Research

July 31, 2024

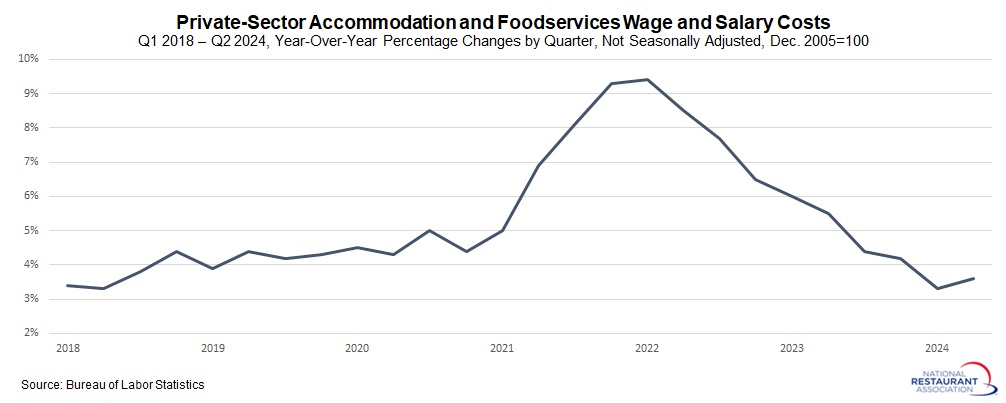

Accommodation and foodservices wages and salaries rose 1.5% in Q2, or 3.6% year-over-year

Dr. Chad Moutray

Private-sector wages and salaries in the accommodation and foodservices sector rose 1.6% in the Q2 2024 using non-seasonally adjusted data, up from 1.0% in Q1 2024 and the strongest quarterly pace since Q1 2023. Indeed, after showing signs of deceleration throughout much of 2023, the cost of wages and salaries for the sector have picked up so far in 2024.

With that said, there has been a very significant moderation in wages and salaries in the accommodation and foodservices sector since the heights of two years ago. Over the past 12 months, private-sector wages and salaries in the sector have risen 3.6%, up from 3.3% year-over-year in Q1 2024. While that represents a solid increase, it is down notably from the all-time high for this series, which was 9.4% year-over-year growth in Q1 2022. Indeed, the cost of wages and salaries have normalized to the average year-over-year growth rates seen in the pre-pandemic years of 2018 and 2019, which was 3.6%.

Note that one advantage of the Employment Cost Index data is that, unlike other labor market figures, it controls for composition of occupations within an industry. As such, it is said to be a better reflection of wage and salary costs over time within an industry, at least by some, including the Federal Reserve.

Private-sector wages and salaries in the accommodation and foodservices sector rose 1.6% in the Q2 2024 using non-seasonally adjusted data, up from 1.0% in Q1 2024 and the strongest quarterly pace since Q1 2023. Indeed, after showing signs of deceleration throughout much of 2023, the cost of wages and salaries for the sector have picked up so far in 2024.

With that said, there has been a very significant moderation in wages and salaries in the accommodation and foodservices sector since the heights of two years ago. Over the past 12 months, private-sector wages and salaries in the sector have risen 3.6%, up from 3.3% year-over-year in Q1 2024. While that represents a solid increase, it is down notably from the all-time high for this series, which was 9.4% year-over-year growth in Q1 2022. Indeed, the cost of wages and salaries have normalized to the average year-over-year growth rates seen in the pre-pandemic years of 2018 and 2019, which was 3.6%.

Note that one advantage of the Employment Cost Index data is that, unlike other labor market figures, it controls for composition of occupations within an industry. As such, it is said to be a better reflection of wage and salary costs over time within an industry, at least by some, including the Federal Reserve.

Track more economic indicators and read more analysis and commentary from the Association's economists.

More from the Association's economists:

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.