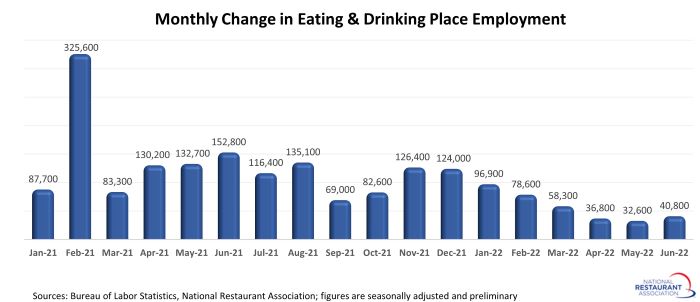

Employment in both the restaurant industry and overall economy continued to rise at a steady pace in June. Eating and drinking places* added a net 40,800 jobs in June on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics.

That was roughly on par with the previous three months, when restaurants added an average of 42,600 jobs. Despite expanding payrolls in 18 consecutive months, eating and drinking places remained 728,000 jobs below their pre-pandemic peak – tops among all U.S. industries.

The story was similar in the overall economy, which added 372,000 jobs in June. That represented the fourth consecutive month in which employers added just under 400,000 jobs.

While total U.S. employment is still down 524,000 from the February 2020 peak, the number of jobs in the private sector surpassed pre-pandemic levels in June.

The economy’s warning lights are starting to flash

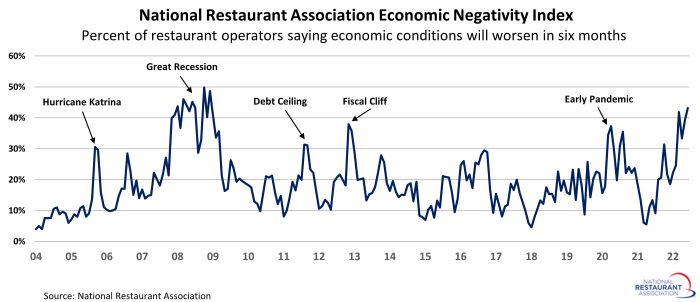

While the 30,000-foot view remains generally positive, those with boots on the ground are not entirely convinced that the positive economic trajectory will continue in the months ahead. In fact, in each of the last four iterations of the National Restaurant Association’s monthly Tracking Survey, restaurant operators had a net negative outlook for the economy six months out.

In the Association’s June 2022 Tracking Survey, only 18% of restaurant operators said they expect economic conditions to improve in six months – the lowest reading since March 2020 (15%). Forty-three percent of operators said they think conditions will worsen in six months, while the other 39% expect conditions to be about the same as they are now.

The ‘conditions-will-worsen’ response option to this survey question feeds into the Association’s Economic Negativity Index, which is illustrated in the chart below. Restaurant operators’ economic pessimism trended sharply higher in recent months, with June’s reading of 43% representing the highest level since 2008.

This is only the second period in the 20-year history of the Association’s tracking survey that over 40% of operators said they expect economic conditions to worsen in six months. The first time was in 2007 during the runup to the Great Recession. Negative sentiment remained elevated until early-2009, when restaurant operators started to anticipate improving conditions.

Restaurant operators are on the front lines of the U.S. economy, and are often the first to notice any changes in consumer behavior or economic conditions. While operators’ growing economic pessimism does not guarantee that a recession is imminent, it has risen to a level that requires close monitoring in the months ahead.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the coronavirus outbreak employed 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.