Elevated costs continue to pressure restaurant profitability

The business environment for restaurants was marked by an array of challenges in recent years. Among the most interminable was a steady rise in input costs across all facets of the restaurant operation.

Prior to the pandemic, the cost breakdown for a typical independent restaurant looked like this:

- Food and labor costs were the two most significant line items, each accounting for approximately 33 cents of every dollar in sales.

- Other expenses – such as utilities, occupancy, supplies, general/administrative, repairs/maintenance and credit card processing fees – combined to represent about 29% of sales.

That left a pre-tax profit margin of roughly 5% for a typical restaurant, which means significant cost increases were not sustainable.

The pandemic ushered in a period of dramatic cost increases for restaurants across the U.S., due in large part to disruptions in the supply chain and labor market. While the growth rates of input costs have eased somewhat from the 2021 and 2022 peaks, they continue to trend higher.

More recently, the operating environment was made even more challenging as these cost pressures were coupled with dampened customer traffic.

Based on government data and surveys of restaurant operators, the National Restaurant Association estimates that input costs posted double-digit percentage increases across all major categories since 2019 – led by 35% gains in both food costs and labor costs.

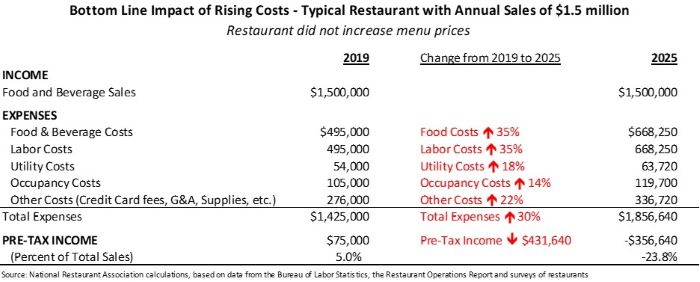

Impact on the bottom line without higher sales or prices

The chart below illustrates the impact that these higher input costs would have on the average restaurant’s bottom line if sales remained flat and menu prices didn’t rise.

Prior to the cost increases, pre-tax income represented 5% of sales for this restaurant, or $75,000. After factoring in the sharp increase in costs, the restaurant would register a pre-tax loss of $356,640, or nearly 24% of sales.

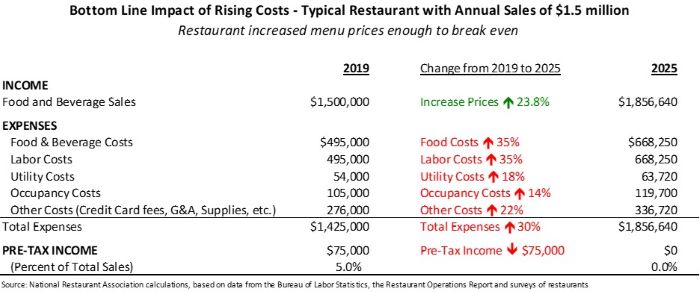

Increasing prices to break even

For many restaurants, customer traffic is still dampened compared to pre-pandemic levels. That means the only way they can cover their rising costs is to increase menu prices.

To cover the higher input costs, the average restaurant would need to increase prices 23.8%. However, that would only mean breaking even, with no profitability.

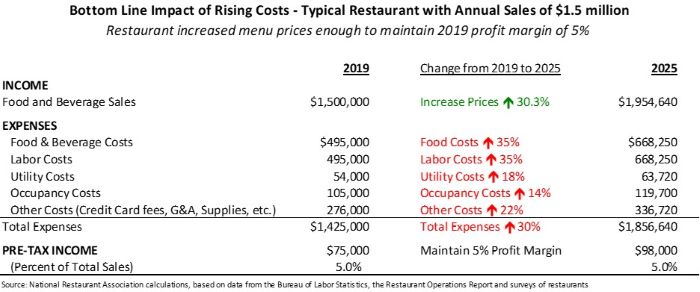

Increasing prices to maintain a 5% profit margin

Most restaurants can’t simply break even, as debt burdens in the industry are still elevated. As of November 2024, 53% of operators said their restaurant was still carrying debt that it accumulated since the beginning of the pandemic. To pay off this debt, restaurants need to make a profit.

To cover the higher input costs and maintain its 5% pre-pandemic profit margin, the average restaurant would have to increase prices more than 30%.