Restaurant Economic Insights Blog

Restaurant job openings dropped sharply in May

Dr. Chad Moutray

July 2, 2024

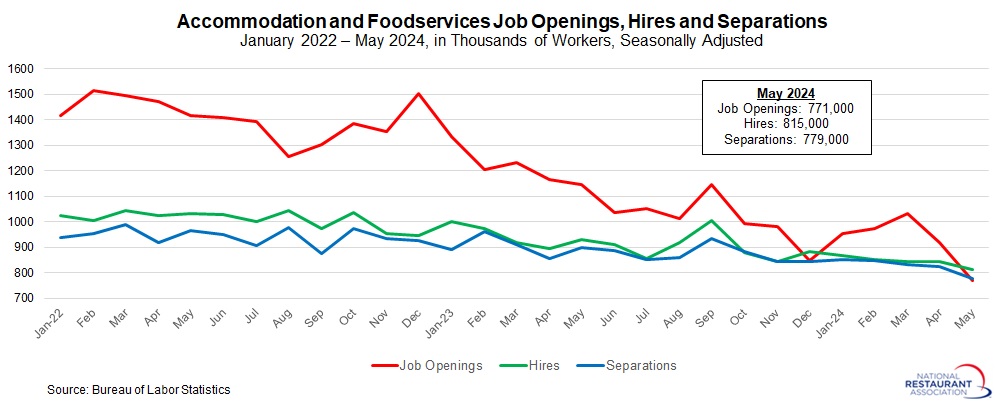

There were 771,000 accommodation and foodservices job openings in May, down sharply from 1,034,000 and 918,000 in March and April, respectively. While the labor market remains solid overall, these data suggest that job postings in the accommodation and foodservices sector have cooled notably in the past couple of months, with the overall level normalizing dramatically from post-pandemic record highs.

It is worth noting that the Job Openings and Labor Turnover Survey data can be highly volatile from month to month, and as such, one should not make too much of one month’s shift. As such, the June data will be closely watched to see if the large drop seen in May is sustained or possibly reversed, looking for the longer-term trend. For now, job openings in the sector have fallen below the average seen in the 2017–2019 period, which was 835,000.

Accommodation and food services businesses hired 815,000 in May, down from 843,000 in April. At the same time, there were 779,000 total separations in the sector in May, down from 827,000 in April and the lowest reading since February 2021. As such, labor market activity in the sector also slowed, but with net hiring (or hires minus separations) rising to 36,000 for the month.

