Restaurant workforce recovery continued in May

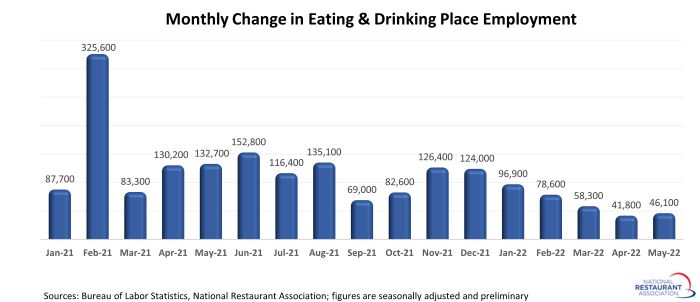

The restaurant industry continued to expand payrolls at a moderate pace in May. Eating and drinking places* added a net 46,100 jobs in May on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics.

Although May represented the 17th consecutive month of restaurant job growth, it was the fifth consecutive month with gains below 100,000. The recent slowdown was likely due in large part to the intense competition for employees across sectors.

In total during the last 17 months, eating and drinking places added a net 1.9 million jobs. Despite the steady gains in recent months, eating and drinking places remained 750,000 jobs – or 6.1% – below their February 2020 pre-pandemic employment peak.

Snack and nonalcoholic beverage bars surpassed pre-pandemic staffing levels

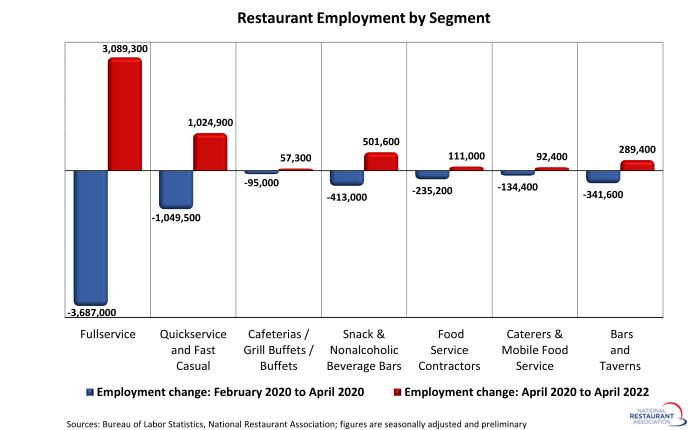

Although staffing levels rebounded from pandemic lows in each of the major restaurant segments, overall employment remains below pre-coronavirus readings in most categories. [Note that the segment-level employment figures are lagged by one month, so April is the most current data available.]

The fullservice segment suffered the most job losses during the initial months of the pandemic – and still has the longest path to recovery. As of April 2022, fullservice restaurant staffing levels were nearly 600,000 jobs (or 11%) below pre-coronavirus readings in February 2020.

Job losses in the limited-service segments were somewhat less severe during the initial months of the pandemic, as these operations were more likely to retain staff to support their existing off-premises business. As of April 2022, staffing levels at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – were nearly 89,000 jobs (or 11%) above February 2020 readings.

Meanwhile, the quickservice and fast casual segments remained 25,000 jobs (or less than 1%) below pre-pandemic levels.

Other segments have a much longer road to reach pre-pandemic staffing levels. Employment counts in the cafeterias/grill buffets/buffets segment (-35%), foodservice contractor segment (-24%), catering and mobile foodservice segment (-20%) and bars and taverns segment (-12%) are still significantly below their February 2020 levels.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the coronavirus outbreak employed 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.