Research

April 22, 2025

A Weaker Dollar Adds Pressure for Restaurants

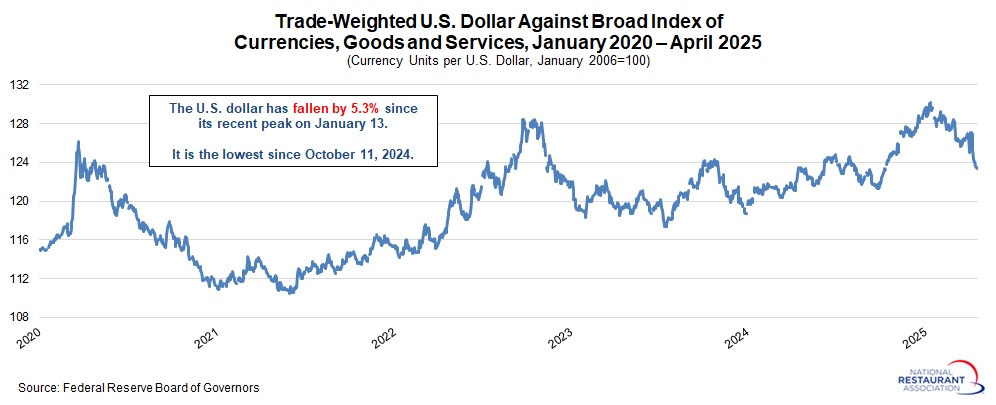

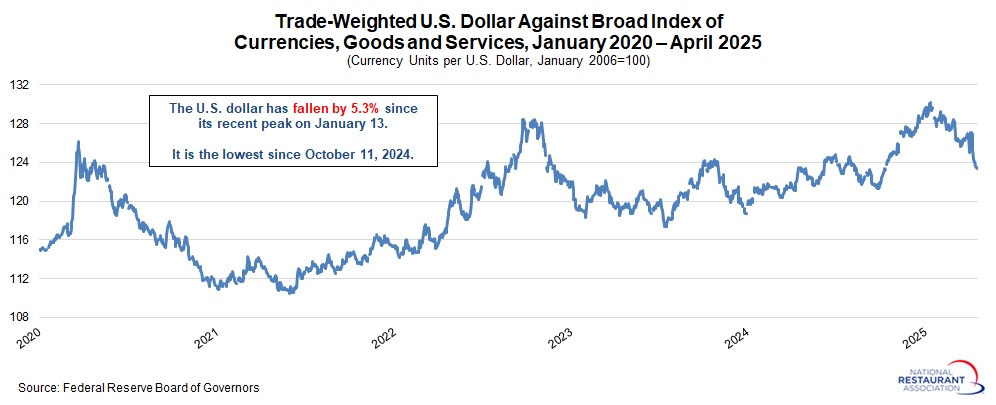

Amid rising tariffs and shifting global supply chains, restaurant operators are also watching currency markets. Typically, higher U.S. tariffs coincide with a stronger dollar, as demand for U.S. currency rises to cover the added import costs—helping to offset some of the impact.

But the opposite has happened in recent months. Since peaking on January 13, the U.S. dollar has declined 5.3% against a broad, trade-weighted index of global currencies, according to the Federal Reserve. Because this index reflects the value of other currencies per U.S. dollar, the drop means the dollar buys less today than it did in mid-January.

For restaurants, this adds a second layer of cost pressure: not only are tariffs raising prices on imports, but the weaker dollar makes those goods—such as food, beverages, equipment, and supplies—even more expensive.

On the upside, a weaker dollar improves the purchasing power of foreign visitors, making the U.S. a more attractive destination. That could benefit restaurants in major tourist hubs.

However, international travel has moved in the wrong direction so far this year. In March, 4.54 million foreign travelers arrived by air—down 9.7% from 5.03 million a year earlier, according to the International Trade Administration. This will be an important trend to watch, especially for restaurants that rely on tourist traffic.

But the opposite has happened in recent months. Since peaking on January 13, the U.S. dollar has declined 5.3% against a broad, trade-weighted index of global currencies, according to the Federal Reserve. Because this index reflects the value of other currencies per U.S. dollar, the drop means the dollar buys less today than it did in mid-January.

For restaurants, this adds a second layer of cost pressure: not only are tariffs raising prices on imports, but the weaker dollar makes those goods—such as food, beverages, equipment, and supplies—even more expensive.

(To be fair, the U.S. dollar is essentially flat relative to where it was one year ago, reflecting the appreciation in the currency seen in recent years.)

On the upside, a weaker dollar improves the purchasing power of foreign visitors, making the U.S. a more attractive destination. That could benefit restaurants in major tourist hubs.

However, international travel has moved in the wrong direction so far this year. In March, 4.54 million foreign travelers arrived by air—down 9.7% from 5.03 million a year earlier, according to the International Trade Administration. This will be an important trend to watch, especially for restaurants that rely on tourist traffic.