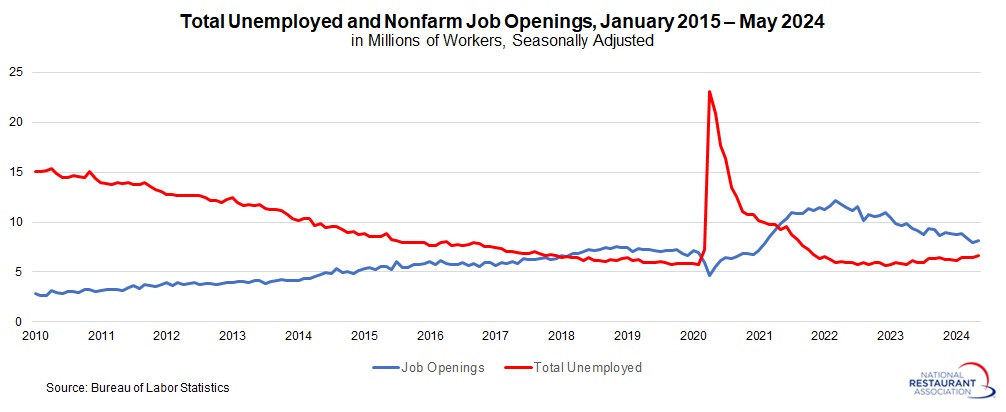

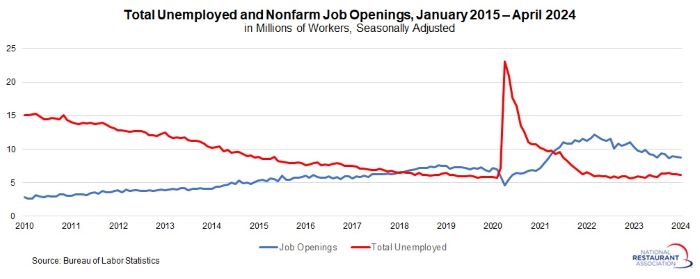

In the larger economy, nonfarm business job openings increased from 7,919,000 in April to 8,140,000 in May, bouncing back somewhat after falling to the slowest pace since February 2021. There were 6,649,000 unemployed Americans reported in May. Therefore, for every 100 job openings in the U.S. economy, there were 81.7 unemployed workers.

Indeed, there continued to be significantly more job openings than people actively looking for work (roughly 1.5 million), even as that gap has narrowed significantly over the past year and a half. For example, it was nearly a 2-to-1 ratio in December 2022, or 51.8 unemployed workers for every 100 job openings, with a gap of nearly 4.7 million more job openings people looking for employment.

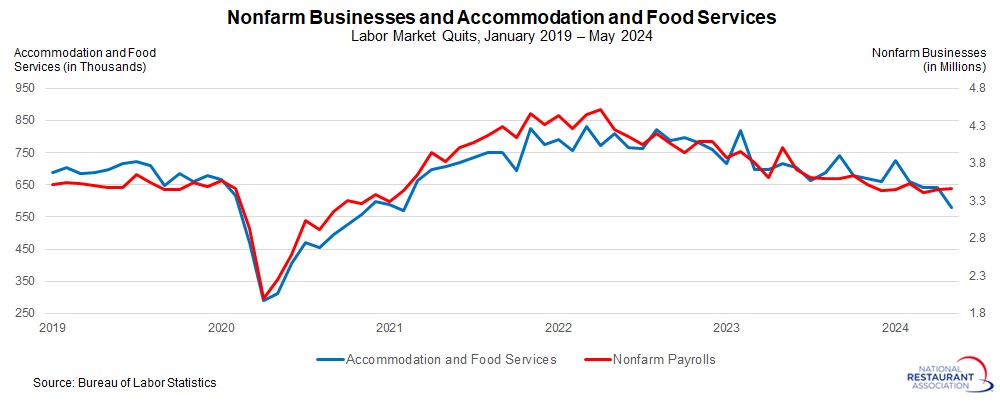

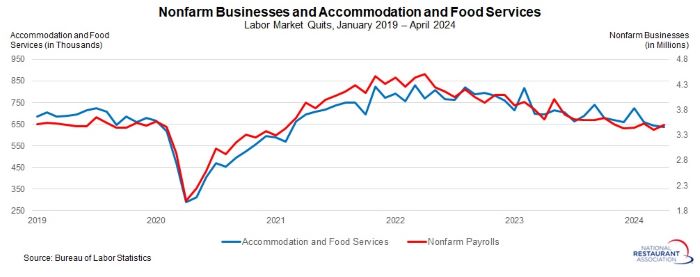

Meanwhile, the number of accommodation and food services quits decreased from 640,000 in April to 579,000 in May, the fewest since February 2021. Much like the openings data, the number of quits in the sector has been decelerating, with the averages for 2022 and 2023 being 787,000 and 704,000, respectively. This is a sign that churn in the labor market has ebbed notably in the past couple of years. In fact, quits are now below the pre-pandemic average of 633,000 seen in the 2017 to 2019 period. At the same time, nonfarm payroll quits edged up to 3,459,000 in May, with total quits above but not far from the pre-pandemic average of 3,339,000.

Restaurant output weakened in the first quarter but remained up over the past year

Dr. Chad Moutray

July 1, 2024

The U.S. economy grew 1.4% at the annual rate in Q1 2024, easing from 3.4% growth in Q4 2023 in real GDP and the slowest pace in seven quarters. The data on consumer spending was mixed, with individuals continuing to open their pocketbooks for services but with declining activity for goods purchases.

