Restaurant employment topped pre-pandemic levels in November

Restaurant job growth was choppy in recent months, but the latest data suggests the industry finally returned to pre-pandemic employment levels in November. That was thought to be the case in September, before the preliminary data was revised sharply lower.

Eating and drinking places* added a net 38,300 jobs in November on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS). That followed upward-revised gains in both September and October.

Including November’s increase, eating and drinking places have now added more than 6 million jobs since the pandemic trough of restaurant employment in April 2020. As of November 2023, eating and drinking places are 46,000 jobs above their February 2020 employment peak.

Fullservice segment still down over 200k jobs

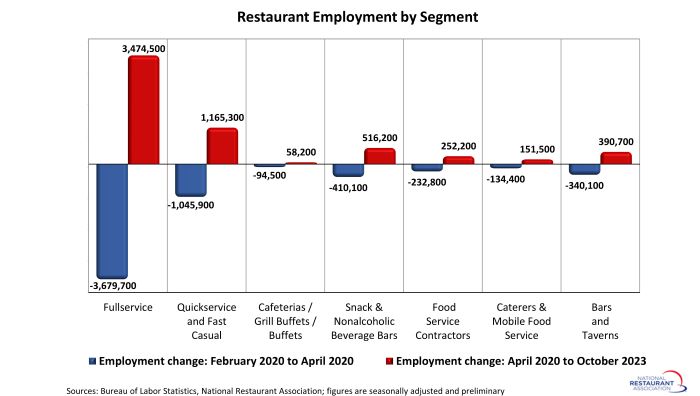

Overall restaurant employment surpassed pre-pandemic levels, but the extent of the industry’s recovery varies significantly by segment. [Note that the segment-level employment figures are lagged by one month, so October is the most current data available.]

The fullservice segment experienced the most job losses during the initial months of the pandemic – and it still has the longest path to recovery. As of October 2023, fullservice restaurant employment levels were 205,000 jobs (or 4%) below pre-pandemic readings in February 2020.

Employment counts in the cafeterias/grill buffets/buffets segment (-33%) also remained below their February 2020 levels.

Job losses in the limited-service segments were somewhat less severe during the initial months of the pandemic, as these operations were more likely to retain staff to support their existing off-premises business. As of October 2023, employment at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – was 106,000 jobs (or 13%) above February 2020 readings.

Staffing levels in the quickservice and fast casual segments were 119,000 jobs (or 3%) above pre-pandemic levels. Headcounts at bars and taverns were 51,000 jobs (or 12%) above the pre-pandemic peak.

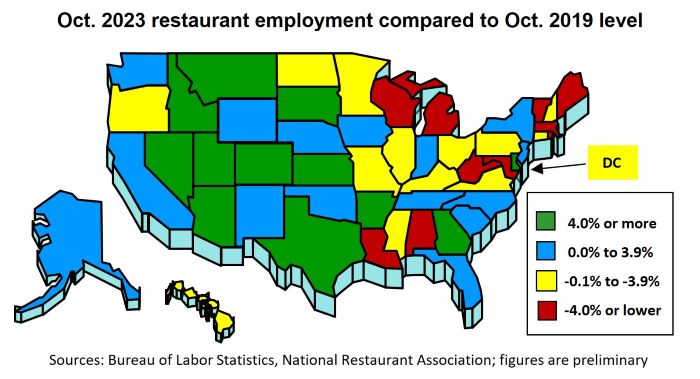

23 states below pre-pandemic employment levels

The rebuilding of the industry workforce has also been uneven across states. As of October 2023, 23 states and the District of Columbia still had fewer eating and drinking place jobs than they did in October 2019.

This group was led by Maryland, which had 9% fewer eating and drinking place jobs in October 2023 than it did in October 2019. Maine (-8%), Vermont (-7%), Michigan (-6%) and Massachusetts (-6%) were also well below their pre-pandemic restaurant employment levels.

As of October 2023, eating and drinking place employment in 27 states surpassed their comparable pre-pandemic readings in October 2019. This group was led by Nevada (+15%), Utah (+13%), Idaho (+12%) and Montana (+9%).

[Note that the state-level analysis uses October 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available.]

View the latest employment data for every state.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, which prior to the COVID-19 pandemic employed more than 12 million out of the total restaurant and foodservice workforce of 15.6 million.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.