Bottom line impact of rising costs for restaurants

Food and labor costs are the two most significant line items for a restaurant, each accounting for approximately 33 cents of every dollar in sales. Other expenses – such as utilities, occupancy, supplies, general/administrative and repairs/maintenance – combine to represent about 29% of sales.

This leaves a pre-tax profit margin of roughly 5% for a typical restaurant, which means significant cost increases are not sustainable for most restaurants.

This analysis illustrates the impact that the current elevated cost environment is having on the bottom line of a typical restaurant.

Soaring costs across all parts of the business

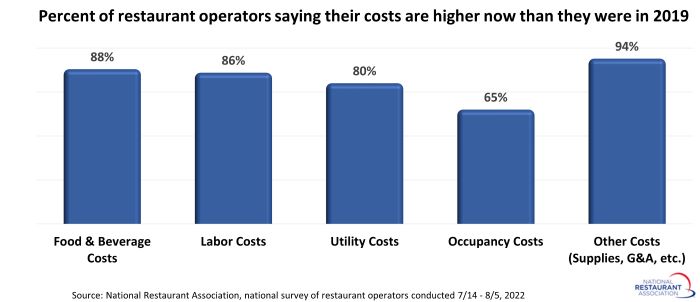

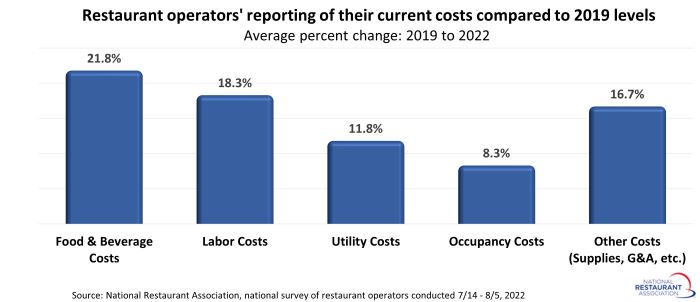

Costs rose sharply across all parts of the restaurant operation during the last several months. In a National Restaurant Association survey of 4,200 restaurants fielded between July 14 and August 5, a strong majority of operators say their costs are higher now than they were in 2019:

On average across all survey respondents (including those reporting higher, lower and steady costs), outlays are significantly higher now than they were in 2019:

Profitability is down from pre-pandemic levels

Not surprisingly, the rising costs are having a significant impact on profitability:

- 85% of operators say their restaurant is less profitable now than it was in 2019 before the pandemic. Only 6% of operators say their restaurant is more profitable, while 9% say their profitability has remained about the same.

These soaring input costs mean there are very little excess profits that can be used to pay off debt or catch up on expenses. This is a broad concern, as 65% of restaurants took on new loan debt since the beginning of the pandemic in March 2020.

Bottom line impact of rising costs

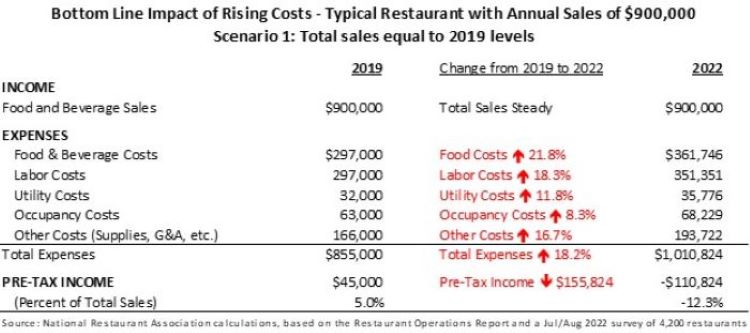

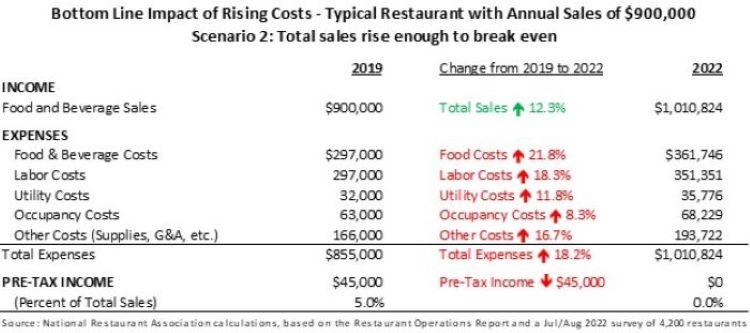

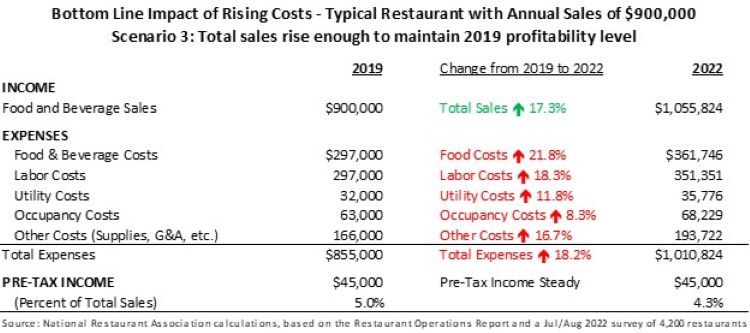

In 2019, pre-tax income represented approximately 5% of sales for a typical restaurant. For a restaurant with annual sales of $900,000, this translated to pre-tax income of $45,000.

The charts below illustrate the impact that the recent cost increases would have on a typical restaurant’s bottom line, if its outlays rose by the average percent reported by survey respondents. As would be expected, the impact varies significantly depending on a restaurant’s current sales compared to pre-pandemic levels.

The 3 scenarios presented below are all based on sales that have recovered to pre-pandemic levels. However, that is not the case for most respondents to the Association’s recent survey:

- 62% of operators say their restaurant’s total sales (in dollar terms) are lower now than they were in 2019 before the pandemic. Only 20% of operators say their sales are higher now, while 18% say their current sales are about the same as 2019.

Scenario 1: Total sales equal to 2019 levels

- Total food and beverage sales for this restaurant are equal to its 2019 levels of $900,000.

- However, after factoring in the broad-based cost increases, it suffered a pre-tax loss of $110,824.

Scenario 2: Total sales rise enough to break even

- To cover its added costs and not suffer a loss, this restaurant’s total sales would have to increase to $1,010,824 – or 12.3% above 2019’s sales volume.

Scenario 3: Total sales rise enough to maintain 2019 profitability level

- To maintain its 2019 profitability level of $45,000, this restaurant’s total sales would have to increase to $1,055,824 – or 17.3% above 2019’s sales volume.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.