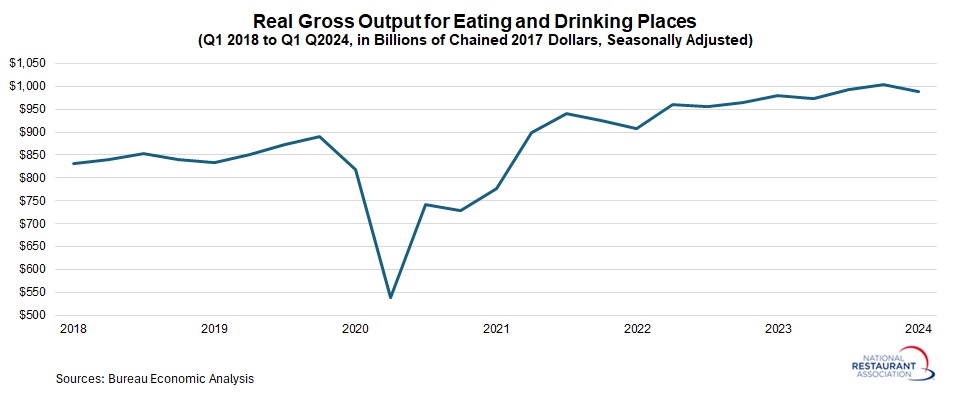

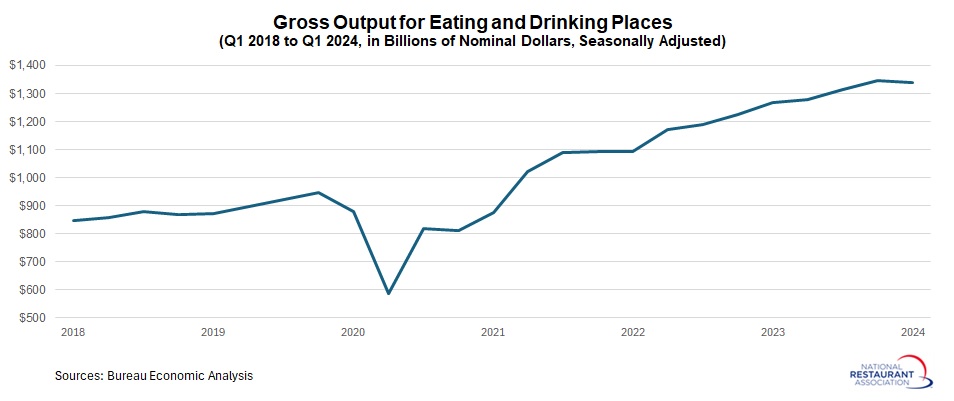

For its part, real gross output at eating and drinking places fell 1.6%, down from $1,004.0 billion in Q4 2023 to $988.5 billion in Q1 2024, expressed in billions of chained 2017 dollars and seasonally adjusted. This follows growth of 1.2% in Q4 2023, and it was the largest decline in two years. On a year-over-year basis, real gross output for eating and drinking places grew 0.8% in Q1 2024, a relatively sluggish (albeit positive) pace. Overall, eating and drinking places accounted for 2.8% of total real gross output for all private industries.

Of course, these data are impacted by prices. In current (or nominal) dollars, gross output at eating and drinking places declined less sharply, down 0.6% from a record $1,345.0 billion to $1,337.6 billion. It was the first quarterly decrease in two years, following the 2.4% increase in Q4 2023. On a year-over-year basis, gross output in the sector rose by a very positive 5.5%. In nominal terms, eating and drinking places accounted for 3.0% of total gross output for all private industries.

Search for AI jobs at restaurants

Dr. Chad Moutray

June 20, 2024

There continues to be a lot of excitement about how artificial intelligence will dramatically alter our lives, improving productivity and changing how companies and people do things. This has the potential to be worthy of the hype, with companies aggressively investing in new technologies and individuals experimenting with ChatGPT and other similar tools. Indeed, just this week, NVIDIA passed Microsoft and Apple to have the highest market cap of any public company, led by soaring demand for AI chips. (Microsoft and Apple are also investing heavily in artificial intelligence.)

