Consumers boosted their restaurant spending in November

Consumers ramped up their spending in restaurants in November – potentially at the expense of other retailers. Eating and drinking places* registered total sales of $90.4 billion on a seasonally adjusted basis in November, according to preliminary data from the U.S. Census Bureau. That represented the fourth consecutive month with a sales increase of at least 0.9%.

In contrast, consumer spending in non-restaurant retail sectors fell 0.8% in November – led by sharp declines at department stores (-2.9%), furniture stores (-2.6%), building supply stores (-2.5%) and vehicle dealers (-2.3%).

The upward trend in real restaurant sales was somewhat more modest in recent months, as menu prices continued to rise steadily. After adjusting for menu price increases, eating and drinking place sales rose 2.7% during the last four months. That’s less than half of the 6.1% gain in nominal sales during the same period.

I’ll gladly pay you Tuesday for a hamburger today

One reason why consumers can sustain elevated levels of spending – even in the face of decades-high inflation – is the significant amount of savings that households have on their balance sheets. Household savings soared during the first year and a half of the pandemic, driven primarily by reduced consumer activity as well as income-supporting fiscal stimulus packages.

A somewhat more concerning reason for elevated consumer spending in recent months was the increased use of credit cards – many of which were safely stowed away during the early months of the pandemic.

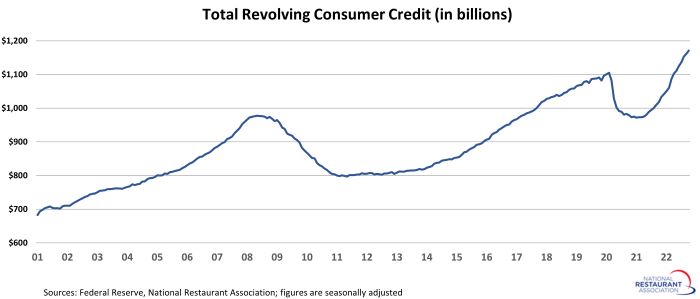

After peaking at more than $1.1 trillion in February 2020, total revolving credit balances fell 12% (or more than $130 billion) during the next 11 months. Consumer credit balances were down to their lowest level in four years – primarily because households had fewer places to spend their money.

That trend quickly reversed as restrictions eased and the economy reopened. Revolving consumer credit rose sharply in recent months, wiping out all of the balance reductions posted during the early months of the pandemic.

By October 2022, total revolving credit balances were approaching $1.2 trillion – more than $66 billion (or 6%) above their pre-pandemic peak.

Unlike J. Wellington Wimpy – who didn’t reliably pay his burger tabs on Tuesdays or any other day – consumers remain reasonably equipped to handle their rising debt load.

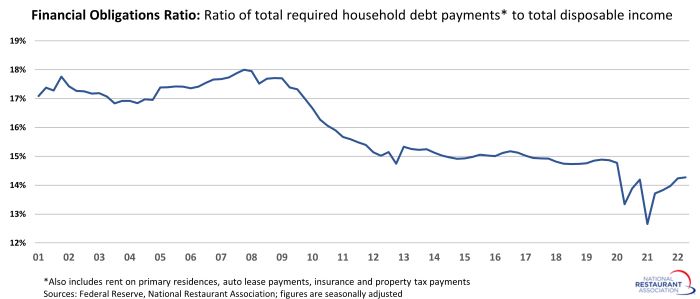

The Federal Reserve’s Financial Obligations Ratio, which is the ratio of total required household debt payments (plus rent on primary residences, auto lease payments, insurance and property tax payments) to total disposable income, was just over 14% in mid-2022.

While this was higher than the lows reached during the first half of 2021, it remained below historical averages. This measure of household debt service averaged 15% between 2012 and 2019, during another period of steady growth in revolving consumer credit.

At current levels, consumers’ revolving credit balances don’t pose a significant threat to the household balance sheet. It bears watching closely in the months ahead though, particularly if interest rates continue rising and the labor market stalls.

*Eating and drinking places are the primary component of the U.S. restaurant and foodservice industry, which prior to the coronavirus pandemic generated approximately 75 percent of total restaurant and foodservice sales.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.