Research

October 03, 2024

ISM: Service-Sector Growth Strengthened in September

Dr. Chad Moutray

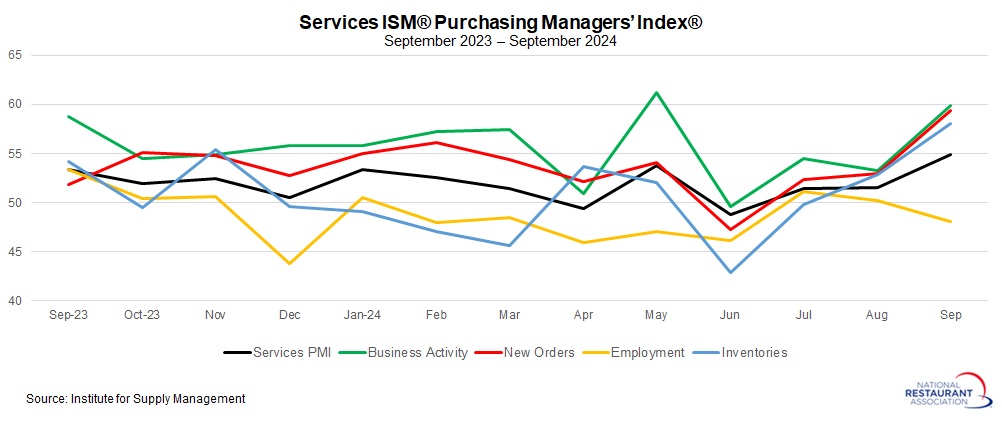

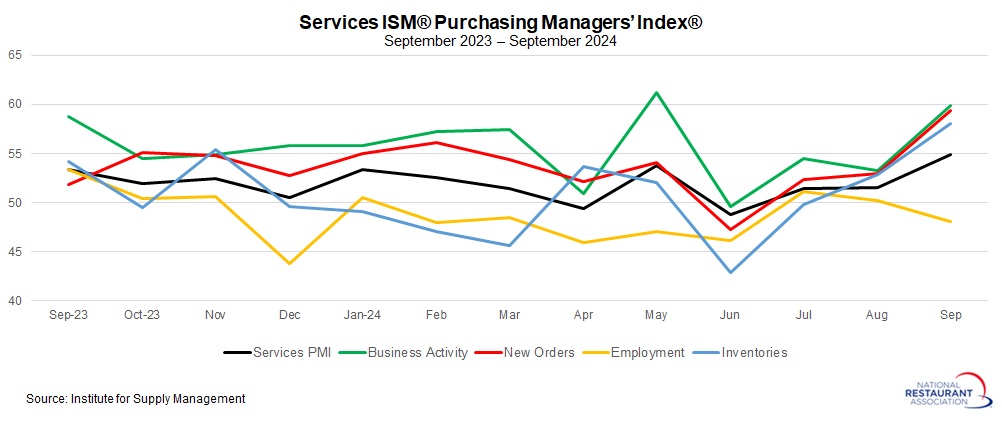

The Institute for Supply Management reported a notable increase in service-sector confidence for September. The Services ISM® Purchasing Managers’ Index® rose from 51.5 in August to 54.9 in September, marking its highest level since February 2023. Index readings above 50 indicate expansion compared to the previous month, while values below 50 signal contraction. Survey respondents cited improved business conditions (up from 53.3 to 59.9) and a surge in new orders (up from 53.0 to 59.4), with both metrics growing at their fastest rates since early 2023.

These results suggest a positive outlook for service-sector businesses and the broader U.S. economy, which have both faced headwinds over the past few years. However, not all indicators were as strong. The employment index declined from 50.2 to 48.1, indicating softness in hiring, while prices increased from 57.3 to 59.4—the fastest pace of growth since January. Comments from survey participants reflected mixed perspectives on the economic environment, highlighting ongoing concerns about elevated interest rates and political uncertainty.

For restaurant operators, this report from the Institute for Supply Management might seem tangential. Although accommodation and foodservice businesses are part of the survey, the services sector encompasses a wide range of industries, making it less immediately relevant to restaurant-specific conditions.