Restaurants and foodservice operators are also beginning to spend in this area, with an eye on the future. The National Restaurant Association’s Restaurant Technology Landscape Report 2024, which was released in April, said that “22% of operators plan to devote resources to augmented reality for training or marketing campaigns, while 16% say they will invest in artificial intelligence (AI) integration (including voice recognition).” At the same time, one-third of limited-service customers said that they would be comfortable ordering food by talking to an artificial intelligence generated person on a video screen, but the comfort level rises with younger generations (49% for millennials).

While the sector is still early in the development of new AI-generated tools, restaurants and foodservice owners will continue to invest in new technologies and in human capital with such skills.

With that in mind, this post is an attempt to learn more about AI job openings in the sector utilizing Lightcast data, which aggregates online job postings from various websites. This differs from the BLS JOLTS data, which counts the number of positions that employers, including restaurants, are actively recruiting to fill, whether online or not. While the methodology and measurements of the two data sources are different, the trends typically move in similar directions.

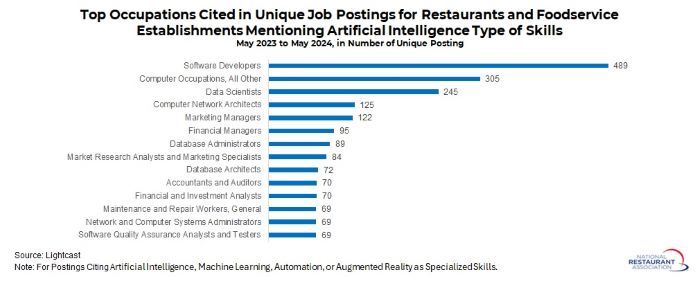

There were 3,889 unique job postings nationally between May 2023 and May 2024 for restaurants and foodservice establishments, limiting the query to openings that mention the following specialized skills: artificial intelligence, machine learning, automation, or augmented reality. The median advertised salary was $49.42 per hour, up 42% over the past three years. Most of these advertised jobs require at least a bachelor’s degree. It is too early to see a dramatic increase in the number of postings, but that could change moving forward.

Over the past year, the top cities for such job postings were (in order): Chicago, New York, Atlanta, Seattle and Dallas. The top occupations being recruited at restaurants and food service establishments over the past year mentioning AI-type specialized skills were software developers, all other computer occupations, data scientists, computer network architects and marketing managers, among others. Beyond the specialized skills mentioned in the query, other common skills noted as requirements in the postings included knowledge of computer science, Python, SQL, agile methodology, project management and data analysis, to name a few.

Federal Reserve leaves rates unchanged, signals just one cut this year

Dr. Chad Moutray

June 12, 2024

The Federal Open Market Committee left short-term interest rates unchanged, as expected, at the conclusion of its June 11–12 meeting. The statement noted that inflation “remains elevated” despite making “modest progress toward the Committee’s 2 percent inflation objective.” Moreover, it noted that “the risks to achieving its employment and inflation goals have moved toward a better balance over the past year.” Yet, it added that “the Committee remains highly attentive to inflation risks.” Indeed, stubborn price growth remains a challenge, with the Federal Reserve committed to having “higher for longer” interest rates until it sees sufficient progress.

With that in mind, the Federal Reserve also released the economic projections of the participants. In March, the median estimate was for three rate cuts in the federal funds rate in 2024. That is now just one, which furthers the estimation that the first cut might come after the election at the conclusion of its December 17–18 meeting. (These are just projections. With incoming data, FOMC participants might feel that conditions are sufficient to warrant a rate cut sooner, perhaps at the September 17–18 meeting.)

