Restaurant job growth slowed in recent months

Restaurant employment was essentially unchanged in November. Eating and drinking places* added a net 11,000 jobs in November on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS).

November marked the continuation of a relatively sluggish period of job growth. During the last 4 months, restaurants added an average of 44,000 jobs each month. This was down from an average monthly increase of nearly 200,000 jobs during the first 7 months of the year.

As of November 2021, eating and drinking places remained nearly 800,000 jobs – or 6.1% – below their February 2020 pre-pandemic employment peak.

Demand for labor continues to outpace supply

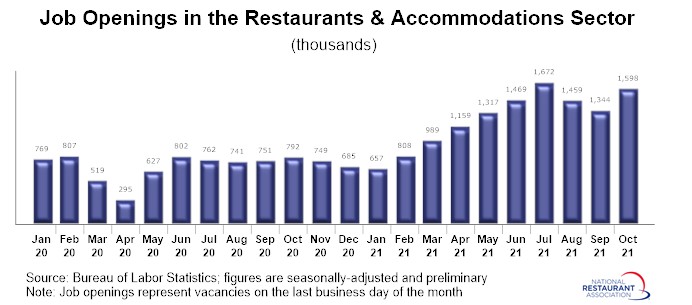

It isn’t a lack of demand for labor that is causing employment levels to remain dampened. In fact, job openings in the hospitality sector soared to record levels during the summer of 2021.

The restaurants-and-accommodations sector had nearly 1.7 million job openings on the last business day of July, according to Job Openings and Labor Turnover (JOLTS) data from BLS. That was up sharply from the beginning of 2021, and represented the highest monthly reading since the JOLTS data series began in 2000.

Although job openings ticked lower in the months since, they still remained elevated in historical terms. On the last business day of October, there were roughly 1.6 million unfilled jobs openings in the hospitality sector – the second highest level on record.

Note: The job openings data presented above are for the broadly-defined Accommodations and Food Services sector (NAICS 72), because the Bureau of Labor Statistics does not report data for restaurants alone.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the coronavirus outbreak employed 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.