Lightcast: Restaurant job postings and wage growth remain solid despite labor market cooling

Dr. Chad Moutray

Job openings are an important indicator of labor market dynamics, with sustained elevated levels suggesting a labor shortage. The Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) program is a commonly used source for job openings data and is based on a monthly survey of business establishments nationwide.

There were 866,000 job openings in June in the combined restaurants and accommodations sector, according to the JOLTS data from BLS. These data have decelerated notably following post-pandemic highs. Indeed, the overall level of job openings has essentially normalized to pre-pandemic levels.

Another measure of job openings is Lightcast, which aggregates online job posting from various websites with greater granularity. This differs from the BLS JOLTS data, which counts the number of positions that employers, including restaurants, are actively recruiting to fill, whether online or not. While the methodology and measurements of the two data sources are different, the trends typically move in similar directions.

******

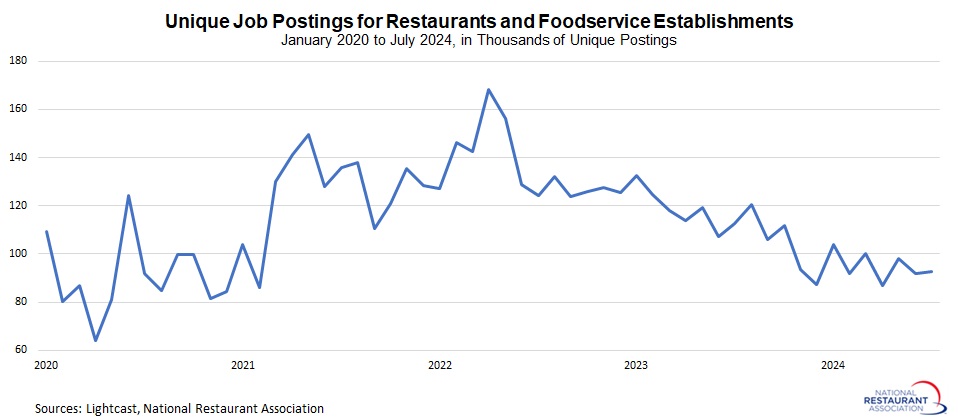

There were nearly 1.3 million unique job postings for restaurants and foodservice establishments over the past 12 months, according to Lightcast data, with 92,795 in July 2024. The pace of job openings remains solid despite these data trending lower over the past two years, with the labor market continuing to soften. For instance, the number of unique job postings in the sector peaked at 168,100 in April 2022. The average advertised base starting wage in entry level postings was $19.05 an hour in July 2024, up 8.4% and 9.2% over the past 12 and 24 months, respectively. This base wage does not include tip income, which could add to the salary.

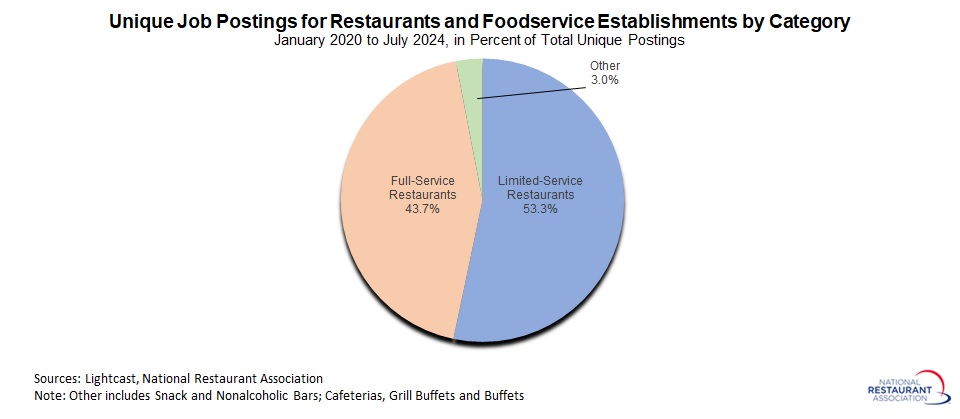

Between July 2023 and July 2024, the bulk of these unique job postings were in limited-service and full-service restaurants, with 691,819 and 567.006 postings over the past 12 months, respectively.

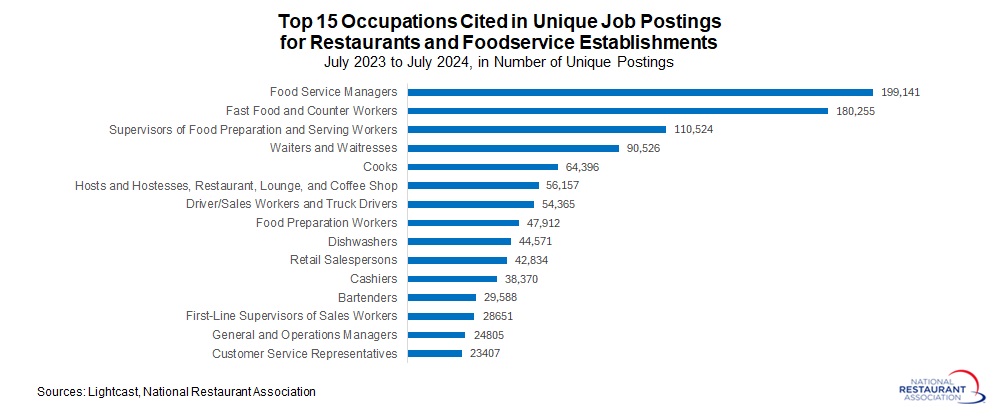

The top occupations being recruited at restaurants and food service establishments over the past year were food service managers, fast food and counter workers, supervisors of food preparation and serving workers, wait staff, cooks, and hosts and hostesses, among others.

In addition, these postings provide insights on the skills that are needed to perform these roles. By far, the largest specialized skill cited in job postings for roles at restaurants and foodservice establishments is to have some knowledge of restaurant operations. Other top specialized skills include food safety and sanitation, cash handling, restaurant management, food preparation, marketing and cooking, among others.

.jpg)

******

Lightcast labor market insights include a variety of economic, labor market, demographic, education and occupational data to provide a broad base of knowledge at national, state and regional levels. This resource can be valuable in assessing job market demand, supplementing what is known from official government data on job openings and employment.

A couple caveats should be noted:

- A single job posting could represent multiple positions at a company, particularly when restaurants are hiring several individuals for one role, potentially undercounting the true number that will be hired. (To be fair, companies might also post positions that ultimately lead to no action.)

- These data are not necessarily reconcilable with official figures from the Bureau of Labor Statistics, even as they offer some unique insights that complement those releases.

Track more economic indicators and read more analysis and commentary from the Association's economists.

More from the Association's economists:

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.