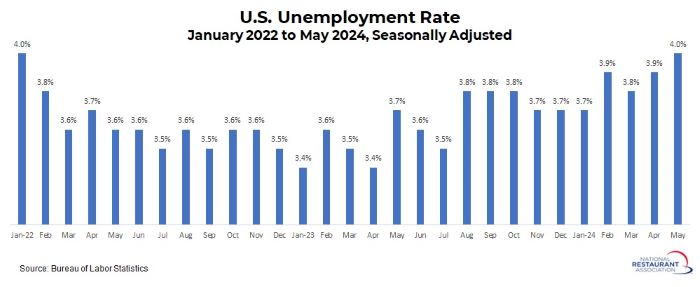

Participants forecast 2.1% and 2.0% growth in real GDP in 2024 and 2025, respectively, with the unemployment rate remaining at its current level, 4.0%. The Fed predicts an unemployment rate of 4.2% next year. In terms of inflation, the core PCE deflator would be 2.8% this year, declining to 2.3% in 2025 and getting nearer to the Fed’s long-term target.

Dining Dynamism: Restaurant start-ups remain strong despite slowing year to date

Dr. Chad Moutray

June 12, 2024

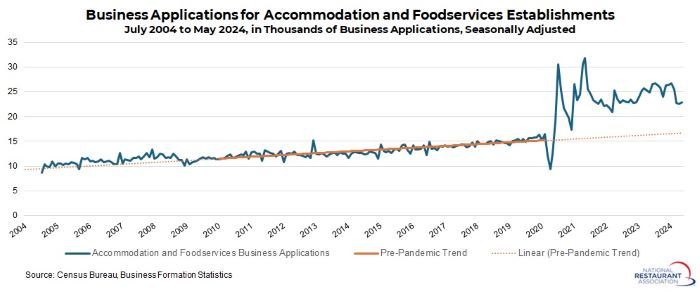

In May, there were 22,918 business applications filed for new accommodation and foodservices establishments, according to seasonally adjusted figures from the Census Bureau. These data, which are part of the Business Formation Statistics series, compile applications for an Employee Identification Number (EIN). It is important to note that this series focuses on business applications only. It does not highlight openings or closings.

Business applications in the accommodation and foodservices sector edged up from 22,648 in April following three straight months of declines, down from 26,663 in January. Moreover, applications have eased significantly since peaking at a record 31,862 in May 2021. Despite pulling back over the past three years, start-ups in the accommodation and foodservices sector remain well above the pre-pandemic trend.

The chart below shows an upward trend in business applications from January 2010 to February 2020. If we were to extend this pre-pandemic trend, there would currently be nearly 16,575 accommodation and foodservices business applications, with the actual number notably higher than that.

Indeed, business applications jumped considerably post-pandemic, and even with some stabilization, that new trend remains well above what was seen in the years before it. As a society, we have become more entrepreneurial in general, and this occurrence extends to restaurants, foodservice operations and accommodations, which is now 38.3% above trend.

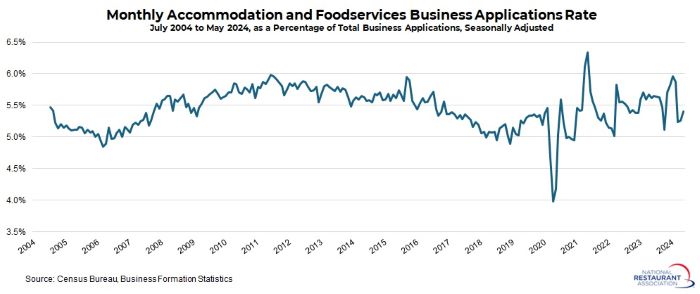

The Business Formation Statistics data begin in July 2004, and over that period, accommodation and foodservices business applications have averaged 5.45% of total applications. In May, it was 5.41%. Much like the data discussed above, the business applications rate in the sector peaked at 6.34% in May 2021, an all-time high, and have pulled back since then.

