Research

August 30, 2024

Moderating Personal Spending Inflation Sets the Stage for an Interest Rate Cut in September

The personal consumption expenditures deflator—the Federal Reserve’s preferred inflation measure—rose 0.2% in July after edging up by 0.1% in June. After inching up 0.1% in both May and June, food prices increased 0.2% in July. At the same time, energy costs were flat in July, stabilizing after declining by 2.1% in the prior two months. Excluding food and energy, the core PCE deflator increased 0.2% for the second straight month.

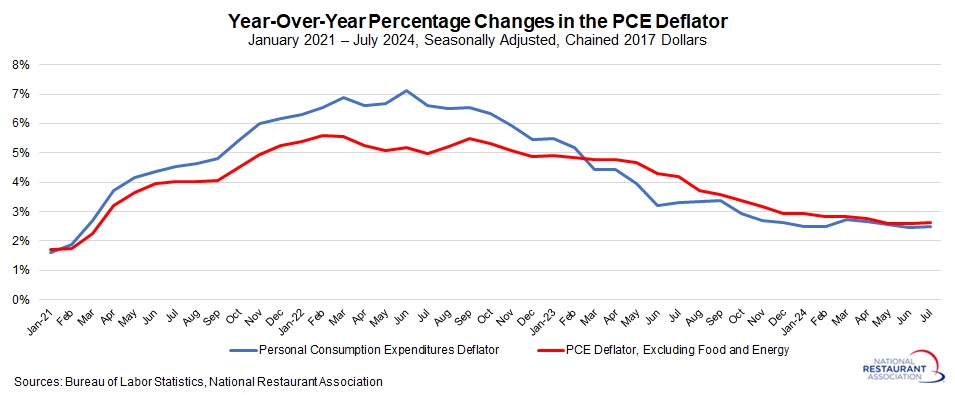

The PCE deflator has risen 2.5% since July 2023, the same year-over-year pace as in June and continuing to be the lowest since February 2021. Core inflation remained at 2.6% year-over-year in July for the third consecutive month, remaining the slowest pace since March 2021. Overall, these data show that pricing pressures have moderated significantly over the past couple of years, with the PCE deflator peaking at 7.1% year-over-year in June 2022 and core PCE inflation topping off at 5.5% in September of that year.

This report sets the stage for the Federal Open Market Committee to cut short-term interest rates at its upcoming meeting on September 17–18, as the Federal Reserve turns it attention to slowing economic growth and the desire to achieve a “soft landing.” This is likely to be 25 basis points, although there is some chatter about a 50-basis-point decrease. Of course, incoming data would dictate whether such a move would be possible. In addition, the Fed should have sufficient time to gauge another cut later this year, likely at its December 17–18 meeting. (The FOMC also meets the week of the U.S. election on November 6–7.)

In other aspects of the latest report, personal consumption expenditures jumped 0.5% in July, up from 0.3% in June and a solid increase. Spending on foodservices and accommodations rose 0.4% in July, the strongest monthly gain in three months. Over the past 12 months, personal spending grew 5.3%, with foodservices and accommodation purchases up 4.7% since July 2023. These data suggest how consumer spending has helped buoy the U.S. economy, helping to provide resilience despite lingering challenges, including for foodservices and accommodations.

.jpg)

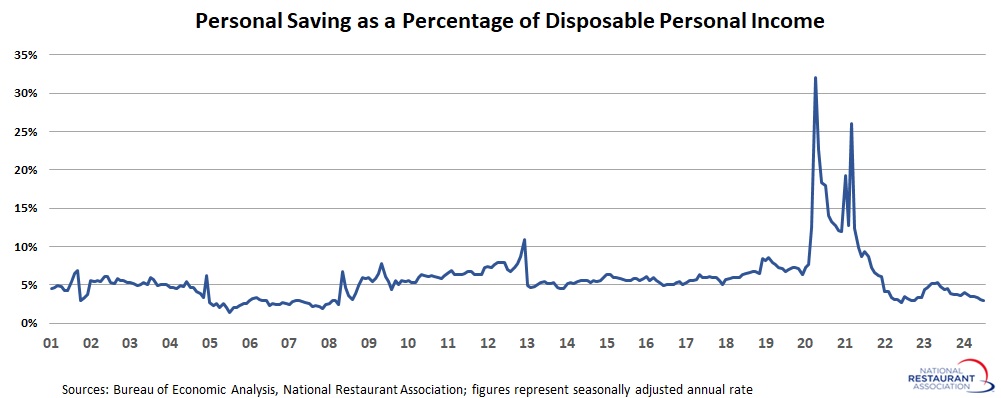

Personal incomes rose 0.3% in July, up from 0.2% in June. Wages and salaries also increased by 0.3% for the month. Over the past 12 months, wages and salaries have increased 4.4%, or 3.7% year-over-year in the service-producing industries. With spending outpacing income growth, the personal savings rate dropped to 2.9% in July, the lowest since June 2022.

Track more economic indicators and read more analysis and commentary from the Association's economists.

More from the Association's economists:

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.