Restaurant sales registered a healthy gain in February

Consumers ramped up their spending on food and beverages away from home in February, which followed several months of stagnation. Eating and drinking places* registered total sales of $73.9 billion on a seasonally adjusted basis in February, according to preliminary data from the U.S. Census Bureau.

That was up a solid 2.5% from January’s seasonally adjusted volume of $72.1 billion, which represented the strongest monthly increase in 9 months. Prior to February’s healthy gain, nominal eating and drinking place sales had remained essentially flat for the previous 6 months.

In inflation-adjusted terms, eating and drinking place sales in January 2022 were lower than the volumes posted in each of the 10 months leading up to the pandemic.

March could be more challenging

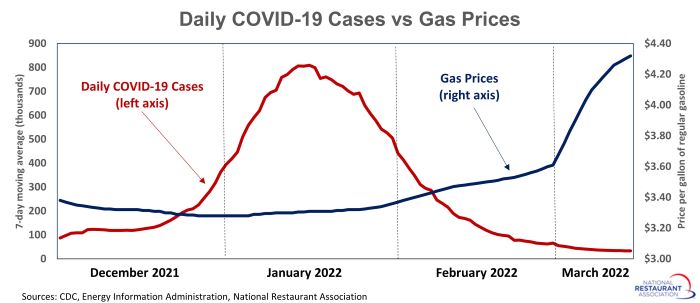

February’s sales were sandwiched between the height of the omicron variant in January and the sharp runup in gas prices in March. After peaking at more than 800,000 daily cases in mid-January, the 7-day moving average of COVID-19 cases fell below 200,000 by early-February.

Consumers were thrown another curveball in early March – this time in the form of sharply higher gas prices. The average price for a gallon of regular gasoline jumped 71 cents during the first 2 weeks of March – reaching a record high of $4.32 on March 14, according to the Energy Information Administration.

While elevated gas prices won’t influence consumers’ confidence to go out to public places like the omicron variant did, they can certainly impact the extent to which many households can spend money in the restaurant and foodservice industry. This could potentially have implications for both the on-premises and off-premises sides of the business.

*Eating and drinking places are the primary component of the U.S. restaurant and foodservice industry, which prior to the coronavirus outbreak generated approximately 75 percent of total restaurant and foodservice sales.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.