Research

January 07, 2022

Most restaurants remained understaffed in December

Restaurant employment continued to trend higher in December, but overall staffing levels remained well below pre-pandemic readings.

Restaurant employment continued to trend higher in December, but overall staffing levels remained well below pre-pandemic readings. Eating and drinking places* added a net 42,600 jobs in December on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics.

This continued a period of relatively modest job growth, compared to the healthy gains posted early in the pandemic recovery. Restaurants added an average of 56,000 jobs during the last 5 months, which was well below the average gains of nearly 200,000 jobs during the first seven months of the year.

In total during 2021, eating and drinking places restored nearly 1.7 million jobs to payrolls. While this was easily the largest calendar-year employment increase on record, it still left the industry roughly 650,000 jobs – or 5.3% – below pre-pandemic staffing levels.

Nearly 4 in 5 restaurants are understaffed

Although restaurant job growth slowed in recent months, demand for employees remained high going into December. In a November 2021 survey fielded by the Association, 77% of operators said their restaurant did not have enough employees to support existing customer demand.

A strong majority of both fullservice operators (80%) and limited-service operators (73%) said their restaurant did not have enough employees to meet customer demand.

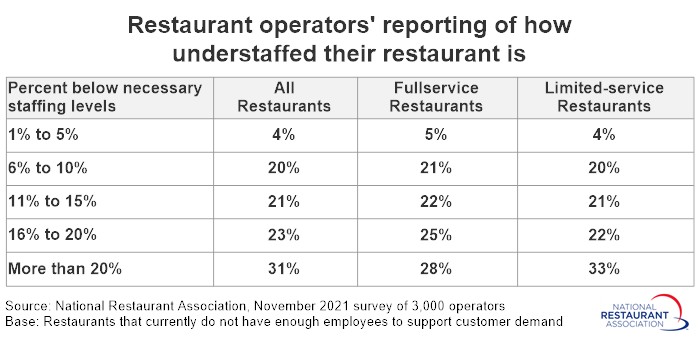

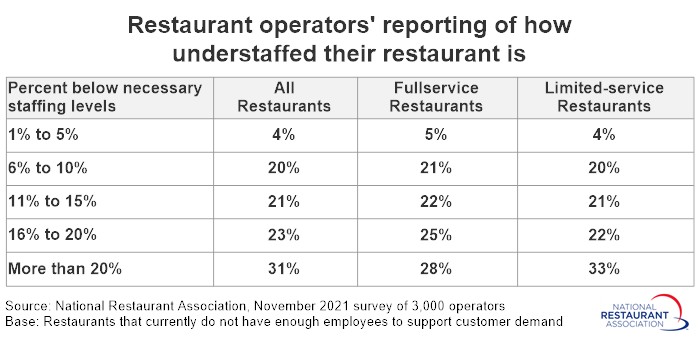

For most restaurants, staffing was significantly below necessary levels. Among restaurants that were understaffed in November, 75% of operators said their restaurant was more than 10% below necessary staffing levels. Thirty-one percent of understaffed operators were more than 20% below necessary staffing levels.

Twenty-eight percent of understaffed fullservice operators and 33% of understaffed limited-service operators said their restaurant was more than 20% below necessary staffing levels in November.

Impact of being understaffed

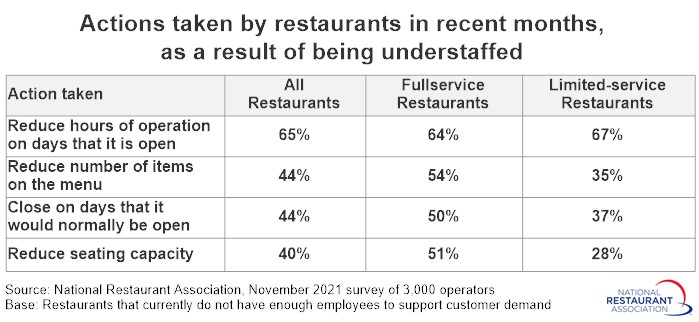

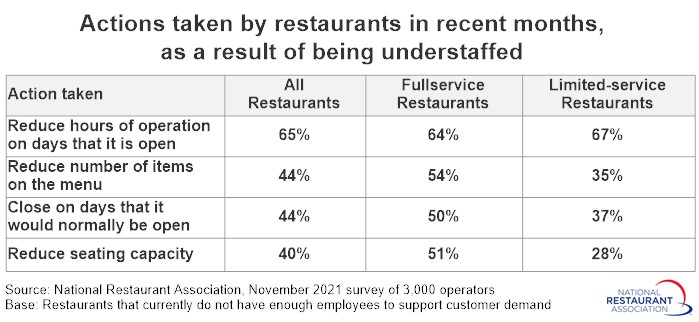

As a result of being understaffed, 65% of operators say their restaurant cut hours of operation on days that it is open for business. Forty-four percent of operators reduced the number of items on their menu, while 44% closed their restaurant on days that it would normally be open. Forty percent of operators say they reduced seating capacity as a result of being understaffed.

Fullservice operators were more likely than limited-service operators to say they cut back on menu items, closed on days that they would normally be open and reduced seating capacity.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the coronavirus outbreak employed 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.

This continued a period of relatively modest job growth, compared to the healthy gains posted early in the pandemic recovery. Restaurants added an average of 56,000 jobs during the last 5 months, which was well below the average gains of nearly 200,000 jobs during the first seven months of the year.

In total during 2021, eating and drinking places restored nearly 1.7 million jobs to payrolls. While this was easily the largest calendar-year employment increase on record, it still left the industry roughly 650,000 jobs – or 5.3% – below pre-pandemic staffing levels.

Nearly 4 in 5 restaurants are understaffed

Although restaurant job growth slowed in recent months, demand for employees remained high going into December. In a November 2021 survey fielded by the Association, 77% of operators said their restaurant did not have enough employees to support existing customer demand.

A strong majority of both fullservice operators (80%) and limited-service operators (73%) said their restaurant did not have enough employees to meet customer demand.

For most restaurants, staffing was significantly below necessary levels. Among restaurants that were understaffed in November, 75% of operators said their restaurant was more than 10% below necessary staffing levels. Thirty-one percent of understaffed operators were more than 20% below necessary staffing levels.

Twenty-eight percent of understaffed fullservice operators and 33% of understaffed limited-service operators said their restaurant was more than 20% below necessary staffing levels in November.

Impact of being understaffed

As a result of being understaffed, 65% of operators say their restaurant cut hours of operation on days that it is open for business. Forty-four percent of operators reduced the number of items on their menu, while 44% closed their restaurant on days that it would normally be open. Forty percent of operators say they reduced seating capacity as a result of being understaffed.

Fullservice operators were more likely than limited-service operators to say they cut back on menu items, closed on days that they would normally be open and reduced seating capacity.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the coronavirus outbreak employed 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.