Research

October 01, 2024

Restaurant Job Openings Rose in August, a Sign of Lingering Resilience in an Otherwise Cooling Labor Market

Dr. Chad Moutray

There were 903,000 accommodation and foodservices job openings in August, up from a revised 815,000 in July and a four-month high. While job postings in the accommodation and foodservice sector have cooled notably over the past year and a half, the pickup in openings in the latest data suggest underlying resilience in labor market demand. The current pace of job openings remains above what was experienced in the pre-pandemic (2017-2019) period, which was 835,000.

Meanwhile, accommodation and food services businesses hired 696,000 workers in August, down from 740,000 in July. At the same time, there were 636,000 total separations in the sector in August, down from 747,000 in July and a four-year low. Overall, these data are consistent with softening in the labor market, as each has trended lower over the past year. With that said, net hiring (or hiring minus separations) was solid in August at 60,000, the strongest monthly gain since January 2023.

.jpg)

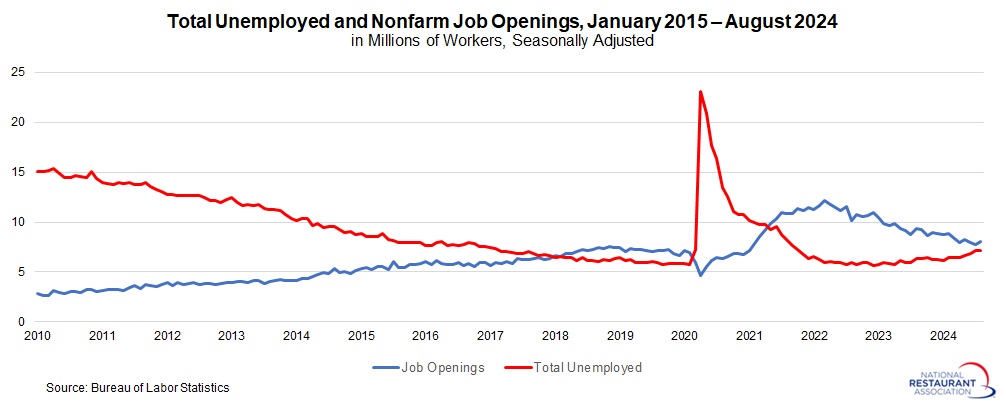

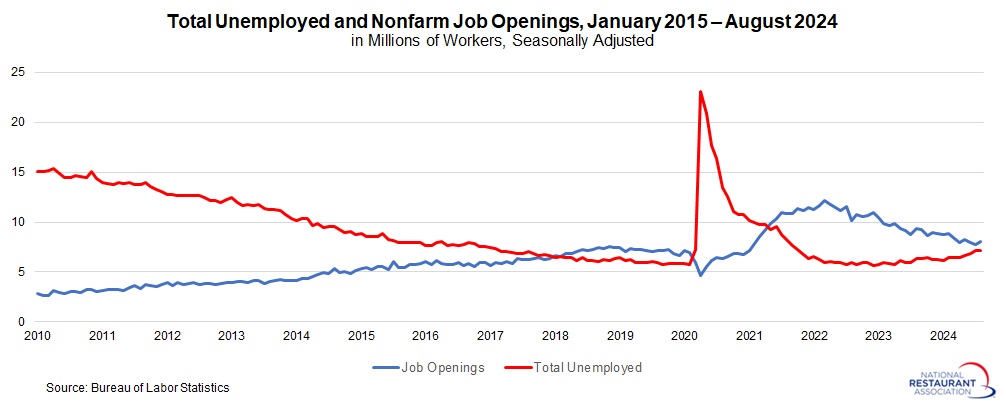

In the larger economy, nonfarm business job openings rose from 7,711,000 in July, the lowest since January 2021, to 8,040,000 in August. At the same time, there were 7,115,000 unemployed individuals reported in August. Therefore, for every 100 job openings in the U.S. economy, there were 88.5 unemployed workers.

While there continued to be significantly more job openings than people actively looking for work (roughly 925,000), that gap has narrowed significantly over the past year and a half. In contrast, it was nearly a 2-to-1 ratio in December 2022, or 51.8 unemployed workers for every 100 job openings, with a gap of more than 5.3 million more job openings people looking for employment at that time.

.jpg) Meanwhile, the number of accommodation and food services quits fell from 560,000 in July to 497,000 in August, the fewest since September 2020. The number of quits in the sector has been decelerating sharply, with the averages for 2022 and 2023 being 787,000 and 704,000, respectively. This is a sign that churn in the labor market has ebbed notably in the past couple of years – signaling an end to the “Great Resignation” era. Indeed, quits are now well below the pre-pandemic average of 633,000 seen in the 2017 to 2019 period. At the same time, nonfarm payroll quits dropped from 3,243,000 to 3,084,000, falling below the pre-pandemic average of 3,339,000 and the lowest since July 2020.

Meanwhile, the number of accommodation and food services quits fell from 560,000 in July to 497,000 in August, the fewest since September 2020. The number of quits in the sector has been decelerating sharply, with the averages for 2022 and 2023 being 787,000 and 704,000, respectively. This is a sign that churn in the labor market has ebbed notably in the past couple of years – signaling an end to the “Great Resignation” era. Indeed, quits are now well below the pre-pandemic average of 633,000 seen in the 2017 to 2019 period. At the same time, nonfarm payroll quits dropped from 3,243,000 to 3,084,000, falling below the pre-pandemic average of 3,339,000 and the lowest since July 2020.

.jpg)

There were 903,000 accommodation and foodservices job openings in August, up from a revised 815,000 in July and a four-month high. While job postings in the accommodation and foodservice sector have cooled notably over the past year and a half, the pickup in openings in the latest data suggest underlying resilience in labor market demand. The current pace of job openings remains above what was experienced in the pre-pandemic (2017-2019) period, which was 835,000.

Meanwhile, accommodation and food services businesses hired 696,000 workers in August, down from 740,000 in July. At the same time, there were 636,000 total separations in the sector in August, down from 747,000 in July and a four-year low. Overall, these data are consistent with softening in the labor market, as each has trended lower over the past year. With that said, net hiring (or hiring minus separations) was solid in August at 60,000, the strongest monthly gain since January 2023.

.jpg)

In the larger economy, nonfarm business job openings rose from 7,711,000 in July, the lowest since January 2021, to 8,040,000 in August. At the same time, there were 7,115,000 unemployed individuals reported in August. Therefore, for every 100 job openings in the U.S. economy, there were 88.5 unemployed workers.

While there continued to be significantly more job openings than people actively looking for work (roughly 925,000), that gap has narrowed significantly over the past year and a half. In contrast, it was nearly a 2-to-1 ratio in December 2022, or 51.8 unemployed workers for every 100 job openings, with a gap of more than 5.3 million more job openings people looking for employment at that time.

.jpg)

.jpg)

More from the Association's economists:

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.