Consumer spending in restaurants continued to rise in November

Restaurant sales rose steadily in recent months, as resilient consumers maintained their willingness to spend on experiences.

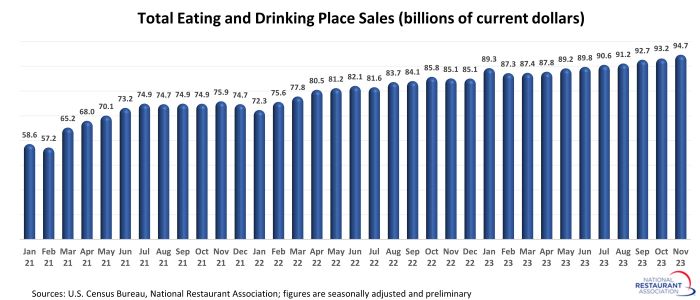

Eating and drinking places* registered total sales of $94.7 billion on a seasonally adjusted basis in November, according to preliminary data from the U.S. Census Bureau. That was up a solid 1.6% from October’s upward-revised volume of $93.2 and represented the ninth consecutive month of sales growth.

In total during the last 9 months, eating and drinking place sales increased 8.5% on a seasonally adjusted basis. That was 5 times stronger than the 1.7% sales gain in non-restaurant retail sectors during the same period. Consumers continue to prioritize restaurants as they burn off the pent-up demand that they accumulated during the pandemic.

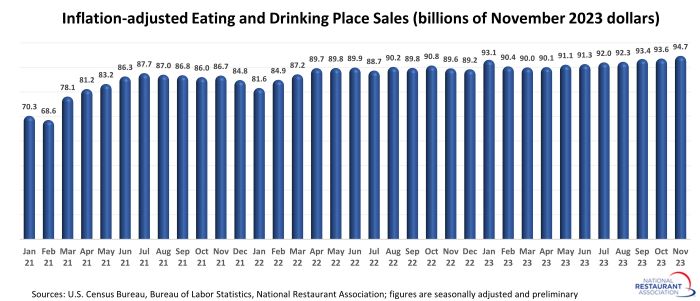

Restaurant sales also trended higher in inflation-adjusted terms during the last several months. After adjusting for menu price inflation, eating and drinking place sales were up 4.7% during the last 9 months.

Economic sentiment leans local

The U.S. labor market remains remarkably resilient and overall inflation is back down near the 3% level, but most Americans are only lukewarm about the national economy.

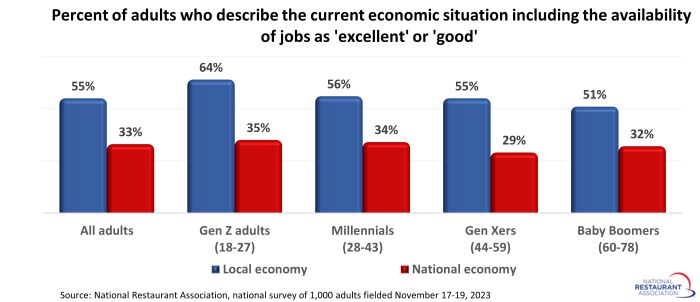

When asked in November to describe the current state of the national economy, a majority of adults gave ratings of either ‘fair’ (37%) or ‘poor’ (30%). Only 1 in 3 adults gave the national economy ratings of either ‘excellent’ (6%) or ‘good’ (27%).

Not surprisingly, this sentiment is often influenced by politics: 45% of Democrats gave the national economy ratings of ‘excellent’ or ‘good,’ compared to just 24% of Republicans and Independents. Similar surveys fielded by the Association when a Republican was in the White House flipped the script, with Republican consumers giving much higher marks to the national economy. Bottom line, political affiliation often distorts consumers’ assessment of the economy, which makes it less useful as a measure of sentiment.

In contrast, consumers across the political spectrum are much more likely to agree about economic conditions in their own communities. At present, consumers’ local economic sentiment is decidedly more bullish than it is about the national economy.

Overall, 55% adults describe the current economic situation – including the available of jobs – in their local area as either ‘excellent’ or ‘good.’ At 64%, Gen Z adults have the most positive perception of their local economy.

Drilling down to political affiliation, 59% of Democrats, 52% of Republicans and 50% of Independents give their local economy ratings of either ‘excellent’ or ‘good.’

Since most households get their paychecks from an employer in their community, consumers’ assessment of the local economy is more likely to influence their spending behavior. However, even with the comparatively optimistic sentiment right now, don’t expect all consumers to be freewheeling with their wallets.

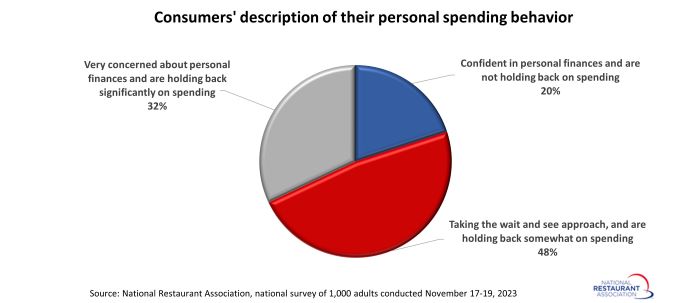

Only 1 in 5 adults say they are confident in their personal finances and are not holding back on spending, according to the Association’s November survey. Another 48% say they are taking the ‘wait and see’ approach and are holding back somewhat on spending. The remaining 1 in 3 consumers say they are very concerned about their personal finances and are holding back significantly on spending.

A healthy labor market is the linchpin of consumer activity. Employed consumers will spend money, and as long as they remain generally positive about the job prospects in their community, it will continue to support restaurant sales.

*Eating and drinking places are the primary component of the U.S. restaurant and foodservice industry, which prior to the coronavirus pandemic generated approximately 75% of total restaurant and foodservice sales. Monthly sales figures presented above represent total revenues at all eating and drinking place establishments. This differs from the National Restaurant Association’s sales projections, which represent food and beverage sales at establishments with payroll employees.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.