Research

October 09, 2024

Health Insurance Costs Rose 7% in 2024

Dr. Chad Moutray

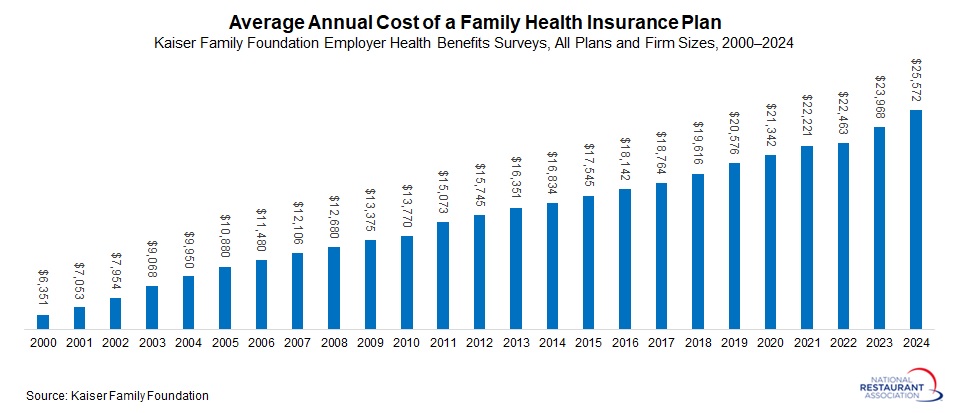

The average health insurance plan for a family of four cost $25,572 in 2024, up 7% from 2023, according to the Kaiser Family Foundation’s latest annual survey. Indeed, the cost of providing health insurance has risen sharply, more than tripling since 2000, with roughly 20% growth since 2020, as shown in the accompanying chart. (For previous surveys, including a discussion of methodological changes over time, click here.) The survey does not break out health costs for restaurants, but the average cost of a family health insurance plan in the service sector was $25,600, essentially the same as the headline number.

The average cost of single coverage health insurance was $8,951 in 2024, up 6% from the previous year. For small firms, that figure was $9,131 on average, with larger firms paying $8,884 for single coverage. Similar to the family coverage data, the cost of offering health insurance for single coverage has also risen significantly, up nearly 19% from $7,470 in 2020 and jumping more than 2½ times from $2,517 in 2000.

Labor costs comprise 36.5% of total sales for a typical restaurant, as reported in the Restaurant Operations Data Abstract 2024. This figure includes wages, salaries, and employee benefits like health insurance. Many restaurants continue to express concern over rising expenses, as inflation compresses margins and puts additional pressure on operations. The increasing cost of health insurance further exacerbates these financial challenges, as highlighted by the data.

At the same time, it is important to note that health insurance remains an important and essential offering for many employees in the labor market, including for those in the restaurant and foodservice industry.

From that perspective, a record 81% of restaurant employees had health insurance coverage in 2022, according to data from the U.S. Census Bureau’s American Community Survey. Of those who have health insurance, 72% have private insurance, either in the employee’s name or someone else’s name, such as a parent or spouse. Coverage under a parent’s plan is likely common in the restaurant industry, as more than 4 in 10 restaurant employees are under the age of 26.

The average health insurance plan for a family of four cost $25,572 in 2024, up 7% from 2023, according to the Kaiser Family Foundation’s latest annual survey. Indeed, the cost of providing health insurance has risen sharply, more than tripling since 2000, with roughly 20% growth since 2020, as shown in the accompanying chart. (For previous surveys, including a discussion of methodological changes over time, click here.) The survey does not break out health costs for restaurants, but the average cost of a family health insurance plan in the service sector was $25,600, essentially the same as the headline number.

The average cost of single coverage health insurance was $8,951 in 2024, up 6% from the previous year. For small firms, that figure was $9,131 on average, with larger firms paying $8,884 for single coverage. Similar to the family coverage data, the cost of offering health insurance for single coverage has also risen significantly, up nearly 19% from $7,470 in 2020 and jumping more than 2½ times from $2,517 in 2000.

Labor costs comprise 36.5% of total sales for a typical restaurant, as reported in the Restaurant Operations Data Abstract 2024. This figure includes wages, salaries, and employee benefits like health insurance. Many restaurants continue to express concern over rising expenses, as inflation compresses margins and puts additional pressure on operations. The increasing cost of health insurance further exacerbates these financial challenges, as highlighted by the data.

At the same time, it is important to note that health insurance remains an important and essential offering for many employees in the labor market, including for those in the restaurant and foodservice industry.

From that perspective, a record 81% of restaurant employees had health insurance coverage in 2022, according to data from the U.S. Census Bureau’s American Community Survey. Of those who have health insurance, 72% have private insurance, either in the employee’s name or someone else’s name, such as a parent or spouse. Coverage under a parent’s plan is likely common in the restaurant industry, as more than 4 in 10 restaurant employees are under the age of 26.

More from the Association's economists:

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.