Inflation-adjusted restaurant sales declined in July

Consumers maintained their total dollar spending in restaurants in July, but the continued rise in menu prices revealed early signs of a downward trend in real sales.

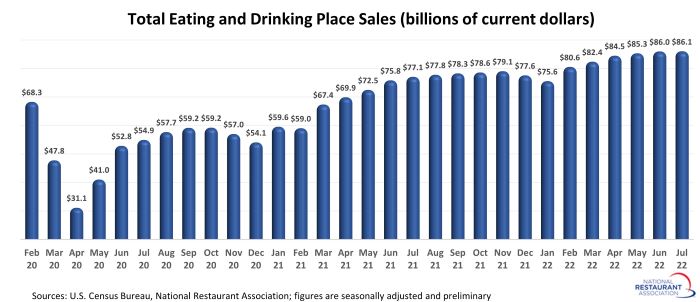

Eating and drinking places* registered total sales of $86.1 billion on a seasonally adjusted basis in July, according to preliminary data from the U.S. Census Bureau. That was up slightly from June’s downward-revised volume of $86.0 billion – and marked the sixth consecutive monthly increase in nominal sales.

However, after adjusting for menu-price inflation, restaurant sales fell 0.6% in July. That followed a 0.2% real sales decline in June – and represented a noticeable break in trend after rising more than 10% between January and May.

Business conditions are softening

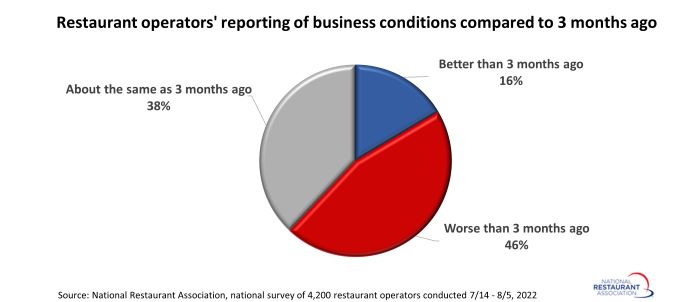

For their part, restaurant operators are also signaling that the business environment is becoming more challenging.

Forty-six of operators say business conditions for their restaurant are worse now than they were 3 months ago, according to a National Restaurant Association survey of 4,200 restaurant operators fielded between July 14 and August 5, 2022.

Only 16% of operators say business conditions improved during the last 3 months, while 38% say conditions remained about the same.

*Eating and drinking places are the primary component of the U.S. restaurant and foodservice industry, which prior to the coronavirus outbreak generated approximately 75 percent of total restaurant and foodservice sales.

Read more analysis and commentary from the Association's chief economist Bruce Grindy.