Restaurant job growth slowed significantly in August

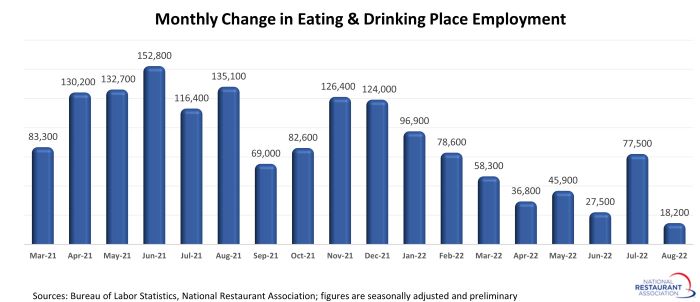

Restaurants expanded payrolls at a modest pace in August, providing additional evidence that the road to normal staffing levels remains long. Eating and drinking places* added a net 18,200 jobs in August on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics.

That was down from a gain of 77,500 jobs in July, and represented the smallest monthly increase since December 2020.

Although August marked the 20th consecutive month of restaurant employment growth, the industry’s workforce recovery remains far from complete. As of August 2022, eating and drinking places were still 633,000 jobs – or 5.1% – below their pre-pandemic employment levels. No other industry has a longer road to reach a full employment recovery.

2 in 3 restaurants are understaffed

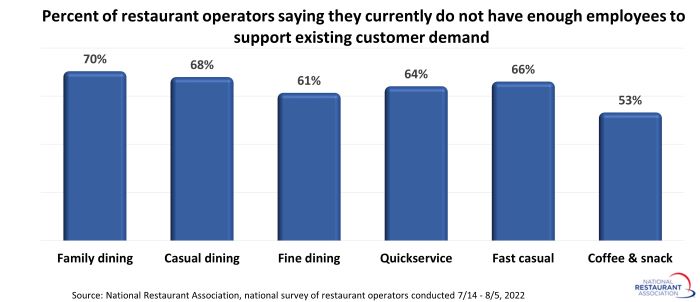

While gradual progress is being made toward rebuilding the workforce, a majority of restaurants remain understaffed. In a National Restaurant Association survey fielded between July 14 and August 5, 65% of operators said their restaurant does not have enough employees to support its existing customer demand.

A majority of operators across each of the six major segments said their restaurant does not have enough employees to meet customer demand.

For most restaurants, staffing is significantly below necessary levels. Among restaurants that are currently understaffed, 62% of operators said their restaurant is more than 10% below necessary staffing levels. Twenty percent of these operators are more than 20% below necessary staffing levels.

Job openings are difficult to fill

The restaurants-and-accommodations sector had more than 1.3 million job openings on the last business day of July 2022, according to Job Openings and Labor Turnover Survey (JOLTS) data from the Bureau of Labor Statistics. While this was down somewhat from the record 1.8 million unfilled job openings recorded in December 2021, it was well above the typical readings during the months leading up to the pandemic.

July also represented the 16th consecutive month with at least 1 million unfilled job openings. Prior to this 16-month streak, hospitality sector job openings had only surpassed 1 million once during the entirety of the JOLTS data series which dates back to 2000.

Note: The job openings data presented above are for the broadly-defined Accommodations and Food Services sector (NAICS 72), because the Bureau of Labor Statistics does not report data for restaurants alone. Eating and drinking places account for nearly 90% of jobs in the combined sector.

It is not only restaurants that are trying to attract employees. In total, there were 11.2 million job openings in the U.S. economy in July 2022 – one of the highest levels on record.

Four different industry categories had more than 1 million unfilled job openings in July. This group was led by the professional and business services and health care and social assistance sectors, which each had roughly 2 million vacancies.

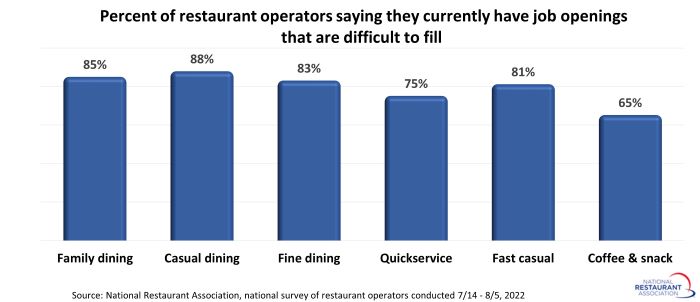

With so many different employers competing in today’s shallow labor pool, it’s not surprising that 81% of operators say their restaurant currently has job openings that are difficult to fill. Fullservice operators are the most likely to say they have trouble filling vacancies.

Despite the continued challenges, a strong majority of restaurant operators say they will likely hire additional employees during the next 6 months if there are qualified applicants available.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the coronavirus outbreak employed 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.