Restaurants added nearly 300k jobs during 2023

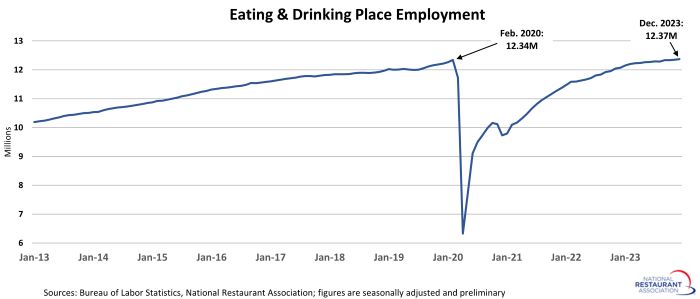

Restaurant employment growth finished 2023 on a positive note, but the trendline was significantly flatter than it was during much of the pandemic recovery period.

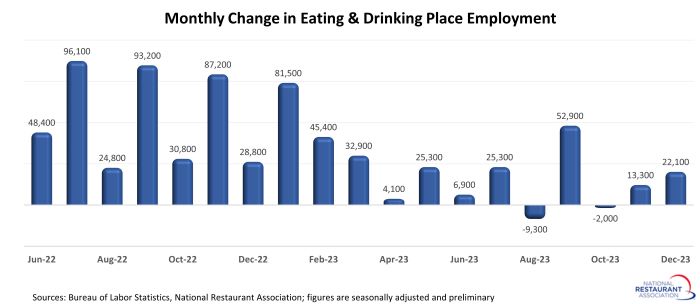

Eating and drinking places* added a net 22,100 jobs in December on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS). That came on the heels of downward-revised changes in both October and November.

In total during the second half of 2023, eating and drinking place payrolls rose by 102,000 jobs. That was only about half of the 196,000 jobs added during the first half of the year. Despite the slowdown, the addition of nearly 300,000 jobs during 2023 was well above 2019’s increase of 246,000 jobs.

Job growth was uneven in recent months, but the industry workforce remains above pre-pandemic levels. As of December 2023, eating and drinking places were 31,000 jobs above their February 2020 employment peak.

More hiring expected in 2024, business conditions permitting

Overall restaurant employment surpassed pre-pandemic readings, but the industry’s workforce expansion likely has more room to run in 2024.

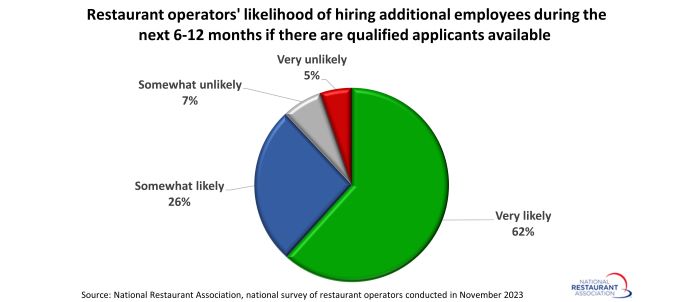

When asked in November 2023, 88% of operators said they are likely hire to additional employees during the next 6-12 months if there are qualified applicants available. Sixty-two percent of operators said they would be ‘very likely’ to expand payrolls, which illustrates the strength of the demand for labor.

A solid majority of both limited-service (89%) and fullservice (87%) operators said they will continue boosting staffing levels if good resumes come across their desk.

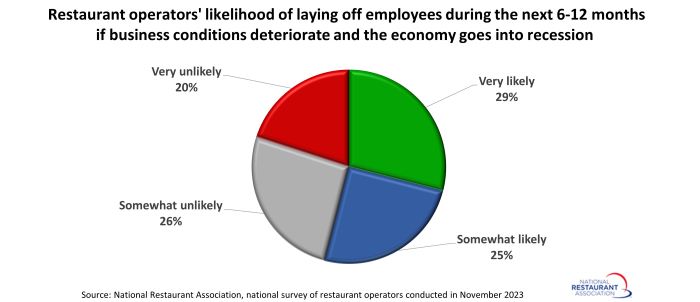

At the same time, restaurant operators will keep a watchful eye on the economy. Fifty-four percent of operators said they would be likely to lay off employees during the next 6-12 months if business conditions deteriorate and the U.S. economy goes into recession.

Fullservice operators (58%) were somewhat more likely than their limited-service counterparts (51%) to say they would lay off employees if business conditions deteriorate.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which employ more than 12 million out of the total restaurant and foodservice workforce of 15.5 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.