Research

September 18, 2024

The Federal Reserve Cut Rates for the First Time Post-Pandemic

Dr. Chad Moutray

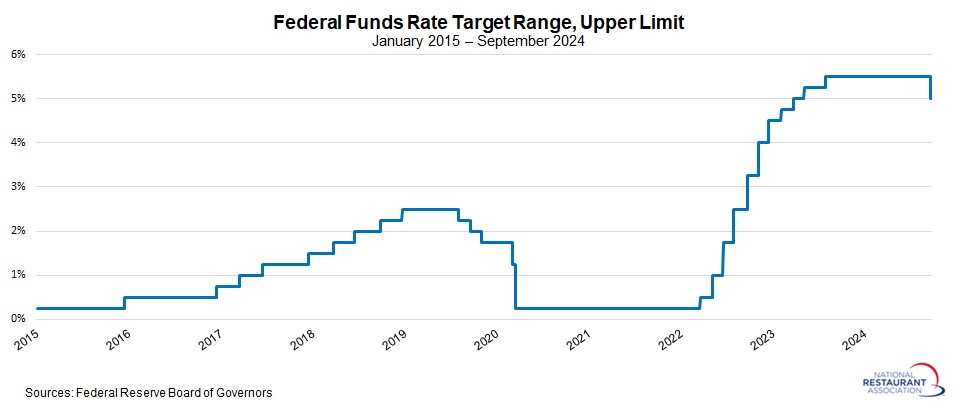

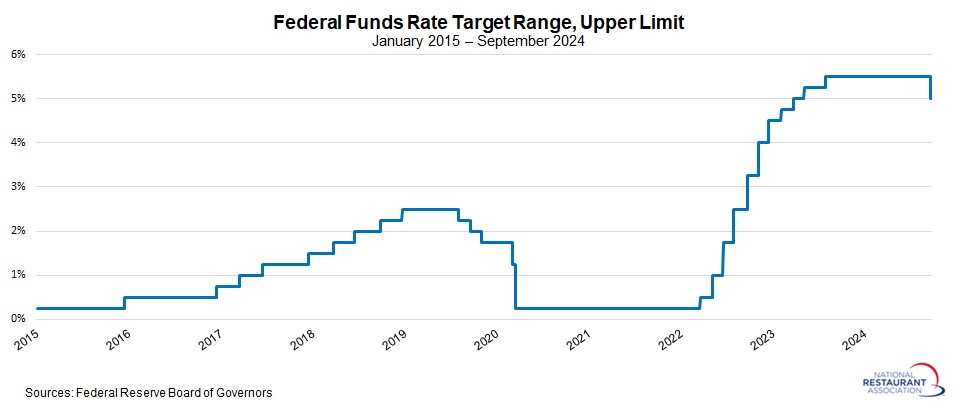

The Federal Open Market Committee reduced short-term interest rates at the conclusion of its September 17–18 meeting. It was the first time since March 2020 that the Federal Reserve has cut rates, which began moving sharply higher in the face of pricing pressures in March 2022. The federal funds rate has been in the 5.25% to 5.50% range since July 2023. After this latest meeting, the new federal funds range will be 4.75% to 5.00%.

The Committee notes, “Inflation made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.” By cutting interest rates, the Federal Reserve is focusing on the risks for slowing economic and employment growth. At the same time, rates remain sufficiently high enough to target lingering pricing pressures in the economy, even with the sizable cut seen at this meeting.

For restaurant operators, the reduction in interest rates will be welcome news on two fronts. First, it suggests that the Federal Reserve is committed to achieving a “soft landing,” with lower rates helping to support more economic growth. Indeed, while the FOMC remains focused on its dual mandate of price stability and maximum employment, the shift to lower rates signals an increased emphasis on the latter. Second, reduced rates will also lower borrowing costs, both for consumers and businesses, and this should encourage more investment and spending.

Meanwhile, the Federal Reserve also released the economic projections of the participants. The median estimate for the federal funds rate is seen declining by another 50 basis points in 2024, with two more meetings this year (November 6–7 and December 17–18). While this is just a survey of FOMC participants, it does signal that each of those two remaining meetings might yield 25 basis-point cuts. In addition, these responses suggest 100 basis points of cuts in 2025, as the FOMC seeks to normalize rates from the elevated levels seen in the past two years.

Moreover, participants forecast 2.0% growth in real GDP in both 2024 and 2025, with the unemployment rate being 4.4% in both years. In terms of inflation, the core PCE deflator would decline to 2.6% by year’s end, falling to 2.2% in 2025 and getting nearer to the Fed’s long-term target.

Track more economic indicators and read more analysis and commentary from the Association's economists.

The Federal Open Market Committee reduced short-term interest rates at the conclusion of its September 17–18 meeting. It was the first time since March 2020 that the Federal Reserve has cut rates, which began moving sharply higher in the face of pricing pressures in March 2022. The federal funds rate has been in the 5.25% to 5.50% range since July 2023. After this latest meeting, the new federal funds range will be 4.75% to 5.00%.

The Committee notes, “Inflation made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.” By cutting interest rates, the Federal Reserve is focusing on the risks for slowing economic and employment growth. At the same time, rates remain sufficiently high enough to target lingering pricing pressures in the economy, even with the sizable cut seen at this meeting.

For restaurant operators, the reduction in interest rates will be welcome news on two fronts. First, it suggests that the Federal Reserve is committed to achieving a “soft landing,” with lower rates helping to support more economic growth. Indeed, while the FOMC remains focused on its dual mandate of price stability and maximum employment, the shift to lower rates signals an increased emphasis on the latter. Second, reduced rates will also lower borrowing costs, both for consumers and businesses, and this should encourage more investment and spending.

Meanwhile, the Federal Reserve also released the economic projections of the participants. The median estimate for the federal funds rate is seen declining by another 50 basis points in 2024, with two more meetings this year (November 6–7 and December 17–18). While this is just a survey of FOMC participants, it does signal that each of those two remaining meetings might yield 25 basis-point cuts. In addition, these responses suggest 100 basis points of cuts in 2025, as the FOMC seeks to normalize rates from the elevated levels seen in the past two years.

Moreover, participants forecast 2.0% growth in real GDP in both 2024 and 2025, with the unemployment rate being 4.4% in both years. In terms of inflation, the core PCE deflator would decline to 2.6% by year’s end, falling to 2.2% in 2025 and getting nearer to the Fed’s long-term target.

Track more economic indicators and read more analysis and commentary from the Association's economists.

More from the Association's economists:

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.