Restaurant sales trended lower to end 2022

Consumer spending tapered off as 2022 came to a close – flashing a potential warning sign for diminished consumer activity in the months ahead.

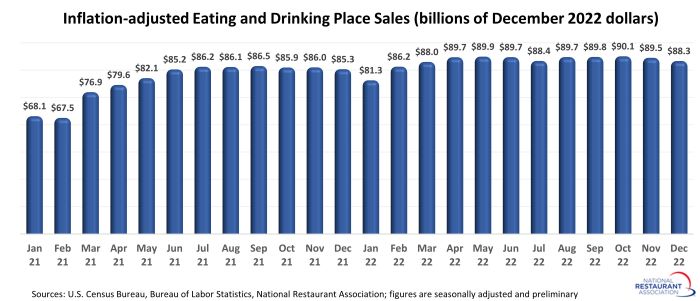

Eating and drinking places* registered total sales of $88.3 billion on a seasonally adjusted basis in December, according to preliminary data from the U.S. Census Bureau. That was down 0.9% from November’s downward-revised volume of $89.2 billion.

Notably, the October and November sales figures were revised significantly lower from the preliminary readings. Taken together, total eating and drinking place sales during the two months were $1.6 billion lower than what was originally reported by the Census Bureau.

Consumers’ pullback in spending was not specifically focused on restaurants. Consumer spending in non-restaurant retail sectors plunged 2.3% between October and December – more than double the 1.0% decline in eating and drinking place sales during the two-month period.

After adjusting for menu price increases, the trendline of restaurant sales was flat to lower in recent months. In inflation-adjusted terms, eating and drinking place sales in December represented the lowest monthly volume since March 2022.

Pent up demand holding firm

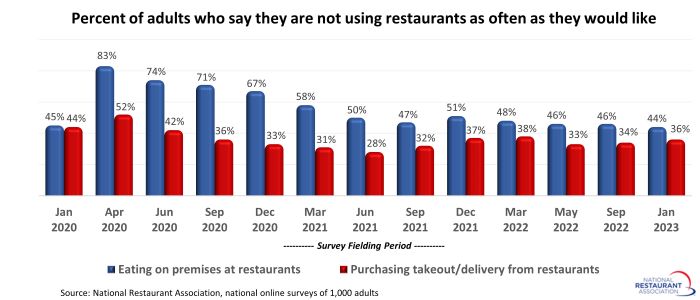

Consumer spending may have dropped off in recent months, but the National Restaurant Association’s measures of pent-up demand indicate it wasn’t for a lack of interest. Forty-four percent of adults say they are not going out to restaurants as often as they would like, according to a survey fielded January 13-15, 2023. This was essentially on par with consumers’ reporting in surveys fielded in May 2022 and September 2022 (both 46%).

Meanwhile, 36% of adults say they are not ordering takeout or delivery from restaurants as often as they would like. This was also similar to readings in the 2022 surveys.

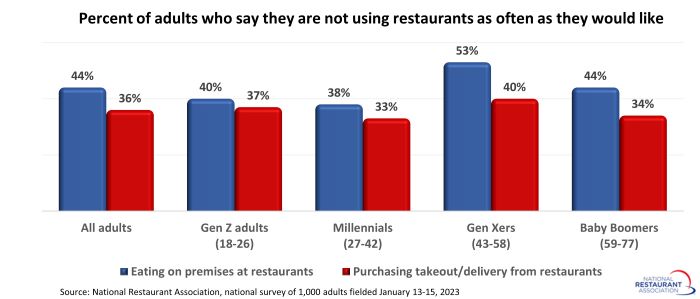

Older adults are more likely to say they aren’t using restaurants enough. Fifty-three percent of Gen Xers and 44% of baby boomers say they are not eating on premises at restaurants as often as they would like. Roughly 4 in 10 millennials and Gen Z adults reported similarly.

On the off-premises side, Gen Xers (40%) are the most likely to say they are not ordering takeout or delivery from restaurants as often as they would like.

*Eating and drinking places are the primary component of the U.S. restaurant and foodservice industry, which prior to the coronavirus pandemic generated approximately 75 percent of total restaurant and foodservice sales.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.