Restaurant job growth picked up speed in July

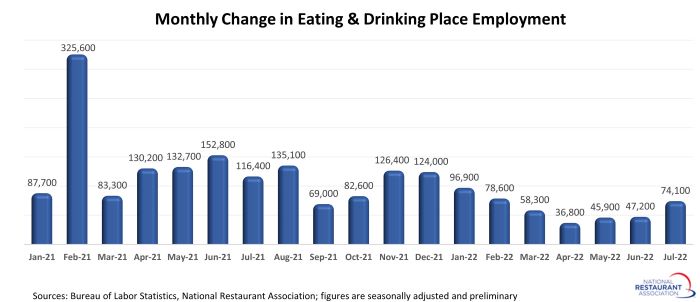

Job growth in the restaurant industry gathered some momentum in July, following a period of modest gains. Eating and drinking places* added a net 74,100 jobs in July on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics.

That represented the strongest monthly increase since February (78,600), and came on the heels of 4 months with average gains below 50,000.

July also marked the 19th consecutive month of employment growth in the restaurant industry – a total increase of more than 2 million jobs.

Help is still wanted

While job growth slowed in some sectors of the economy in recent months, other industries are still working their way back to normal staffing levels. Restaurants fit squarely into the latter category – and in fact are leading this group with employment levels that are still 635,000 jobs below the pre-pandemic peak.

That’s why a strong majority of restaurants are still actively seeking to fill positions – even as they face the building headwinds of a slowing economy.

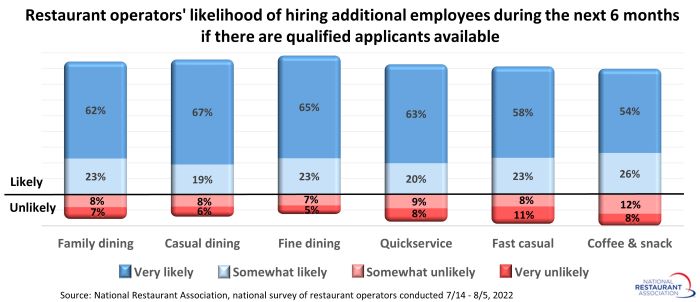

According to a National Restaurant Association survey fielded between July 14 and August 5, 84% of restaurant operators say they will likely hire additional employees during the next 6 months if there are qualified applicants available. Sixty-two percent of operators say they are ‘very likely’ to add employees during the next 6 months, while 22% are ‘somewhat likely.’

Although fullservice operators are slightly more likely than limited-service operators to express this sentiment, at least 80% of operators in each of the 6 major segments say they will likely add employees in the coming months.

Fifty percent of restaurant operators said ‘recruiting-and-retaining employees’ was the top challenge facing their business in July; only 13% said it was ‘the economy.’ If this differential holds, look for restaurants to be one of the strongest performers in a potentially deteriorating labor market in the months ahead.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the coronavirus outbreak employed 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.