Federal Reserve’s preferred inflation measure: Prices remain sticky

The personal consumption expenditures deflator—the Federal Reserve’s preferred inflation measure—rose 0.3% in March, extending the 0.4% and 0.3% gains seen in January and February, respectively. Energy prices increased 1.2% in March, with food costs flat for the month. Excluding food and energy, the core PCE deflator also increased by 0.3% in March, the same pace as in February.

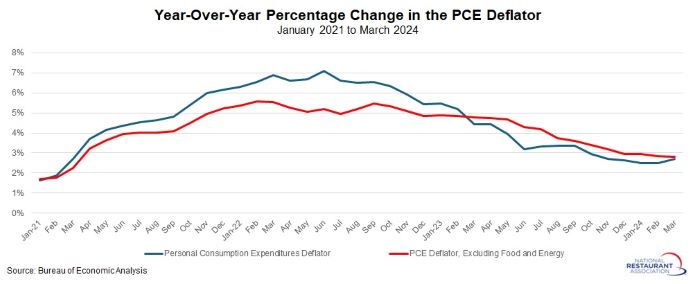

The PCE deflator has risen 2.7% since March 2023, up from 2.5% year-over-year in January and February. At the same time, core inflation remained at 2.8% year-over-year in March for the second straight month. Overall, these data show that pricing pressures have moderated significantly over the past couple of years, with the PCE deflator peaking at 7.1% year-over-year in June 2022 and core PCE inflation topping off at 5.5% in September of that year.

Yet, progress has somewhat stalled, with the core PCE deflator averaging 2.88% year-over-year over the past four months. The Federal Open Market Committee’s stated goal is for core inflation to be 2% over the long-term. Getting to that threshold—the so-called “last mile” in the battle against inflation—is proving to be challenging. Despite prices remaining somewhat sticky, core PCE inflation is likely to get closer to the Fed’s target by year’s end.

Until there is more progress on inflation, the Federal Reserve will be hesitant to pull back on interest rates. With that in mind, the FOMC is likely to stand pat in rates at the next two meetings: April 30-May 1 and June 11-12. Accordingly, the first short-term rate cut could come at one of the meetings after that: July 30-31 or September 17-18. Of course, incoming data would dictate whether such move(s) would be possible. Financial markets have reacted negatively in recent weeks to the notion that there might be fewer rate cuts in 2024 than was thought possible even a month or two ago.

In other aspects of the latest report, personal consumption expenditures increased 0.8% in March for the second consecutive month, with spending on foodservices and accommodations up 0.5%. In the first quarter, personal spending rose 1.8%, with foodservice and accommodation purchases up 1.0%. The year-over-year data were more encouraging, illustrating why the U.S. economy has remained so resilient, with personal spending up 5.8% since March 2023 and foodservice and accommodations spending jumping 7.2%.

Personal incomes rose 0.5% in March, up from 0.3% in February. Wages and salaries increased 0.7% for the month. Over the past 12 months, wages and salaries have increased 5.9%. With spending outpacing income growth, the personal savings rate dropped to 3.2% in March, the lowest since October 2022.

Read more analysis and commentary from the Association's economists, including the latest outlook for consumers and the economy.