Restaurant employment growth slowed in recent months

Job growth in the restaurant industry slowed to a crawl in recent months, according to preliminary data from the Bureau of Labor Statistics (BLS).

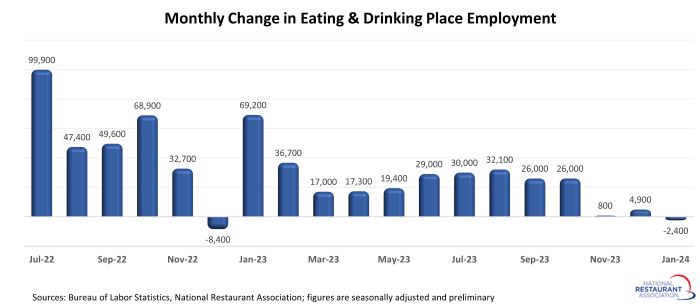

Payrolls at eating and drinking places* shrunk by a net 2,400 jobs in January on a seasonally-adjusted basis. That followed a combined increase of only 5,700 jobs in November and December.

The modest employment growth during the November – January period was a sharp departure from the average monthly increase of 30,000 jobs during the first 10 months of 2023.

A deceleration from the rapid pandemic-recovery hiring of the past few years was inevitable, so it remains to be seen if this is a temporary blip or a complete reversal of trend. Operator surveys suggest a healthy demand for employees, so the expectation is that restaurant employment levels will continue to rise in 2024.

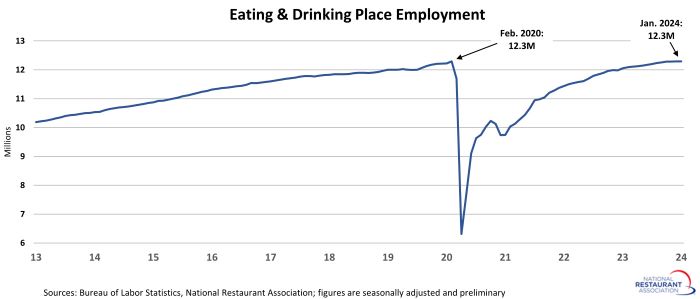

With the release of the January employment data, BLS incorporated their annual benchmark revisions. This process benchmarks the monthly establishment survey data to the Quarterly Census of Employment and Wages (QCEW), which counts jobs covered by the Unemployment Insurance (UI) tax system.

In addition to revising the month-to-month changes, this resulted in a downward shift in overall eating and drinking place employment levels for the last several years. The net result is that the January 2024 employment reading at eating and drinking places was essentially par with the February 2020 pre-pandemic level.

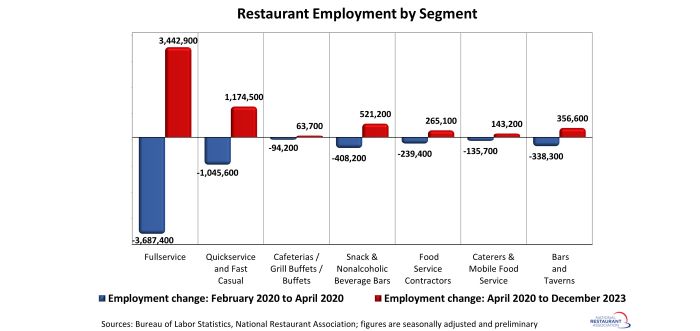

Fullservice segment still down over 240k jobs

Within the restaurant industry, the benchmark revisions had the largest impact on the fullservice segment. As of December 2023, fullservice restaurant employment levels were 245,000 jobs (or 4%) below pre-pandemic readings in February 2020.

Staffing levels in the limited-service segments were well above pre-pandemic readings. As of December 2023, employment at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – was 113,000 jobs (or 14%) above February 2020 readings. Staffing levels in the quickservice and fast casual segments were 129,000 jobs (or 3%) above pre-pandemic levels.

Headcounts at bars and taverns were 18,000 jobs (or 4%) above the pre-pandemic peak. This represented a downward revision from preliminary readings.

[Note that the segment-level employment figures are lagged by one month, so December 2023 is the most current data available.]

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, providing jobs for roughly 80% of the total restaurant and foodservice workforce of 15.5 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.