Restaurants are being challenged by rising food costs and supply chain issues

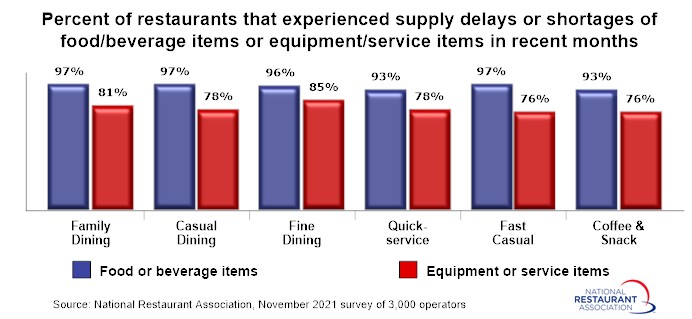

Like many sectors across the economy, restaurants are being impacted by disruptions in the supply chain. In a November 2021 survey fielded by the Association, 96% of operators said their restaurant experienced supply delays or shortages of key food or beverage items in recent months.

The impact was felt across all types of restaurants, with more than 9 in 10 operators across each of the major segments reporting supply delays or shortages in recent months.

It isn’t just food items that are in limited supply. Another 8 in 10 operators said they experienced supply delays or shortages of equipment or service items in recent months.

Impact on menus

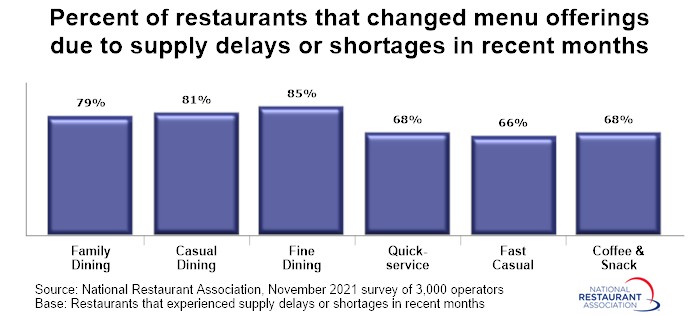

For many restaurants, these supply challenges altered what they could offer to customers. Among operators that experienced supply delays or shortages in recent months, 3 in 4 said they made changes to their menu offerings as a result.

Tableservice restaurant menus were the most likely to be impacted by the recent supply chain challenges. Eighty-five percent of fine dining operators and 81% of casual dining operators said their restaurant changed menu offerings as a result of food supply delays or shortages.

Two-thirds of limited-service operators said they changed their menu offerings as a result of these food or beverage supply delays or shortages.

Food costs are soaring

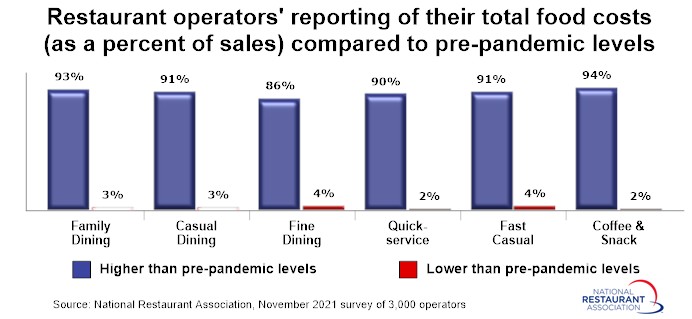

On top of the supply chain challenges, restaurant operators are paying higher prices for many of their food items. In the Association’s November 2021 survey, 91% of operators said their total food costs (as a percent of sales) are higher than they were prior to the COVID-19 outbreak. Only 3% said their food costs make up a smaller proportion of sales.

Operators’ reporting of rising food costs was confirmed by recent wholesale price data from the Bureau of Labor Statistics. The Producer Price Index for All Foods – which represents the change in average prices paid to domestic producers for their output – jumped 12.2% between November 2020 and November 2021. That represented the fourth consecutive month with 12-month gains above 10% – the first such occurrence in more than 4 decades.

Profitability is down

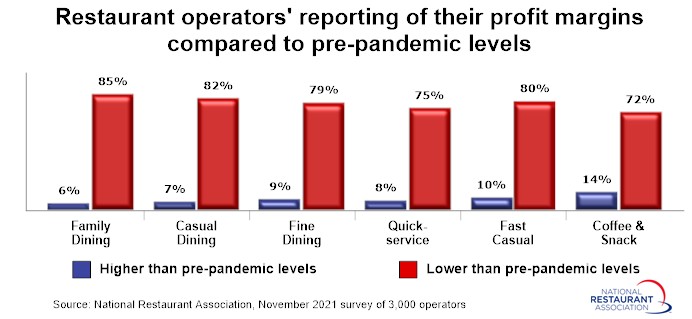

Due in large part to soaring food costs, profitability is down from pre-pandemic levels for the vast majority of restaurants. In the Association’s November 2021 survey, 80% of operators said their profit margin is lower than it was prior to the COVID-19 outbreak. Only 8% of operators said their profit margin is higher.

Most operators don’t expect their profitability to improve in 2022. Only about 1 in 4 operators think their restaurant will be more profitable in 2022 than it was in 2021. One in 3 operators expect to be less profitable in 2022.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.