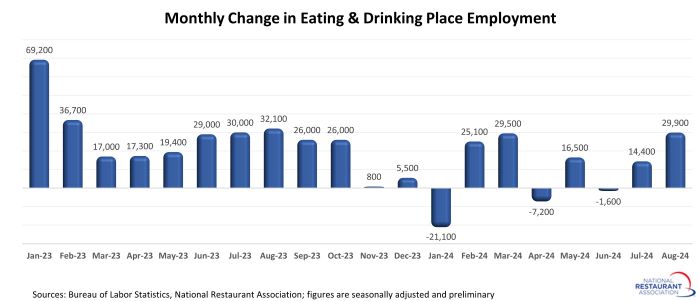

Restaurants added nearly 30k jobs in August

Restaurants expanded payrolls in August at the strongest pace in a year, representing a solid improvement over the choppy readings in recent months.

Eating and drinking places* added a net 29,900 jobs in August on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS). That represented the strongest monthly increase since August 2023 (+32,100) and followed a 4-month stretch that alternated between gains and declines.

Although August represented the largest monthly employment gain thus far in 2024, the overall rate of growth has clearly slowed from the robust pandemic-recovery period. On average during the first 8 months of 2024, eating and drinking places added a net 10,700 jobs each month.

That was down from 2023’s average monthly increase of nearly 26,000 jobs, and was significantly below the monthly gains in 2021 (+136k) and 2022 (+51k), when the industry was rebuilding its workforce.

Restaurant job growth was uneven in recent months, but the overall trendline remains generally positive. As a result, the industry continues to rise further above pre-pandemic staffing levels. As of August 2024, eating and drinking places were nearly 87,000 jobs (or 0.7%) above their February 2020 employment peak.

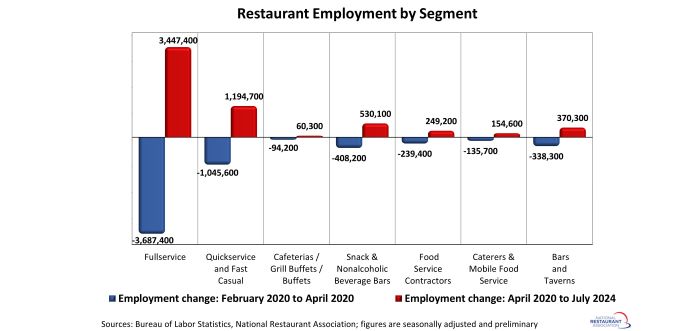

Fullservice segment still down 240k jobs

While the overall restaurant industry surpassed pre-pandemic employment levels, significant differences still exist by segment.

The fullservice segment experienced the most job losses during the initial months of the pandemic – and it still has the longest path to recovery. As of July 2024, fullservice restaurant employment levels were 240,000 jobs (or 4%) below pre-pandemic readings in February 2020.

Employment counts in the cafeterias/grill buffets/buffets segment (-31%) also remained below their February 2020 levels.

Job losses in the limited-service segments were somewhat less severe during the initial months of the pandemic, as these operations were more likely to retain staff to support their existing off-premises business. As of July 2024, employment at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – was nearly 122,000 jobs (or 16%) above February 2020 readings.

Staffing levels in the quickservice and fast casual segments were nearly 150,000 jobs (or 3%) above pre-pandemic levels. Headcounts at bars and taverns were 32,000 jobs (or 7%) above the pre-pandemic peak.

[Note that the segment-level employment figures are lagged by one month, so July is the most current data available.]

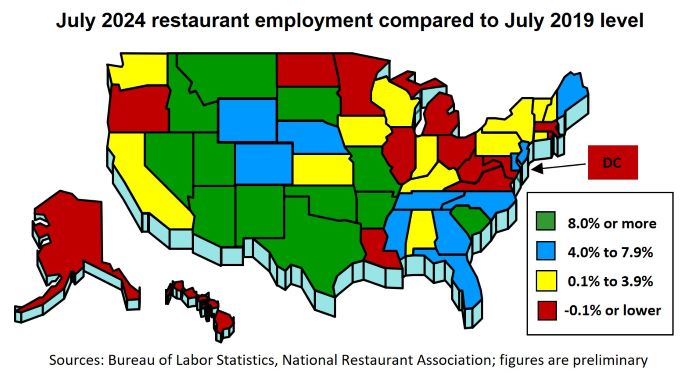

Restaurant job growth varies across the states

Restaurant employment trended higher in recent months, but the extent of the industry’s workforce recovery varies significantly by state. As of July 2024, 14 states and the District of Columbia had fewer eating and drinking place jobs than they did in July 2019.

This group was led by North Dakota, which had 8% fewer eating and drinking place jobs in July 2024 than it did in July 2019. Louisiana (-7%), Maryland (-5%) and Hawaii (-5%) were also well below their pre-pandemic restaurant employment levels.

As of July 2024, eating and drinking place employment in 36 states surpassed their comparable pre-pandemic readings in July 2019. This group was led by South Dakota (+17%), Montana (+15%), Utah (+15%) and Nevada (+13%).

[Note that the state-level analysis uses July 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available.]

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, providing jobs for roughly 80% of the total restaurant and foodservice workforce of 15.5 million.

Read more analysis and commentary from the Association's economists.