Rising food costs and supply chain issues are creating challenges

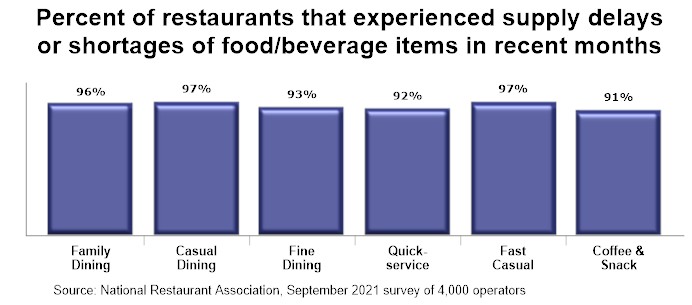

The restaurant industry isn't being spared from the array of supply chain issues that are currently impacting many sectors across the economy. In a September 2021 survey fielded by the Association, 95% of operators said their restaurant experienced supply delays or shortages of key food or beverage items in recent months.

The impact was felt across all types of restaurants, with more than 9 in 10 operators across each of the major segments reporting supply delays or shortages in recent months.

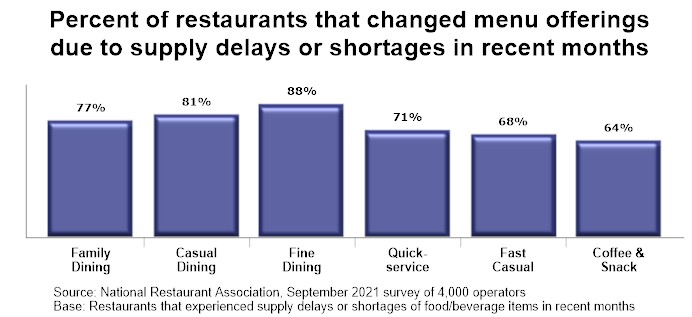

Impact on menus

For many restaurants, these supply challenges altered what they could offer to customers. Among operators that experienced supply delays or shortages in recent months, 75% said they made changes to their menu offerings as a result.

Tableservice restaurant menus were the most likely to be impacted by the recent supply chain challenges. Eighty-eight percent of fine dining operators and 81% of casual dining operators said their restaurant changed menu offerings as a result of food supply delays or shortages.

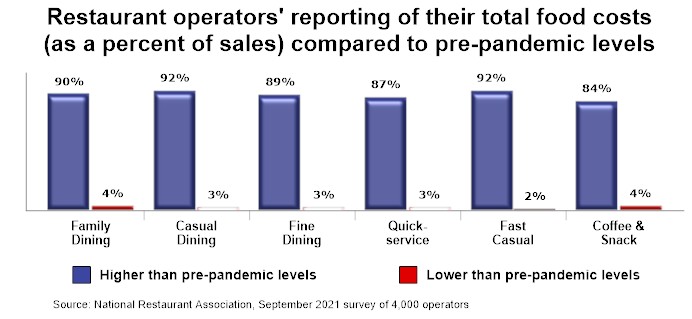

Food costs are soaring

On top of the supply chain challenges, restaurant operators are paying higher prices for many of their food items. In the Association’s September 2021 survey, 91% of operators said their total food costs (as a percent of sales) are higher than they were prior to the COVID-19 outbreak. Only 3% said their food costs make up a smaller proportion of sales.

Operators’ reporting of rising food costs was confirmed by the latest wholesale price data from the Bureau of Labor Statistics. The Producer Price Index for All Foods – which represents the change in average prices paid to domestic producers for their output – jumped 12.9% between September 2020 and September 2021. That represented the strongest 12-month increase in more than 4 decades.

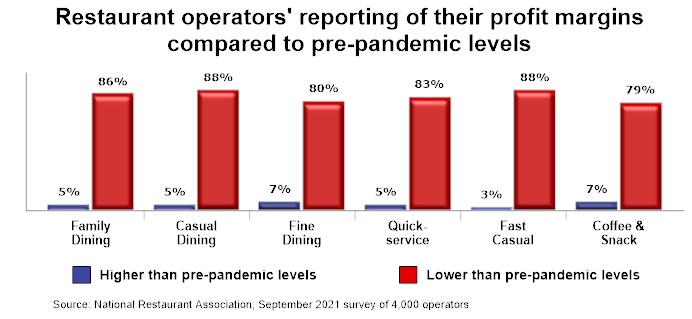

Profitability is down

Due in large part to soaring food costs, profitability is down from pre-pandemic levels for the vast majority of restaurants. In the Association’s September 2021 survey, 85% of operators said their profit margin is lower than it was prior to the COVID-19 outbreak. Only 5% of operators said their profit margin is higher.

Most operators also reported a deterioration of profitability during the last few months. Overall, 65% of operators said their restaurant was less profitable in September than it was in June. Only 6% of operators said their restaurant was more profitable than it was 3 months earlier.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.