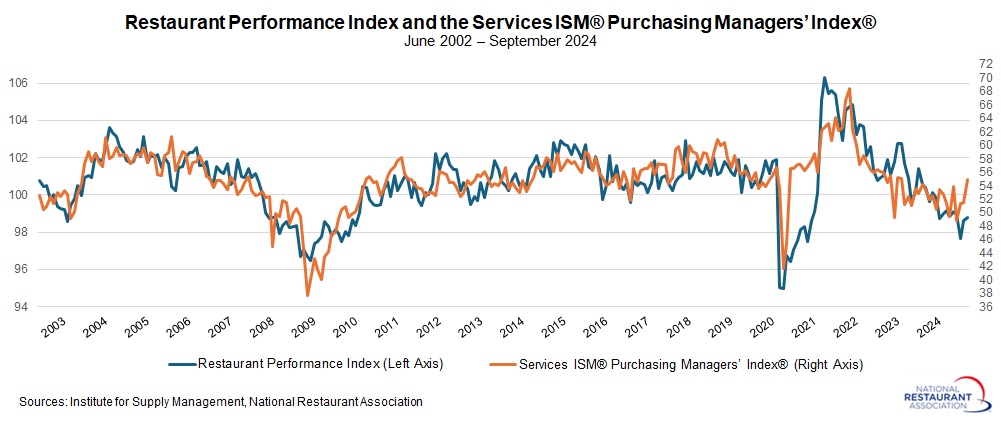

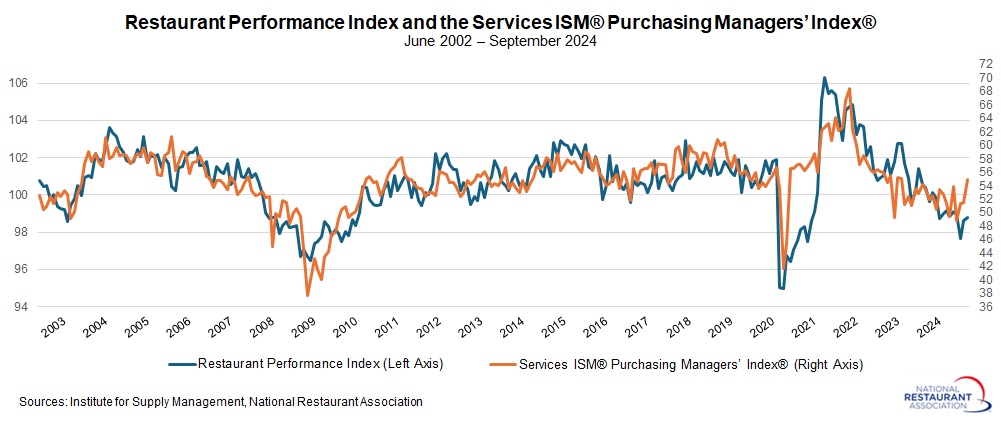

Still, a rise in service-sector sentiment, as measured by the Services ISM® Purchasing Managers’ Index®, often signals positive outcomes for restaurants based on historical trends. There is a strong correlation between this measure and the National Restaurant Association’s Restaurant Performance Index (RPI), which rose 1.0% in August. If this pattern holds, another increase in the RPI could be expected for September.

The National Restaurant Association will continue to monitor industry conditions closely, particularly the relationship between the RPI and the broader services sector's performance, as indicators suggest resilient growth moving forward.

The Institute for Supply Management reported a notable increase in service-sector confidence for September. The Services ISM® Purchasing Managers’ Index® rose from 51.5 in August to 54.9 in September, marking its highest level since February 2023. Index readings above 50 indicate expansion compared to the previous month, while values below 50 signal contraction. Survey respondents cited improved business conditions (up from 53.3 to 59.9) and a surge in new orders (up from 53.0 to 59.4), with both metrics growing at their fastest rates since early 2023.

These results suggest a positive outlook for service-sector businesses and the broader U.S. economy, which have both faced headwinds over the past few years. However, not all indicators were as strong. The employment index declined from 50.2 to 48.1, indicating softness in hiring, while prices increased from 57.3 to 59.4—the fastest pace of growth since January. Comments from survey participants reflected mixed perspectives on the economic environment, highlighting ongoing concerns about elevated interest rates and political uncertainty.

For restaurant operators, this report from the Institute for Supply Management might seem tangential. Although accommodation and foodservice businesses are part of the survey, the services sector encompasses a wide range of industries, making it less immediately relevant to restaurant-specific conditions.

Still, a rise in service-sector sentiment, as measured by the Services ISM® Purchasing Managers’ Index®, often signals positive outcomes for restaurants based on historical trends. There is a strong correlation between this measure and the National Restaurant Association’s Restaurant Performance Index (RPI), which rose 1.0% in August. If this pattern holds, another increase in the RPI could be expected for September.

The National Restaurant Association will continue to monitor industry conditions closely, particularly the relationship between the RPI and the broader services sector's performance, as indicators suggest resilient growth moving forward.

More from the Association's economists:

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.