Restaurant job growth stalled in June

Job growth in the restaurant industry ground to a halt in June, according to preliminary data from the Bureau of Labor Statistics (BLS).

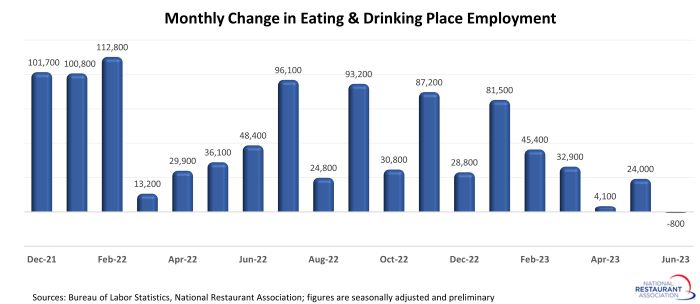

Eating and drinking places* lost a net 800 jobs in June on a seasonally-adjusted basis. That followed 29 consecutive months of employment gains – a period during which the industry added more than 2.5 million jobs.

Employment levels in April and May were also revised lower from preliminary readings. In total during the second quarter, eating and drinking places added a net 27,300 jobs.

That represented the weakest quarterly employment performance since the fourth quarter of 2020, when the industry cut nearly 250,000 jobs due to the onset of the delta variant.

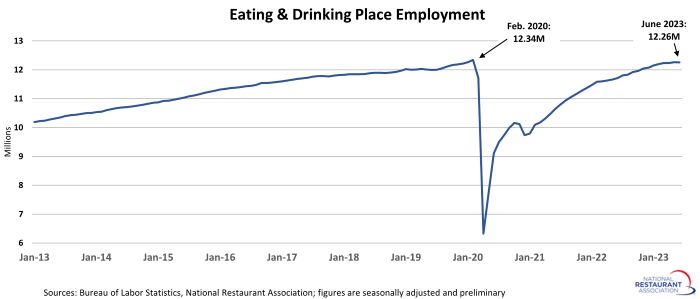

As a result, the industry’s staffing levels are still below pre-pandemic readings. As of June 2023, eating and drinking places were 80,000 jobs – or 0.6% – below their February 2020 employment peak.

Help wanted signs are still out

Although job growth slowed significantly in recent months, elevated job openings suggest a continued desire to boost staffing levels.

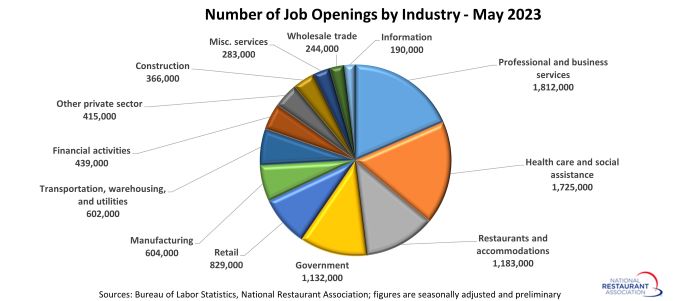

On the last business day of May, there were nearly 1.2 million job openings in the combined restaurants and accommodations sector, according to Job Openings and Labor Turnover Survey (JOLTS) data from BLS. That was essentially unchanged from the previous 3 months, and represented the 26th consecutive month with at least 1 million openings.

Prior to this 26-month streak, hospitality sector job openings had only surpassed 1 million once during the entirety of the JOLTS data series which dates back to 2000.

In terms of pre-pandemic comparisons, there were an average of 875,000 hospitality job openings each month during 2019. Using this as a proxy for normal labor market conditions, it means there were more than 300,000 job openings above normal in May 2023.

Note: The job openings data presented above are for the broadly-defined Accommodations and Food Services sector (NAICS 72), because the Bureau of Labor Statistics does not report data for restaurants alone. Eating and drinking places account for nearly 90% of jobs in the combined sector.

Restaurants aren’t the only sector looking to boost staffing levels. Four different industry categories had more than 1 million unfilled job openings in May. This group was led by the professional and business services (1.8 million) and health care and social assistance (1.7 million) sectors.

Retailers – who often compete with restaurants for employees – reported more than 800,000 job openings in May.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the COVID-19 pandemic employed more than 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.