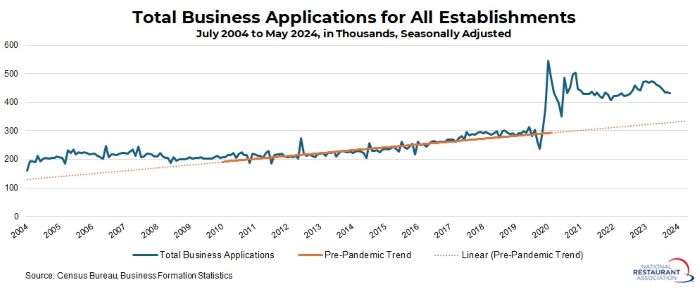

The current business formation rate for the sector is not far from the historical average despite the sizable leap in applications post-pandemic. This suggests that total applications have also soared since February 2020, which they have.

There were 423,945 total business applications in May, with these data largely pulling back over the past 10 months from 473,722 in July 2023. In the aftermath of the pandemic, Americans leaned heavily into starting their own businesses, with a record 545,914 applications files in July 2021.

The number of applications has settled somewhat since then but remain highly elevated and above the pre-pandemic pace in a manner similar to accommodation and foodservice establishments. If we were to extend the pre-pandemic trend, there would be roughly 330,710 business applications today, or 28.2% fewer than the actual figure.

National economy added 272,000 jobs in May

Dr. Chad Moutray

June 7, 2024

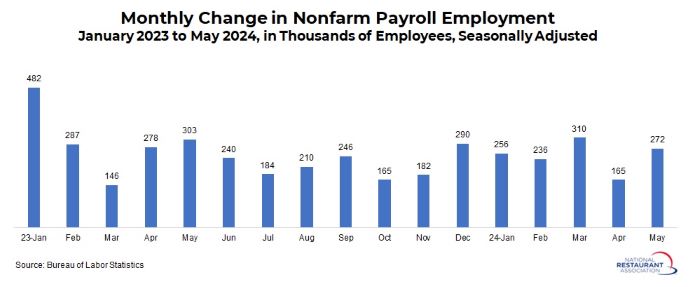

Nonfarm payroll job growth rose by 272,000 workers in May on a seasonally adjusted basis, rebounding from the gain of 165,000 seen in April. This was stronger than the consensus expectations of around 190,000 employees being added in the month. Overall, U.S. job growth remains solid, with 1,239,000 net new workers added year to date.

Overall, these data show that the labor market remains a bright spot, helping to provide resilience to economic growth and for increased spending. Nonfarm payroll employment has risen for 41 consecutive months, adding 16.0 million jobs in that period. As a result of the steady gains, total U.S. nonfarm payroll employment stood 6.2 million (or 4.1%) above the February 2020 pre-pandemic peak, rising to a new record level: 158.5 million.

The unemployment rate ticked up from 3.9% in April to 4.0% in May, remaining a strong figure despite rising to the highest rate since January 2022. The number of unemployed Americans rose from 6,492,000 to 6,649,000. At the same time, the labor force participation rate slipped from 62.7% to 62.5%.

Average hourly earnings for production and nonsupervisory workers among private sector workers rose 4.2% over the past 12 months, up from 4.1% year-over-year in April. The labor market remains tight but has seen some cooling over the past couple of years. For reference, year-over-year earnings growth peaked at 7.0% in March 2022.

Job growth continued across both the private and public sectors in May, including a gain of 24,600 for eating and drinking places. The private sector added a net 229,000 jobs in May, while government employment increased by 43,000. Here is a breakdown of the employment growth in May by sector (ranked from highest to least):

• Private education and health services (up 86,000)

• Leisure and hospitality (up 42,000, including 24,600 for eating and drinking places)

• Local government (up 34,000)

• Professional and business services (up 33,000)

• Trade, transportation and utilities (up 27,000, including 12,600 for retail sales)

• Construction (up 21,000)

• Financial activities (up 10,000)

• Manufacturing (up 6,000)

• Other services (up 6,000)

• Federal government (up 4,000)

• State government (up 5,000)

• Information (unchanged)

• Mining and logging (down 4,000)

