Restaurant workforce recovery continued in February

Restaurant industry job growth settled into a remarkably consistent trend in recent months. Eating and drinking places* added a net 123,700 jobs in February on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics.

February represented the fourth consecutive month with job growth in the 125,000 range – and 14th straight month of employment gains overall. In total during the last 14 months, eating and drinking places added a net 1.8 million jobs.

Despite the steady gains in recent months, eating and drinking places remained 824,000 jobs – or 6.7% – below their February 2020 pre-pandemic employment peak.

Snack and nonalcoholic beverage bars surpassed pre-pandemic staffing levels

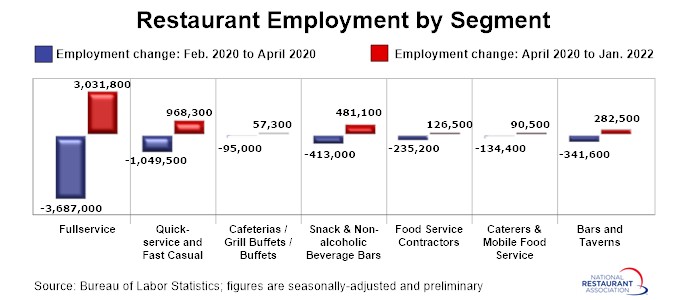

Although staffing levels rebounded from pandemic lows in each of the major restaurant segments, overall employment remains below pre-coronavirus readings in most categories. [Note that the segment-level employment figures are lagged by one month, so January is the most current data available.]

The fullservice segment suffered the most job losses during the initial months of the pandemic – and still has the longest path to recovery. As of January 2022, fullservice restaurant staffing levels were over 650,000 jobs (or 12%) below pre-coronavirus readings in February 2020.

Job losses in the limited-service segments were somewhat less severe during the initial months of the pandemic, as these operations were more likely to retain staff to support their existing off-premises business. As of January 2022, staffing levels at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – were 68,000 jobs (or 8%) above February 2020 readings.

Meanwhile, the quickservice and fast casual segments remained 81,000 jobs (or 2%) below pre-pandemic levels.

Other segments have a much longer road to reach pre-pandemic staffing levels. Employment counts in the cafeterias/grill buffets/buffets segment (-35%), foodservice contractor segment (-21%), catering and mobile foodservice segment (-20%) and bars and taverns segment (-14%) are still significantly below their February 2020 levels.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the coronavirus outbreak employed 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.