Beware how you report tips post-COVID-19, tax experts say

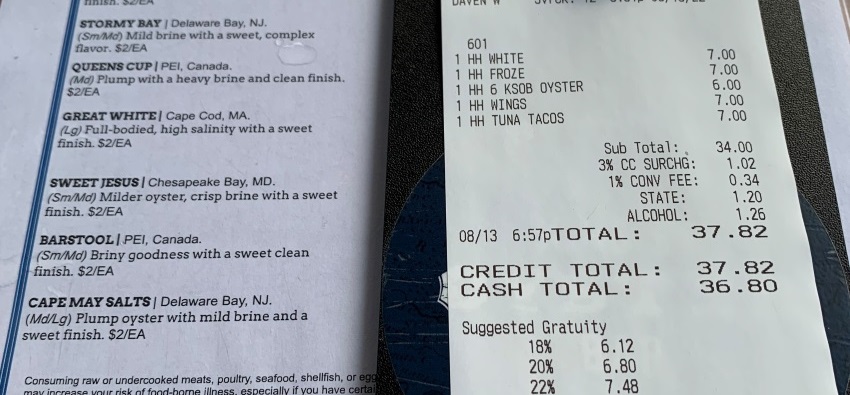

If you offer a calculation of tip rates (15%, 18%, and 20%, for example), but leave the tip line blank, and the customer decides the amount and writes it on the tip line, it’s clearly a tip.

Tip reporting—never a simple subject—likely has gotten even more complicated as a result of the COVID-19 pandemic. That’s the takeaway from a presentation during the Association’s 2022 Finance, Tax and Internal Audit Expert Exchange conference in July.

Tipping patterns have changed due to the pandemic, according to presenters Marianna G. Dyson, senior of counsel, and Michael Chittenden, of counsel, at Covington & Burling LLP, Washington, D.C., and that can have an impact on how you, the employer, report tips and ramifications on the payroll taxes you owe and when.

As a reminder, they say, there are four factors that distinguish tips from service charges. To be a tip,

• the customer must not be compelled to contribute a gratuity

• the customer gets to determine the amount of the gratuity

• the amount a customer contributes is not subject to negotiation or employer policy

• the customer decides who receives the gratuity

The differences are pointed out further in Revenue Ruling 64-40, which more deeply explains a “Compelling moral obligation” to pay an additional amount on a check, saying it may defeat the voluntary nature of a tip.

Changing dining patterns raise new questions about whether tipping patterns result in tips or service charges. For example, they highlighted quickservice settings where a cashier provides the tip selection (“Would you like to leave a tip?”); or pre-paying a gratuity at buffet-concept restaurants. In both situations, consider whether customers might feel compelled to leave a gratuity or whether the customer is deciding who receives the gratuity.

Another example, Dyson says, is a wonderful small bakery she visited, which recently switched to a plastic-only payment policy; no cash accepted. On the touchscreen pad to close out the sale, there were tip box choices of 15%, 18%, 20% and 25% but no box to decline tipping altogether. “I could not close that sale without picking a tip percentage,” she says. “And I mentioned to the manager, I think you have a problem here because these extra amounts are all going to be service charges, not tips.”

Tips vs. service charges

Here’s how the IRS views it. Say your menu “specifies” that 18% will be added to a customer’s bill, the addition is included on the tip line of the bill in the amount specified by the menu, and the addition, or gratuity, is included in the total, i.e., either by the POS system or by an employee totaling the bill.

The conclusion is that the additional amount is a service charge subject to FICA and income taxes. (It’s unclear, however, whether the IRS would view any “for the convenience of the customer” language on menu as “specifying” a service charge.)

Here’s another way the IRS looks at the issue. If you provide a sample calculation of tip rates (15%, 18%, and 20%, for example) beneath the signature line on a charge receipt, but leave the tip line blank, and the customer determines the amount, writes it on the tip line and totals the bill, the conclusion is: it’s clearly a tip.

All of this is important to remember because tips and service charges are treated differently from a tax standpoint.

Tips reported by employees to employers are subject to FICA taxes and income taxes (e.g., federal payroll taxes), if there are sufficient wages from which to withhold the taxes. After withholding the FICA and income taxes on the regular wages:

• The employer must pay its share of FICA taxes on reported tips.

• If there are insufficient regular wages from which to withhold the payroll taxes on tips, the employer reports under-withheld FICA taxes on the employee’s Form W-2 in a special box and is not secondarily liable for those taxes or for the income taxes on reported tips that it could not withhold.

• The employer receives a § 45B credit for FICA taxes (in excess of applicable minimum wages).

Service charges are considered regular wages that are subject to FICA taxation and federal income tax withholding.

• The employer must pay its share of FICA taxes.

• The employer is secondarily liable for failing to withhold employee FICA taxes and income taxes on the service charges.

• The employer doesn’t get a § 45B credit.

Perhaps most important to you, Chittenden says, is whether or not you can get the section § 45B tax credit on your share of FICA tax payments. “I have never met an industry that hugs a provision of the Internal Revenue Code like this industry hugs § 45B,” he says. “It’s your favorite code provision of all time.”

Other differences between tips and service charges (because service charges are subject to the same treatment as regular wages) include the requirement that service charges must be counted when calculating:

• benefit contributions (401k—subject to the plan’s definition of compensation—and healthcare)

• minimum wage

• overtime

• whether regular wages are sufficient for purposes of withholding payroll taxes on tips

And there are state sales tax implications, too. In many states, such as California, service charges are subject to sales tax.

Pandemic developments

One of the things that changed dramatically during the pandemic was where and how much customers tipped as restaurants switched from table service to takeout only. “On Form 8027, you have credit card charge receipts with credit card tips and total receipts, which include cash receipts, credit card charge receipts without credit card tips, and ‘all other’ non-allocable receipts,” Chittenden says.

“Takeout sales are non-allocable receipts—the tips on them are reported in total tips but they’re not counted as charge tips, even if paid with a credit card.” Dealing with the discrepancy in tips in 2020 and 2021 compared with previous years has puzzled the IRS.

“It’s my sense that because of this pandemic and what we've been through, at some point the IRS is going to go back to its day job,” Dyson says. “And underreporting of tips has always been a sore point—they have an entire division devoted to it. They're supposedly hiring personnel and ramping up to do more of this. So, I would not be surprised if you see some unusual strategies or arguments coming at you. I just don't think they'll let this area ride for long as we try to get back to the new normal.”