Research

March 06, 2025

Imports Jump to Record High in January in Anticipation of New Tariffs

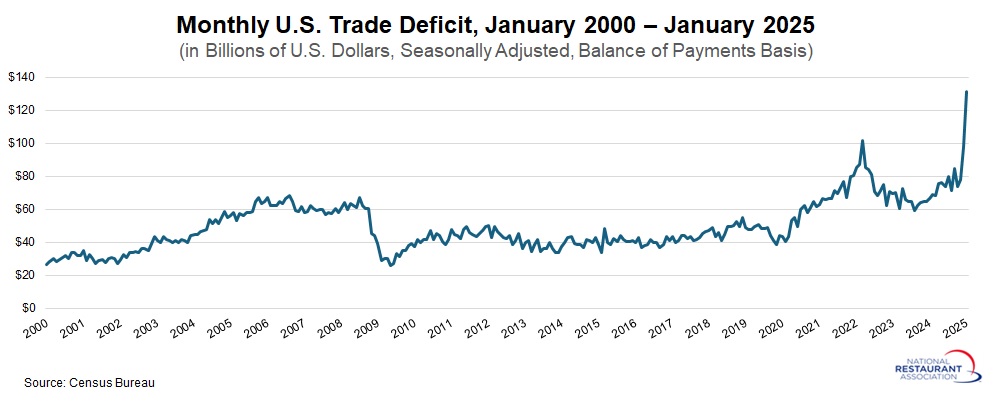

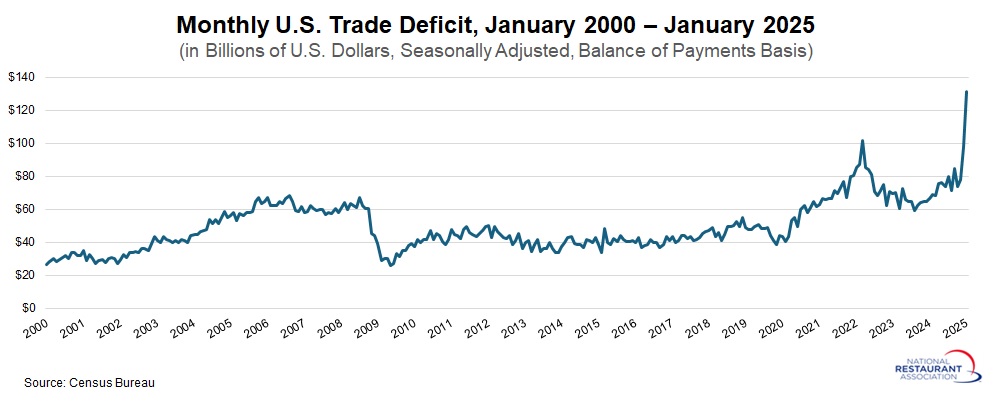

The U.S. trade deficit surged to a record high in January, rising from $98.06 billion in December to $131.38 billion, easily surpassing the previous peak of $101.91 billion in March 2022, when supply chain disruptions were at their worst in the aftermath of the pandemic.

Goods imports soared from $293.36 billion to $329.55 billion, while goods exports saw a more modest increase from $170.08 billion to $172.78 billion. The biggest jumps in imports came from industrial supplies and materials (+$23.10 billion), consumer goods (+$6.02 billion), non-automotive capital goods (+$4.65 billion), automotive goods (+$856 million), and foods, feeds, and beverages (+$834 million). At the same time, the service-sector trade surplus was little changed, inching up from $25.22 billion to $25.39 billion.

The data suggest firms are front-loading imports ahead of potential tariffs, with notable spikes in finished metal shapes (+$20.48 billion), computers, accessories, and telecom equipment (+$5.31 billion), pharmaceuticals (+$5.25 billion), cell phones (+$1.16 billion), and passenger cars (+$1.00 billion).

For the restaurant sector, the trade balance for foods, feeds, and beverages is of particular interest. In January, exports in this category fell $1.03 billion to $13.43 billion, led by a decline in soybean shipments. Meanwhile, food imports climbed to $20.04 billion, up from $19.21 billion in December, with broad-based increases across cocoa beans, wine and beer, and meat products.

Looking ahead, volatility is likely to persist. If front-loading is driving much of this surge, future data may show a sharp reversal. Regardless, higher imports weigh on GDP growth, making these figures crucial as policymakers navigate tariff debates and broader economic implications. Either way, uncertainties about tariffs are already having a major impact on trade data and flows.

Goods imports soared from $293.36 billion to $329.55 billion, while goods exports saw a more modest increase from $170.08 billion to $172.78 billion. The biggest jumps in imports came from industrial supplies and materials (+$23.10 billion), consumer goods (+$6.02 billion), non-automotive capital goods (+$4.65 billion), automotive goods (+$856 million), and foods, feeds, and beverages (+$834 million). At the same time, the service-sector trade surplus was little changed, inching up from $25.22 billion to $25.39 billion.

The data suggest firms are front-loading imports ahead of potential tariffs, with notable spikes in finished metal shapes (+$20.48 billion), computers, accessories, and telecom equipment (+$5.31 billion), pharmaceuticals (+$5.25 billion), cell phones (+$1.16 billion), and passenger cars (+$1.00 billion).

For the restaurant sector, the trade balance for foods, feeds, and beverages is of particular interest. In January, exports in this category fell $1.03 billion to $13.43 billion, led by a decline in soybean shipments. Meanwhile, food imports climbed to $20.04 billion, up from $19.21 billion in December, with broad-based increases across cocoa beans, wine and beer, and meat products.

Looking ahead, volatility is likely to persist. If front-loading is driving much of this surge, future data may show a sharp reversal. Regardless, higher imports weigh on GDP growth, making these figures crucial as policymakers navigate tariff debates and broader economic implications. Either way, uncertainties about tariffs are already having a major impact on trade data and flows.

More from the Association's economists:

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.