Restaurant job openings cooled in April

Dr. Chad Moutray

June 5, 2024

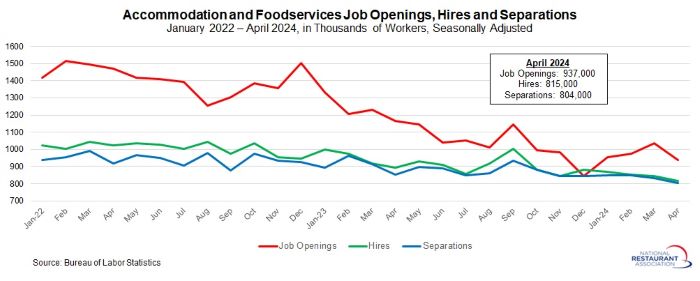

There were 937,000 accommodation and food services job openings in April, down from 1,034,000 in March. This data continues to reflect a labor market that remains solid despite notable cooling over the past year, with accommodation and food services job openings still above pre-pandemic levels (but that gap is narrowing).

Over the past six months, job openings in the sector have averaged 955,000. In comparison, job openings were 1,410,000 and 1,075,000 in calendar years 2022 and 2023, respectively. For a pre-pandemic comparison, the average number of job openings in the sector in the 2017–2019 period was 835,000. As such, job postings for accommodation and food services businesses remain elevated and above pre-pandemic levels, but with these data normalizing.

Accommodation and food services businesses hired 815,000 in April, down from 845,000 in March. At the same time, there were 804,000 total separations in the sector in April, down from 834,000 in March. The data reflect some slowing in labor market activity overall, with 11,000 net new hires in both March and April.

In the larger economy, nonfarm business job openings decreased from 8,355,000 in March to 8,059,000 in April, the slowest pace since February 2021. There were 6,492,000 unemployed Americans reported in April. Therefore, for every 100 job openings in the U.S. economy, there were 80.6 unemployed workers.

As such, there continued to be significantly more job openings than people actively looking for work (roughly 1.6 million), even as that gap has narrowed significantly over the past year and a half. For example, it was nearly a 2-to-1 ratio in December 2022, or 51.8 unemployed workers for every 100 job openings, with a gap of nearly 4.7 million more job openings people looking for employment.

Meanwhile, the number of accommodation and food services quits decreased to 643,000 in March to 637,000 in April, the fewest since February 2021. Much like the openings data, the number of quits in the sector has been easing lower, with the averages for 2022 and 2023 being 787,000 and 704,000, respectively. This is a sign that churn in the labor market has ebbed notably in the past couple of years. Indeed, quits are just shy of the pre-pandemic average of 633,000 seen in the 2017 to 2019 period. At the same time, nonfarm payroll quits rose to 3,507,000 in April, with total quits being not far from the pre-pandemic average of 3,339,000.

While government data do not offer more detail on job openings, other sources provide additional insights. For instance, Lightcast aggregates online job postings from various websites with greater granularity. This differs from the BLS JOLTS data, which counts the number of positions that employers, including restaurants, are actively recruiting to fill, whether online or not. While the methodology and measurements of the two data sources are different, the trends typically move in similar directions. [For more information on Lightcast sources, click here.]

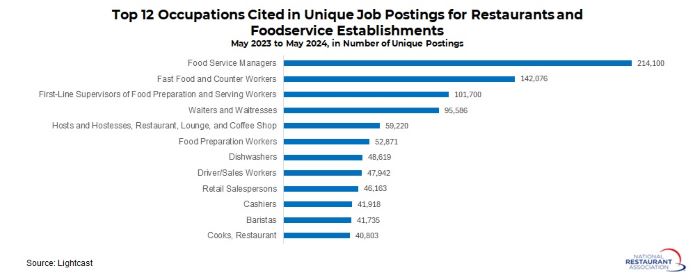

Between May 2023 and May 2024, 53.6% of job postings among restaurants and foodservice establishments were from limited-service restaurants, with 44.2% from full-service restaurants. The remainder were from snack and nonalcoholic beverage bars or cafeterias and buffets.

The top occupations being recruited at restaurants and food service establishments over the past year were food service managers, fast food and counter workers, first-line supervisors of food preparation and serving workers and wait staff, among others.

Track more economic indicators and read more analysis and commentary from the Association's economists.